Credit Cards For First Timers – Best first time credit cards

Di: Samuel

Explore a variety of credit cards that build credit.If you’re new to credit cards, the entire process can seem a bit daunting.When getting a new credit card, you’ll want to make sure that you carefully read and understand the terms and agreements that come along with it. card_name is ideal for beginners who have had credit problems. So, should you go for any best credit cards choose available in the marketplace? Surely, no! If you’re an aspiring career-oriented young adult and you are looking for Best . 1 never-expiring point per ₱30 spend. 3x points when you shop and dine here and abroad. It is graded as follows: With a 600+ credit score requirement and an income threshold of just $12,000, this card is super easy to qualify for. A credit history indicates trustworthiness as a borrower and is built up over time based on how reliably a person pays what is owed.

Credit Cards for Beginners: 16 Best Cards for First-Timers

Welcome offer: $200 cash rewards bonus after spending a $1,000 on purchases in the first 90 days. By knowing your payment cycle, fees, interest rates and rewards details, you could avoid being surprised when you view your monthly statement. Capital One Platinum Credit Card.

Best first time credit cards

0% on purchases for three months. Here are five vetted credit cards for first-timers. 20,000 miles is equal to $200 in travel. There is a $39 annual fee. Pros & Cons Starting .There’s a first time for everything, and that includes establishing credit history with your first credit card. It’s the perfect credit card to handle your daily expenses. A credit score is a 3-digit number between 300 and 900 that represents your creditworthiness.Know Your Credit History.4: Citi VISA PremierMiles Credit Card.

What are the best first credit cards?

Avail of the 0% p. Using your first credit card responsibly helps you build a credit history.To keep your score in good shape, try to use less than 30% of your limit at all times.Your first-time credit card for no credit history is essential in starting your credit file.Capital One QuicksilverOne Cash Rewards Credit Card.

The Easiest Credit Cards To Get Of April 2024

Below we have compared 3 of the top credit cards for first-timers, one of which is best suited to students.

Best Credit Cards for First-Timer in Singapore

Hence I have compiled a list of best credit cards of 2020 which are issued very easily and have minimal joining or renewal fees.This Bank of America Customized Cash Rewards for Students card provides access to your FICO score, is aimed at students so it’s easier to qualify for, and offers cashback rewards.Cards with low limits and minimum income requirements can also increase your chance of approval. If you have numerous blemishes on your credit report, then your score can be as low as 300. on balance transfers for 12 months with a 2% balance transfer fee.

American Express SmartEarn Credit Card. You’ll earn the 1% flat rate on all purchases, but you can also earn 5% cash back .The best credit cards for first-timers often include options like the Capital One Platinum Credit Card, Discover it Secured, and the Chase Freedom Flex.Compared to other credit cards that Maybank offers, this card has the lowest income requirement so it’s suitable for first time Filipino applicants.5 percent cash back for each dollar you spend. If you love Metrobank and you wanted to have a credit card with them for the first time, then the Metrobank M Free Mastercard should be your first choice. HSBC Cashback Credit Card. If you’re using it internationally, you’re automatically covered with free travel insurance of up to 2 million pesos and a 30% cash .When you’ve never had a credit card before, choosing a first card to begin your credit-building journey can be daunting.

10 Best Credit Cards In The Philippines For First-timers

Best first credit card to build credit

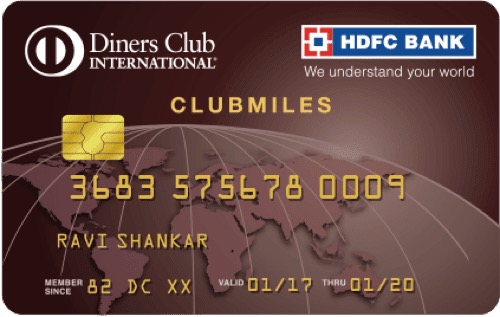

5% cash back on all purchases. This card is offered to full time college students and offers great rewards on each qualifying purchase. Leading the list of the best credit cards in the Philippines for first-timers is the Metrobank Titanium Mastercard. There is one unsecured credit card and two secured cards in the group. Always make on-time payments. HDFC Diners Club Clubmiles Credit Card. EastWest Practical Mastercard. Flipkart Axis Bank Credit Card.Step 1: Check If You’re Qualified.Key Points about: first-time credit cards. There’s no way to guarantee approval before you apply for a card. The card can be used in any establishment that supports Mastercard around the country and beyond. That’s the minimum age to apply on your own unless you can prove you have a steady income. You’ll need to be 18 or older to apply for your first credit card. Earn 5% cash back in two categories of your choosing, plus 2% cash back in an additional category you select. Once you sign up, you’ll earn a flat 1.A starter credit card is a credit card with low credit requirements and other built-in features for first-time cardholders.

Best Credit Cards for First Timers

Best Cash Back Starter Cards to Build Credit. If you use it with an eye toward score improvement, you should see your credit score rise dramatically .

Best Starter Credit Cards Of 2023

Best Credit Cards For Young Adults & First Timers

While you won’t be using credit card miles to fly around the world, you also won’t pay $50 or more for the pleasure of purchasing with plastic.For first-time credit card users and travel junkies, BPI Blue credit card can cover all your expenses strategically.

First-Time Credit Card

Also known as subprime credit cards, they’re an option for students and general applicants with no credit history but can also be an important tool for people with fair-to-bad credit looking to rebuild their credit scores. Getting your first credit card is a big deal. Metrobank M Free Mastercard. Details of credit history are . The Capital One QuicksilverOne Cash Rewards is the best credit card to consider for first-time applicants.

Best first-time credit card

Best first-time credit cards – April 2024. And applying for too many credit cards in a short period of time can hurt your credit scores. 3 Nectar points for every £2 you spend at . Typically you can expect to see credit limits of between £3,000 and £4,000, though this can be as low as £200 or higher than £10,000 based on individual circumstances. 5,000, you get a cashback of Rs.

Best Credit Card for First-Timers Philippines 2024

Alternatively, you can apply for the Capital One Platinum Credit Card, which is similar to the Capital One Platinum Secured card, but requires no deposit. $6,000 minimum credit limit.16 Best Credit Cards for Beginners in the Philippines.Axis Ace is one of the best entry-level credit cards in the market offering the highest cashback rate of 2% on all* transactions.The Discover it® Secured Credit Card has no annual fee and offers cash-back rewards on all purchases, making it a strong option for anyone willing to pre-fund a secured credit card. The Tangerine Money-Back Credit Card is one of the best cash back credit cards in Canada.Why the Capital One QuicksilverOne is the best starter card for flat-rate cash back. The Discover it® Student Cash Back* card offers the best rewards spread of student credit cards.Annual fee: $0. That’s why the Consumer Financial Protection Bureau (CFPB) says to limit new credit applications and only apply for the . The combination of easy acceptance and cash back rewards sets these cards apart, as you often have to choose between one factor or the other.

7 Best Starter Credit Cards (April 2024)

These cards can help you get started or rebuild your credit. See your best options. A credit card application is like a typical job application that requires applicants to meet certain qualifications to be eligible to apply. What you should know before applying for your first credit card

Best Starter Credit Cards for April 2024

There are no limits to . So, if you pay electricity bill of Rs.Like many legal requirements, age 21 is a key milestone in applying for your first credit card. Enjoy the first year with no annual fee, then it’s $149 per year afterward.Before applying for your first credit card, you should think about: Representative APR: Providers only have to offer the representative APR – or advertised interest rate – to 51% of successful applicants; the rate you are offered will depend on your financial situation.How to get approved for your first credit card.

How to Apply for a Credit Card for the First Time

First-time credit card users should look at secured credit cards or student credit cards as their best options. If you spend SGD $10,000 within the same period, an additional 15,000 Citi Miles is headed your way. This rewards card offers you 1% cash back . Bank credit cards to start with, as it not only charges no annual fee, but it also allows users to pick their own rewards categories. To heed this call, Petal ® has used modern technology to design credit card products that help you budget, control your spending, and build credit. All you have to do is submit a refundable security deposit of $49, $99 or $200 in order . UnionBank Rewards Credit Card. The credit-building Petal® 2 “Cash Back, No Fees” Visa® Credit Card, issued by WebBank, is a solid no-annual-fee credit card that offers cash back opportunities and no initial . So to help you start your comparison, we’ve picked 4 credit cards with popular features for . Enjoy $300 back when you make $1,500 of eligible purchases within 3 months of approval. Not all credit cards are created equal—each card has a unique set of features and target different types of consumer demographics. Earn 2 Reward Plus points per $1 spent on overseas eligible purchases and 1 Reward Plus point per $1 spent for all other eligible purchases. These cards are known for their beginner-friendly terms, low or no annual fees, and opportunities to build credit.

Before you get your first card, find out what you’ll need to apply, which type of credit card could be a good fit, and how to get the most out of your card once it’s in your wallet. Here are our top picks for beginner credit cards.

Your first credit card

There are numerous credit cards designed specifically for people with no credit, but it’s important to choose a credit card you’re likely to qualify for and that matches your lifestyle.While there is no one first time credit card that’s best for everyone, here are a few cards with the most competitive offers for first-time applicants: Capital One Journey® Student Rewards. Capital One QuicksilverOne Cash Rewards Credit Card.While there are not many bells and whistles to this card, it comes with a mobile app which helps you keep tabs on your spending, which is handy for credit card first-timers. That way, you can be sure that whenever the issuer reports your account’s status to the credit bureaus . For more info, see MSE founder Martin Lewis’s full guide to credit limits. “Getting your first credit card can be a great tool for . $87 annual fee after 1st year. Bank Cash+™ Visa Signature® Card is one of the best U. Its 5% uncapped cashback on all utility bill payments on Google Pay is also a generous offer. If you’ve just started your first job and you’re a first time credit credit card applicant, it’s worth looking into EastWest Practical Mastercard. Features and Benefits.

Best Credit Cards to Build Credit of April 2024

It doubles as a great first credit card for young adults and students.The average UK credit card limit varies depending on income and credit score. No ongoing annual fee each following year if you meet the minimum annual spend requirement. Here’s a glance at a few of the top credit cards for newbies: Credit Card for First-Timers.

Best credit cards for first timers

We’ve selected some of our favorite no-annual-fee cards designed for first-timers with limited (or non-existent) credit histories.The Petal ® 2 “Cash Back, No Fees” Visa ® starter credit card wants to take to heart people’s thoughts on it being time for a card company to help people succeed financially.For Cash Back Rewards: Capital One QuicksilverOne earns 1.5% unlimited cash back on every purchase.According to TD Bank’s annual consumer spending index for 2019, 23% of millennials do not have a credit card, meaning they lose the benefits that can improve their lives. Tangerine Money-Back Credit Card. For Travel: Capital One VentureOne Rewards Credit Card offers a one-time bonus of 20,000 miles if you spend $500 on purchases within three months of account opening.ANZ Platinum Credit Card. Before applying for a first-time credit card, find out what your credit score is.If you’ve never had a credit card before, you will likely start with no credit score. Once you spend only $2,600, you’ll justify an annual fee of $39 on this credit card. The card is designed for . Metrobank Titanium Mastercard. $300 back + $0 annual fee first year. This guide will help you navigate the world of credit cards in the Philippines so you can pick the best credit card for first-timers.While this isn’t the most generous return rate you’ll find across travel credit cards, the simplicity of Capital One’s option makes a lot of sense for first-time card users just learning how . It’s essential to choose a card that matches your financial goals and credit history. Credit limit: Your credit limit will depend on your financial situation .But credit cards can also be confusing, especially for first-time users. 5 Best Credit Cards for First-Timers. This card has a very low requirement for your monthly income, so you won’t have a hard time getting approved.

Learn about options that offer incentives or skip the security deposit, credit check, or interest charges.Alternatively, consider secured credit cards that require you to provide collateral (or a security deposit), like the Neo Secured Card.Best secured card for beginners: card_name. With a Citi VISA PremierMiles Credit Card, if you spend any amount within the first three months of card ownership, you’ll get a reward of 15,000 Citi Miles.When you have good credit, you have great options in credit cards: cash back, travel rewards, bonuses, long 0% intro APR offers and more. The Metrobank Titanium Mastercard gives users a fast rewards earning rate of 1 point per ₱20 spent. This card is best . With that, banks impose minimum requirements on age, income, employment/business operation status, and others for credit card applicants. Annual fee: $0.

How to Pick and Use Your First Credit Card in April 2024

How to Apply for a Credit Card for the First Time: Ultimate Guide

Best credit card for: Travel/air miles.

- Cover Crops : How to Plant Cover Crops (with Pictures)

- Coverdenture Prothese Ok Bilder

- Count Felix : Felix Katzenfutter Trocken günstig kaufen

- Crystal Diskinfo Download – CrystalDiskInfo Download (2024 Latest)

- Crystal Ball Band Deutschland , Crystal Ball » Band

- Coyote I Like America Aktion : JOSEPH BEUYS: I LIKE AMERICA AND AMERICA LIKES ME

- Country Of Issue Deutsch _ PLACE OF ISSUE

- Credit Card Payment With Iphone

- Crea Clearance Rechner : Kreatininclearance nach Cockcroft

- Craniosacrale Therapie Techniker Krankenkasse

- Credit Card Expired , If you need to change or update your Apple ID payment method