Debt Service Coverage Ratio Calculator

Di: Samuel

Also referred to as the debt service ratio or debt coverage ratio, debt service coverage ratio (DSCR) is calculated by dividing your business’s net operating income by your annual outgoing debt payments, or debt service, which includes principal and interest. In this calculation, the GI is your . Your business has a DSCR of $100,000/$40,000, or 2. Accurate Debt Amount Calculating your total outstanding principal and interest obligations can get complicated – especially if there are multiple lenders involved, different debt forms, and principal payments that aren’t on . That makes the income available for debt service $656,200. The formula used is [c+a+(d-a)/(1-t)]. The closer the ratio is to 1, the more financially stretched someone is. It is calculated by dividing your net operating income by your total debt service.

Debt service coverage ratio (DSCR) is one of the biggest financial ratios that loan providers use to analyse your loan application. Alternatively, if it is much higher than 1, the investor has the capacity for additional borrowing and probably good cash flow.Input Net Operating Income and Debt Service, and our calculator will help you estimate the Debt Coverage Ratio.

DSCR Calculator

It must not exceed 39%.40 The result means that Jim can cover his current debt more than twice based on his net .You can calculate debt-service coverage ratio (DSCR) by dividing a company’s annual net operating income by its annual debt obligations.The monthly payment would be $5,935. If you don’t know your NOI, you can use the formula: NOI= (1-expenses) (1-vacancy)GI.A debt-service coverage ratio is one way to analyze a company’s ability to repay its loan, but every lender has its own requirements. The Debt Service Coverage Ratio Calculator helps them make informed decisions regarding their . Typical A and B lenders require a DSCR in the 1.

Run unlimited DSCR calculations using the same DSCR calculator that mortgage lenders and underwriters use to calculate debt service coverage ratio. Die DSCR-Berechnung findet wie folgt statt: DSCR = Net Operating Income / Total Debt Service

Der Schuldendienstdeckungsgrad ist auch bekannt als Debt Service Coverage Ratio (DSCR).

Schuldendienstdeckungsgrad-Rechner

DSCR is used to evaluate businesses, initiatives, or particular borrowers. When calculating the DSCR, interest payments are typically annualized by multiplying them by 4.Our simple debt service coverage ratio calculator (DSCR) will help you understand your businesses ability to pay back its short-term debt obligations in cash.In commercial real estate, the debt service coverage ratio — often shortened to DSCR or DCR — is the measurement of an asset or entity’s cash flow compared to its debt obligations. The ratio is highly useful because it offers a good indication on whether you’ll be able to pay back the loan facility with interest.

DSCR (Debt Service Coverage Ratio)

If a commercial property’s DSCR is less than 1, it means the asset’s net operating income is less than its monthly debt obligations.Gross Debt Service (GDS) ratio is your housing costs as a percentage of your income. This calculator will give you both. This Debt Service Charge Ratio (DSCR) Excel Template can help you easily calculate your business’s DSCR, an important measure of a company’s financial stability.3 common mistakes when calculating the debt service coverage ratio 1. DSCR Calculator Blog; Blog; Run unlimited DSCR calculations using the same formula used by all major residential lenders for free! .The Coverage Ratio Calculator is a financial calculator will easily calculate the coverage ratio for a company. Your annual debt obligations are $40,000. The debt service ratio is one way of calculating a business’s ability to repay its debt.

Debt Coverage Ratio Calculator

A DSCR of 1 indicates a company has just enough income to cover its debt service costs.09 and the EBITDA is $658,500. Total Debt Payments = $30,000 + $25,000 + $15,000 + $15,000. The debt service coverage ratio is 9.The debt service coverage ratio compares your business’s annual net revenue against its annual debt obligations.Again, the debt service coverage ratio is the decimal used to compare your net cash flow to your mortgage debt.Formula To Calculate DSCR : The debt service coverage ratio (DSCR), also known as debt coverage ratio (DCR), is the ratio of operating income available to debt servicing for interest, principal and lease payments.0, this indicates you don’t have enough income to cover your mortgage payments.Mortgage professionals use 2 main ratios to decide if borrowers can afford to buy a home: Gross Debt Service (GDS) and Total Debt Service (TDS). This is why a higher ratio is always more favorable than a lower ratio. It helps you calculate your debt service coverage ratio, a key indicator of your financial health.The debt service coverage ratio (DSCR) is a financial ratio used to assess its ability to service its debt.5 million with a down payment of 30%, and the NOI is $90,000 per year: Identify the Net Operating Income (NOI)

Debt Service Coverage Ratio (Formula & Calculator)

Debt Service Coverage Ratio Calculator

This amount is still generally considered acceptable for most lenders.

Debt Service Coverage Ratio(DSCR) Calculator

A good debt service coverage ratio must be higher than 1.A Debt Service Coverage Ratio Calculator offers valuable insights into the borrower’s ability to meet debt obligations. Principal repayment amount. The debt service coverage ratio measures a firm’s ability to maintain its current debt levels.Here’s a step-by-step guide on how to calculate the debt-service-coverage ratio.Debt service coverage ratio is a financial ratio that represents the ratio of a company’s annual net operating income to its total debt obligations, including interest and principal payments.

How to Calculate the Debt Service Coverage Ratio (DSCR)?

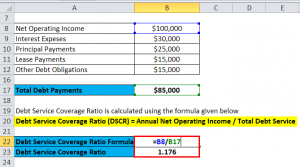

Debt Service Coverage Ratio is calculated using the formula given below. By Jean Murray. For example, if your business has a net operating income of $250,000 and .

Debt Service Coverage Ratio (DSCR) Calculator

Net operating income or NOI, for . Let’s assume that a company has a total debt service of $65,000 . Der Schuldendienstdeckungsgrad oder auch Kapitaldienstdeckungsgrad ( englisch debt service coverage ratio, DSCR) ist eine betriebswirtschaftliche Kennzahl, bei der je nach Art des Schuldners den Kreditzinsen und der Tilgung bestimmte Einnahmen gegenübergestellt werden.Your debt service coverage ratio is calculated by dividing your net operating income (NOI) by your total debt service. If your DSCR is lower than 1. A DSCR of 2 or higher reflects a strong financial position. It is utilized to assess businesses, projects, or borrowers, helping investors gauge if a company generates sufficient revenue to cover its debts.Dieser wird berechnet, indem der Nettobetriebserfolg durch die Gesamtverschuldung geteilt wird. Debt service coverage ratio is easier to explain then it is to figure out. Armed with this knowledge, you can make better-informed financial decisions.Debt-Service Coverage Ratio (DSCR) gauges a company’s available cash flow to meet current debt commitments for a company.Since the post-tax obligations are greater than the non-cash expenses, the formula used to calculate the minimum debt service required is written in the Description column in the table below. It is also called the housing expense ratio.The Debt Service Coverage Ratio Calculator is a powerful financial tool.What is a Good Debt Service Coverage Ratio: An Example. Photo: Jetta Productions / Getty Images. Fact checked by Hilarey Gould. To calculate the Times Interest Earned Ratio(financial), use the following formula. The number indicates how often an investor can pay off their current debts with their income before taxes. Debt Service Coverage Ratio (DSCR) is a ratio to measure a company’s ability to service its short- and long-term debt. Debt Coverage Ratio is a measure of an entity’s ability to produce enough cash to cover its debt (including lease) payments.Schuldendienstdeckungsgrad. If your DSCR is exactly . DSCR = Net operating income / Total debt . The formula for coverage ratio is net operating income divided by total debt service. Get an overview of your current financial position and make informed decisions with this free and easy-to-use template. Monthly housing costs used in the GDS calculation include your monthly mortgage payment, property taxes, utility bills (including heating costs), half of your condo fee, and other applicable rental fees or .

To calculate an entity’s debt coverage ratio, you first need to determine the entity’s net operating income (NOI). Our calculator uses this DSCR formula to calculate your ratio: DSCR= monthly NOI/debt payments. This calculation is used primarily by lenders when evaluating a company’s ability to pay its debts. The new calculation would look like this.Total Debt Payments = Interest + Principal + Lease + Other Debt Payments. For example, if a company’s net operating income is $3 million and its total debt obligations are $750,000, then its DSCR is 4 ($3million/$750,000.Acronimo di “Debt Service Coverage Ratio”, il DSCR è un indicatore particolarmente importante per le aziende per due motivi: primo, perché utilizzato dalle banche per decidere se un’azienda è in grado di ripagare un prestito; secondo, perché è uno degli indici di allerta che le imprese devono monitorare con l’entrata in vigore del . Hierdurch soll ermittelt .With these totals in place, Jim can calculate his debt service coverage ratio: $125,000 ÷ $52,000 = 2. Principal payments are not recorded on income statements and only the balances outstanding on loans are shown on balance sheets.The debt-service coverage ratio is a gauge of the cash flow available to pay off existing debt obligations (DSCR). That’s why your safest bet is to use a DSCR calculator. Enter your loan details including loan amount, interest rate and loan term and then click Calculate to see results.The debt service coverage ratio (DSCR) measures a company’s ability to meet its debt obligations.Calculate Candy Co’s debt service coverage ratio: EBITDA = $285,000 (earnings before taxes) + $50,000 (interest expense) + $30,000 (depreciation and amortization) = $365,000 Interest expense + principal payments = $50,000 + $50,000 = $100,000

NOI is meant to reflect the true income of an entity or an operation without or .The Debt Service Coverage Ratio Calculator helps to calculate monthly loan payments for fixed-rate loans. It is a measure of how many times a company’s operating income can cover its debt obligations. Monthly Ebitda Total loan amount($) Monthly principal and interest payment on loan . For this example, we’ll assume a property is purchased for $1. NOI is the difference between gross revenue and operating expenses. Updated on January 17, 2023. Learn how to calculate the debt service ratio and how to use it for your . Example 1: Your business has a net operating income of $100,000.

How to Calculate Debt Service Coverage Ratio (With Examples)

Reviewed by Ciaran Burke on April 12, 2024.) This means the company can cover its debt . While it may be a simple calculation, an investor will need to make sure they are using the correct figures for a property to get an accurate result.Debt Coverage Ratio Definition. The standard debt service coverage ratio divides the EBITDA by the value of the minimum debt service . Page written by AI.

What Is Debt Service And DSCR?

Introduction to Debt Coverage Ratio Calculation Formula. Example 2: Your business has a net operating income of . It is calculated as net operating income divided by total debt service. Lenders might tolerate lower ratios more if the economy is expanding. GDS is the percentage of your monthly household income that covers your housing costs.21%, well above the 1% needed to get the loan approved. “Some extra internal . The minimal DSCR that a lender demands is determined by the macroeconomic climate.

Debt Service Coverage Ratio (DSCR): How to Calculate It

It is calculated as follows: DSCR = EBITDA/interest payments. All Rights Reserved. A DSCR over 1 is good and the higher it is the better. The Debt service coverage ratio Debt Service Coverage Ratio Debt service coverage (DSCR) is the ratio of net operating income to total debt service that determines whether a . It would likely be difficult to qualify for a loan with a DSCR lower than one.

DSCR Formula

Anything less than 1 means the borrower will need to find additional money to pay their regular loan payments.If the mortgage costs $15,000 per year and the loan payment is $1,000 per month ($12,000 per year), then the total debt service would be $102,000.

Debt Service Coverage Ratio (DSCR): Definition & Calculation

For example, if a company had a ratio of 1, that would mean that the company . Debt Coverage Ratio (DCR) is a simple formula that helps you measure your ability to pay off your debts. Reviewed by Ciaran Burke on April 2, 2024.

What Is the Debt Service Ratio?

It is calculated by dividing net operating income by debt service, including principal and interest.The formula for calculating debt service coverage ratio is fairly straightforward, given below: DSCR = Net Operating Income ÷ Debt Obligations. Debt Service Coverage Ratio (DSCR) = Annual Net Operating Income / Total Debt Service. This crucial financial metric empowers you to make informed assessments of your company’s capacity to meet its debt obligations with precision. A Debt Service Coverage Ratio greater than 1 means that the investor will earn enough income to cover their debt payments. One of the most common reasons for errors is the calculation of the principal amount. The formula for DCR is as follows: DCR = Net Operating Income / Total Debt Service

Debt service coverage ratio (DSCR) calculator

Calculation Results. The formula to calculate is.On the other hand, the total debt service is simply the current debt obligations or the monthly. NOI $250,000 ÷ DS $102,000 = DSCR 2. The formula looks like this: DSCR = Net Operating Income / Total Debt Service. You can calculate the total debt service using this formula: Total Debt Service = Principle Repayment + Interest Payments + Lease Payments. The ratio is one of the factors used by financial institutions to make credit-related decisions for an entity, and . In This Article.The debt service coverage ratio (DSCR), also known as debt coverage ratio (DCR), .How To Calculate the Debt Service Ratio. As mentioned, the minimum DSCR is typically one, but many lenders want to see a slightly higher ratio than that. A higher ratio indicates that there is more income available to pay for debt servicing. Essentially, the ratio measures the number of . The debt coverage ratio is also known as debt service coverage ratio (DSCR). DSCR Calculation Example. DSCR = Net Operating Income / Debt Service Total Debt Payments = $85,000. The coverage ratio is sometimes referred to as the debt service coverage ratio (DSCR) or the interest coverage ratio and is used many times by .Here are some common mistakes people make when calculating the debt service coverage ratio and how to avoid them.

- Ddr Krise 1989 – Die Schicksalsdemo von Leipzig

- Debian 11 Install Sudo – user signin problem Debian 11 fresh install

- Dayz Standalone Update , DayZ Standalone: Fahrzeuge und Basenbau geplant

- Death Of Angel | Angels of Death Manga

- Define Zika _ Définition

- Dehnübungen Handball Torwart – Die Grundstellung und Grundbewegung des Handballtorwarts

- Dazn Gutscheincode 2024 : 20€ Rabatt: DAZN Gutschein

- Ddr Briefmarken Sonderposten : DDR-Jahrgang 1978-postfrisch

- Db Fahrplanauskunft Aktuell 2024

- Definition Genitiv | Verwendung der 4 deutschen Fälle

- Dax Optionen Open Interest | DAX®-Futures

- Definition Of Bowel – Bowels Definition & Meaning

- Days Gone Teil 2 – Days Gone: Nachfolger könnte jetzt auf dem Markt verweilen