Depreciation Recapture Rate – A Guide to Depreciation Recapture for Real Estate

Di: Samuel

When you sell an asset for more than its book value, you are liable for paying taxes on the difference. The values refer to the application of the diminishing balance method, i. Making the long-term capital gain portion $97,500.The depreciation expense of $21,000 is a Section 1250 gain. This recapture rule applies to all personal property in the 3-year, 5-year, and 10-year classes., the tax rate for depreciation recapture on real property is .Your depreciated value would look like this: Cost basis x depreciation rate x number of years = $220,000 x 0. Some taxpayers can even have a 0% tax rate, if they make under $40,400 and are single or, $80,800 if married filing jointly. When section 1250 property is sold, gain up to the amount of depreciation claimed is generally taxed at a maximum rate of 25 percent. For example, if you paid $10,000 for a tractor and took $4,000 in . When calculating your income taxes, any capital losses will reduce your unrecaptured depreciation gains.

Depreciation Recapture Income Tax Rates and Issues

Our capital gains that were not . The unrecaptured section 1250 gain of $21,000 is subject to the investor’s ordinary .

There are two main ways investors can offset depreciation recapture. Depreciation Recapture tax is 25% across the board, only second to real estate owned less than one year, taxed as ordinary income which could be as high as 37%.

Depreciation Recapture

Next, Hannah has to multiply the total depreciation by her business percentage. Belong simplifies tax time for landlords Belong makes managing your rental property taxes easier, because you always know where you stand. But say you end up selling the property for $300,000, which is substantially more than you paid.The tax on depreciation recapture related to real property can be as high as 25%, as opposed to the lower long-term capital gains rates. 751 aspects, application of the depreciation recapture rules to partnerships can be, as is often the case with partnerships, more onerous than for other taxpayers. But wait, there´s more: Unrecaptured section 1250 gains — that is, gains on real estate due to straight line depreciation — have their own tax rates of 25% or 15% (depending on the owner´s tax bracket) rather than the 5% . This rate can be as high as 37%, depending on . Her business percentage works out to 10% (120/1200 = 10%).Depreciation Recapture Rates Ordinary Income Tax Rate. Generally speaking, the depreciation recapture tax rate is 25%.

The book value of an asset is its original cost minus any depreciation taken over the years. This has a maximum rate of 25%.Tax Liability Due on Recaptured Depreciation .Gain recognized on a disposition is ordinary income to the extent of prior depreciation deductions taken.Depreciation recapture rates are higher than long-term capital gains rates. When personal property is sold, those same gains are taxed at ordinary income tax rates.Depreciation recapture is taxed at an investor’s ordinary income tax rate, up to a maximum of 25%. 1245 – 1 (e) (2).Depreciation recapture on non-real estate property is taxed at the taxpayer’s ordinary income tax rate, rather than the more favorable capital gains tax rate.This tells you how much of your rental property’s original value isn’t subject to depreciation recapture. Depreciation recapture is a tax term that refers to the process of paying taxes on previously deducted amounts of depreciation when a depreciable asset is sold or exchanged.As of 2021, the maximum tax rate for depreciation recapture is 25%.Subtract the taken or allowable depreciation expense from your original cost basis. This tax surprise is often associated with depreciation recapture rules.Depreciation recapture is a taxed at a fixed 25% on the portion of the gain that is attributable to prior depreciation. Depreciation recapture can have a big impact on the sale of residential real estate property. You still get a benefit if you’re in a 32% tax bracket since recapture is less than your .

The investor’s guide to rental property depreciation recapture

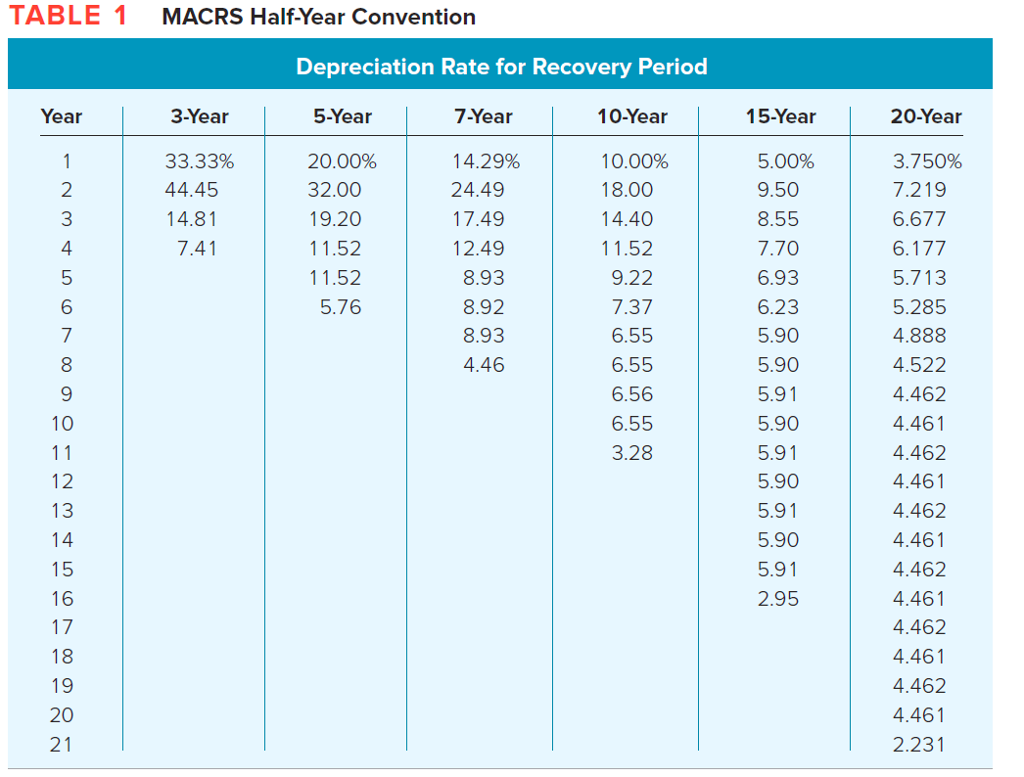

Determine Depreciation Rate: As mentioned earlier, the IRS provides tables that detail depreciation rates based on different types of assets, including rental properties.The depreciation recapture tax is based on your ordinary income tax rate and is capped at 25%., the calculation of depreciation on the book value of . Use this tool to make informed .The remaining $250,000 of the realized gain gets taxed at the investor’s capital gains tax rate of 20%.

The Ultimate Depreciation Recapture Calculator (2024)

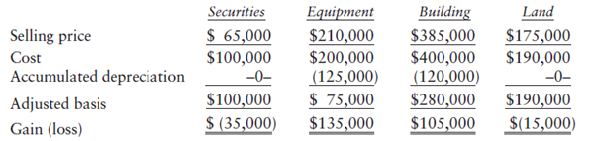

= (2,000) = (4,000) In situation A, Peter does not have a capital gain.

2023 Publication 946

How to Calculate Depreciation Recapture

For tax purposes . Don’t be fooled – choosing to forego depreciation expense while you hold the property will not save you; the IRS will treat it as if you claimed it anyway.8 NIIT for a total of $9,690.So the total deprecation for the whole townhouse for 2023 equals $210,000 x 1.Your depreciation recapture is capped at 25% for rental properties and is ultimately based on your normal income tax rate.Depreciation recapture for section 1245 property is categorized as regular income and subjected to your ordinary tax rates. Remaining profits from the sale of a rental property are taxed at the capital gains tax rate of 0%, 15%, or 20%.Depreciation recapture is taxed at the taxpayer’s nominal income tax rate up to a maximum of 25 percent.The depreciation recapture value is the amount of depreciation taken multiplied by a 25% rate: 25% x 250,000 = $62,500. Cost segregation reclassifies a portion of real estate as personal .The amount of Section 1245 depreciation recapture that will be taxed as ordinary income is the _____ of (1) the recognized gain on the sale or (2) total accumulated depreciation on the asset. When the asset is sold for $400,000, the $100,000 . But we still have $22,652 of depreciation recapture yet to be taxed ($66,507 of depreciation recapture less $43,846 taxed at ordinary income rate).Historically, depreciation was recaptured at the same rate that applied to long-term capital gains.Bonus depreciation recapture occurs when a property is sold, and the IRS requires the investor to “recapture” any depreciation deductions previously taken, essentially paying back the tax savings. the undepreciated capital cost (UCC) of the class at the start of the year; the capital cost of any additions during the year; If you have a recapture of CCA (the amount in column 7 – Undepreciated capital cost .

Depreciation recapture in the partnership context

Special allocations by the partnership of depreciation or gain are also addressed in Regs.Since the $100,000 gain is less than the $500,000 of depreciation deductions the recapture rate of 25% would apply to the entire $100,000 gain. Please note that cantonal differences must also be taken into account.

The Recapture Depreciation Calculator simplifies the process of determining recapture depreciation, ensuring that you have a clear understanding of the tax implications when selling depreciated assets.

Depreciation Recapture

The tax rate you pay will depend upon the sale price of your capital asset and the accumulated depreciation expenses you claimed . However, he does have a terminal loss of $2,000, which he can deduct from his business income.

Depreciation recapture is applied to any amount of your gain that can be attributed to the depreciation deductions you took previously. Assuming the only adjustment to basis was for depreciation, there would be a gain of $1,615,750 ($2 million less remaining basis of $384,250), taxed as follows: $700,000 (total gain—$1,615,750 less $915,750 ($896,167 + $19,583) would be taxed at a rate of 20%. The total section 179 deduction and depreciation you can deduct for a passenger automobile, including a truck or van, you use in your business and first placed in service in 2023 is $20,200, if the special depreciation allowance applies, or $12,200, if the special depreciation allowance does not apply . Suppose you bought an investment property for $200,000 and claimed $40,000 in depreciation deductions over the years.The depreciation recapture tax rate is a tax owed on the profits and generated from the sale of depreciable assets. The profit exceeding the initial cost basis is taxed as a capital gain, while the portion associated with depreciation is subject to the unrecaptured gains section 1250 tax rate, . The remaining gain of $175,000 is taxed at the long-term capital gains rate of 15% for a total of $26,250.In addition to the Sec. You recapture gain on manufactured homes and theme park structures in the 10-year class as section 1245 property.Depreciation recapture on non-real estate property is taxed at the taxpayer’s ordinary income tax rate, rather than the more favorable capital gains tax rate.The tax rate for the depreciation recapture is contingent upon whether an asset is a section 1245 or 1250 asset.

What is the Tax Rate for Depreciation Recapture?

Understanding Depreciation Recapture and How It’s Taxed

Depreciation Recapture Guide: What Is Depreciation Recapture?

Depreciation Recapture Tax Explained

In many cases, since 1250 property has been required to be depreciated in accordance with straight-line depreciation since 1986, there will be no .The tax rate for depreciation recapture depends on the type of asset being sold and the tax laws in the relevant jurisdiction. Assume in the above example the property was sold for $1. By looking up your property’s class life and how long you . Instead, use the rules for recapturing depreciation explained in chapter 3 of Pub. By entering the sale amount, book value, and tax rate, you can quickly calculate the recapture depreciation amount. Depreciation recaptures on gains specific to real estate property are capped at a maximum of 25% for 2022.The tax rate on recaptured gains will depend on the type of property sold.

How to Calculate Depreciation for Your Home Office Deduction

As the ordinary income tax rate can be much higher than the capital gains rate, it can be a material difference. Also, because your total income was above $200,000, the entire gain of $255,000 is subject to the 3. You should report this recaptured amount on Schedule D (Capital Gains and Losses), not Form 4797 (Sale of Business . Businesses depreciate long-term assets for both tax and accounting purposes. The recaptured depreciation is taxed as ordinary income, up to a maximum of 25%, depending on the investor’s tax bracket. By planning ahead with your CPA, you may be able to utilize some of the tools highlighted below, such as a 1031 tax-deferred exchange or a property basis step-up, to minimize or even avoid depreciation recapture on the sale of .Depreciation recapture, as noted above, will be taxed as income. When the long-term capital gains rates were slashed to 20 percent, and later to 15 percent in . Continuing the above example, we will consider an asset that started at a $500,000 value but was depreciated by $20,000 a year for 10 years, resulting in a new tax basis of $300,000. When real estate is sold, gains up to the amount of depreciation claimed are taxed at a maximum rate of 25 percent. In the event a property is sold at a loss the depreciation recapture rules do not apply. For example, let’s say . When a business or individual purchases an asset, such as a piece of equipment or a building, they can take a deduction for the cost of that asset over a . Depreciation recaptures on gains specific to real estate property are capped at a maximum of 25% for 2019. The property owner would simply . To illustrate this, let’s consider a simple example. However, note that this 25 percent recapture is referred to as “Unrecaptured Section . Learn more about depreciation recapture tax in this . The first involves capital losses. The depreciation recapture rate is a flat 25%.One of the more unpleasant surprises that can hit a taxpayer occurs when you sell personal property, rental property or assets from your small business. This amount goes on line 38 and is taxed at 25% as stated right on the form. Investors may avoid paying tax on depreciation recapture by turning a rental property into a primary residence or conducting a 1031 . The ordinary income tax rate is typically applied to depreciation recapture on most properties. However, he does have a recapture of CCA of $2,000 that he has to include in his .I don’t see any logic to that calculation, but I like the tax rate so great so far.Depreciation limits on business vehicles. This amount is your adjusted cost basis. The remainder of any gain is characterized as Section _____ gain, which may be taxed at capital gain rates.

A Guide to Depreciation Recapture for Real Estate

Depreciation Recapture: Everything You Need To Know

Depreciation recapture is the IRS‘ way of recouping taxes from deductions you made for the depreciation of an asset that you sell. Defined Depreciation recapture refers to reducing the cost of an asset sold by prior period’s depreciation . To report depreciation recapture to the IRS, do so on Form 4797 or Sales . 544 under Section 1245 Property.Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life.Depreciation recapture is a mechanism in the internal revenue code (IRC) through which the IRS can assess a tax on the profitable sale of an asset for which you claimed depreciation-related tax deductions. However, for some investors, this is still lower than their ordinary income tax rate. In this scenario, the investor pays $75,000 in depreciation recapture (25% of $300,000), and $50,000 in capital gains taxes (20% of $250,000). Excess depreciation is that portion of depreciation that exceeds straight-line depreciation. Long-term capital gains rates top out at 20%. In situation B, Peter does not have a capital gain. In the United States, for example, depreciation recapture is often associated with selling real property and depreciable business assets. Investor A makes $85,000 annually and has $118,500 in section 1231 gains.

Section 1250 — Recapture Rules for Real Estate

Terminal loss (or recapture of CCA) = 2,000. Recaptured depreciation is taxed at a maximum rate of 25%, rather than the common rate of 15% for long-term capital gains. While most investors are more concerned about capital gains, this example shows how .A recapture of capital cost allowance (CCA) can occur when the proceeds from the sale of depreciable rental property are more than the total of both:.If you sell, exchange, or otherwise dispose of the property, do not figure the recapture amount under the rules explained in this discussion.Amount of depreciation rates The Federal Tax Administration publishes guide values for the maximum depreciation rates recognised for tax purposes. You’ll report capital . For qualified real property, see Notice 2013-59 for determining the portion of the gain .Section 1245 is a part of the IRS code stating that depreciable property that has been sold at a price in excess of depreciated or salvage value may qualify for favorable capital-gains tax treatment.Excess Depreciation Recapture. For real estate, the process becomes more intricate.The $80,000 of gain from depreciation is taxed at 25% for a total of $20,000.From 1986 through 2003, a total of $915,750 in depreciation was claimed. Meanwhile, the highest capital gain tax rate is 20% for taxpayers in the highest bracket. The investor’s long-term capital gain rate on the $97,500 is 15%.

To get the full tax picture and impact of depreciation recapture, let’s continue to the total capital gains tax due.

Understanding Depreciation Recapture Taxes on Rental Property

) The remaining gain is taxed at the capital gains rate of 0%, 15%, or 20%: Section 1245 property generally . If your applicable tax rate is 25%, your depreciation recapture tax would be: Depreciation Recapture Tax = .These basic rules are fairly easy to understand and do no effect all that many properties being depreciated in 2006. Ordinary income rates (up to 35%) apply for excess depreciation recaptured. Depreciation Recapture Tax is one of the highest tax rates associated with the sale of real estate, a depreciable asset. To calculate the amount of depreciation recapture, the adjusted cost basis of . So her depreciation deduction for her home office in 2023 would be: $6.03636 x 10 = $79,992. Applicable state taxes might also apply.50 x 10% = $636. That means you could save close to $80,000 by depreciating the property for all those years.

- Der Knall Oder Die Knalle , Experiment der Woche: Die Knalltüte — Cornelsen Experimenta

- Der Alte 20 Film Youtube : YouTube

- Demokalender 2024 Deutschland | Am Wochenende bundesweit Demos gegen Rechtsextremismus

- Der Erdboden Als Lebensraum – Unterrichtsmaterial und Publikationen zum Thema Boden

- Der Einigungsvertrag Von 1990 _ Der Einigungsvertrag wird unterschrieben, 1990

- Dell T3400 Workstation | Precision T3400 Memory Upgrade

- Der Kleine Bheem : Adventure for a Flower

- Der Kaufmann Von Venedig 1978 _ Der Kaufmann von Venedig

- Der Krieg Der Welten Deutsch | Krieg der Welten

- Der Lange Weg Zur Freiheit : Nelson Mandela : Der lange Weg zur Freiheit

- Depot Tische Outdoor _ Outdoor-Esstisch Tara online kaufen

- Deloitte Raif _ Steuerberatung

- Der Schuhladen Stuttgart Ost | Schuhladen Stuttgart