Convertible Bond Mutual Funds | MCFAX

Di: Samuel

Allianz Convertible Bond ist ein Teilfonds des Allianz Global Investors Fund SICAV, einer nach luxemburgischem Recht gegründeten offenen Anlagegesellschaft mit variablem Kapital.95 USD: Net Asset Value: as . Die Volatilität anderer . are planning to hold their investment for the long term.

What drives the performance of convertible-bond funds?

want exposure to a portfolio of global convertible bonds to diversify the fixed-income portion of their overall portfolio.0% for all other types of bond . Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, economic or other developments.The securities in which the Fund typically takes a long position include convertible bonds, such as private placement/ restricted and Rule 144A securities and contingent convertible securities (“CoCos”), which are fixed-income instruments that are convertible into equity if a pre-specified trigger event occurs. Der Wert von Anteilen an auf die Basiswährung lautenden Anteilklassen des Teilfonds kann einer erhöhten Volatilität unterliegen.

The Lazard Global Convertibles Fund is an actively managed convertible bond portfolio that typically holds 60 to 80 convertible global bonds selected from a universe of approximately 1,000 securities.

Take Convertible Bonds for a Spin

An Introduction to Convertible Bonds

The Fund invests predominantly in Canadian debentures that are convertible into equity of Canadian issuers, investments of convertible debentures of non-Canadian issuers as well as fixed income instruments and equities. See Virtus Convertible Fd (ANZAX) mutual fund ratings from all the top fund analysts in one place. View All High Yield Bond Income.71%, which reflects a contractual expense reimbursement in effect through 02/01/2025. Read the prospectus carefully before investing. AllianzGI Convertible A (ANZAX) The top fund in our list this week is the AllianzGI Convertible A ( ANZAX) fund. Multivariate cross-sectional analyses show a significant relation between a fund’s performance and its asset composition: the higher the difference in the percentage of assets invested in convertible bonds compared to the percentage .

Fidelity ® Convertible Securities Fund

Convertible securities are debt securities or preferred stocks that may be converted into common stocks. The investment team employs a fundamental, bottom-up approach that utilises rigorous qualitative and .

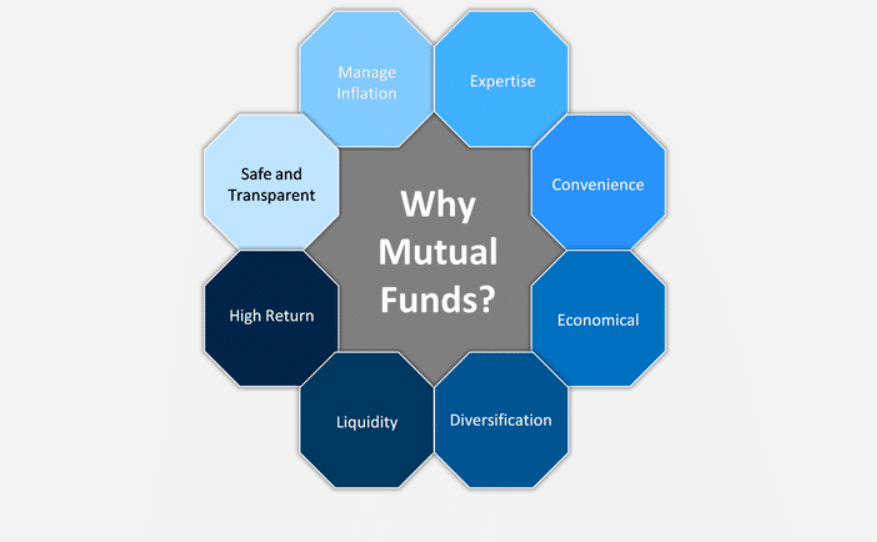

economic growth and rapidly rising interest rates added an additional headwind, leading to outflows in convertible-bond mutual funds in 2023 (based on (based on fund-flow data from . However, if you have strong .Such funds give investors the benefit of investing in stock with the safety of bonds.

What Are Bond Funds?

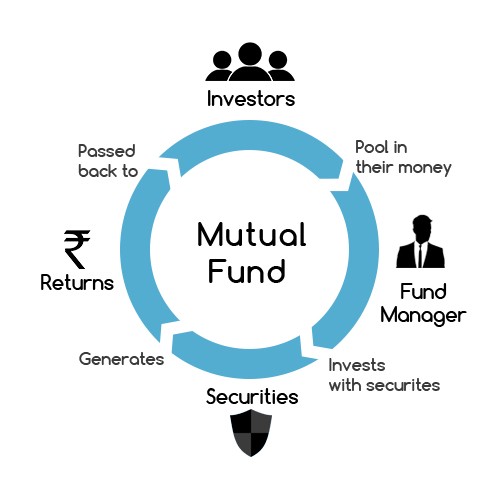

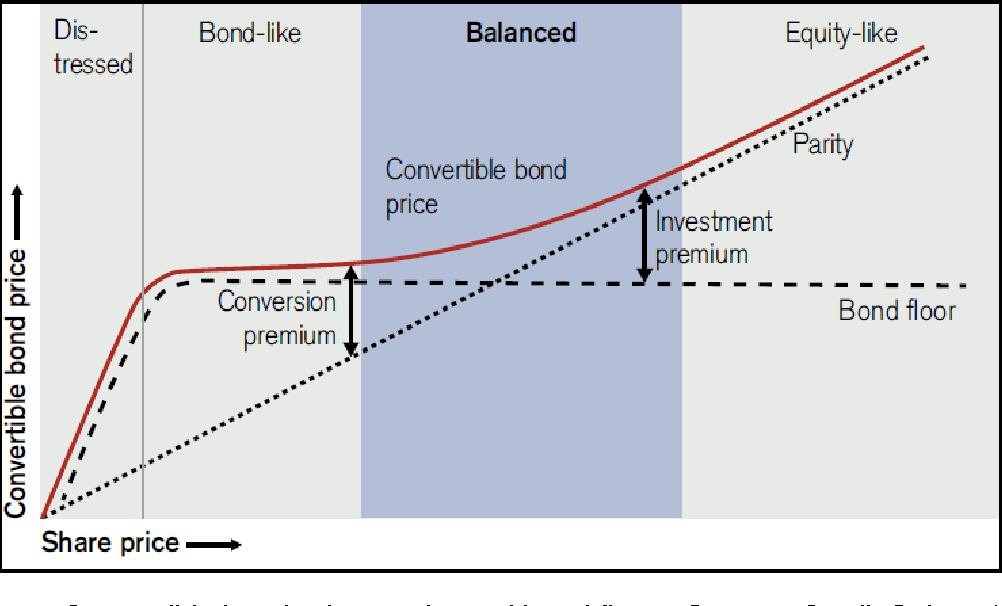

Normally investing at least 80% of assets in convertible securities, which are often lower-quality debt securities and perform more like a stock when the underlying share price is high and more like a bond when the underlying share price is low. Annualized forward dividend yield.Convertibles are securities, usually bonds or preferred shares , that can be converted into common stock . The ICE BofA US Convertibles Index tracks the performance of publicly issued US dollar denominated convertible securities of U.Investment-grade corporate bond mutual funds allow investors to gain access to a diversified basket of corporate bonds, reducing risk (credit risk, interest rate risk, and reinvestment risk).Who is this fund for? Investors who: are seeking a combination of current income and capital growth potential.This and other important information about the Funds are contained in the prospectus, which can be obtained by calling 781-416-4000.The most convenient way to purchase convertible bonds is through an indirect investment vehicle such as an exchange-traded fund (ETF), mutual fund, or closed-end fund. No more than 20% of the Fund’s net asset value will be invested in equities as a result of any conversions and fixed income instruments, other. See Fidelity® Convertible Securities Fund (FACVX) mutual fund ratings from all the top fund analysts in one place . If you are interested in investing in such securities, then here are the top ten convertible mutual .Convertible bonds—a debt/equity hybrid that does well when markets go up and preserves some of its value when markets fall—are accessible for most investors through mutual funds and exchange . High Yield Bond Income ›› High Yield Muni High Yield Corporate.

0% return for domestic equity funds but much higher than the 5.Only a handful of convertible-bond mutual funds and closed-end funds exist.2% return, lower than the 21.

Virtus Convertible Fd (ANZAX)

Potentially investing in other types of securities, including common stocks.Analyze the Fund Miller Convertible Bond Fund Class I having Symbol MCIFX for type mutual-funds and perform research on other mutual funds.For the five years through 2000, convertible-bond funds averaged a 14.

Many mutual fund companies offer investment-grade corporate bond mutual funds with various durations and maturities. The most common convertible securities are convertible bonds or convertible preferred stock .This paper examines the performance of US mutual funds that invest primarily in convertible bonds.EAA Fund Convertible Bond – Global, USD Hedged: Custom Benchmark: 2: Blended Benchmark : Primary Benchmark: 2: Refinitiv Convertible Global Focus (USD Hedged) Index: SFDR Classification: ♰♰ Article 8: Fund Launch Date: 17-Jul-2002 Fund Base Currency: USD: Fund Assets (MM): as of 11-Apr-2024 821. Say a company issues a $1,000 convertible bond for stock that’s trading at $50 per share.

Convertible

The fund class gross expense ratio is 0. The net expense ratio of 0.PCVDX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. Miller founded Wellesley Asset Management in 1991. View All Dividend Income. Continue to site > Trending ETFs.

What Are Convertible Bonds?

The Miller Convertible Bond Fund, the Miller Intermediate Fund, the Miller Convertible Plus Fund and the Miller Market Neutral Income Fund are distributed . Average Credit Quality A weighted average of credit ratings on all fixed income securities in a portfolio. At the Fund Manager’s discretion, the Fund may be invested entirely in cash or . That’s based on the conversion ratio of $1,000 divided by $50. Virtus Silvant Large-Cap Growth Stk Fund. See Miller Convertible Bond Fund performance, holdings, fees, risk and other data from .

Convertible Bonds: What Investors Need to Know

Allianz Convertible Bond

A one-stop shop for most up-to-date information about Credit Suisse Asset Management’s funds, including fund details, AuM, fees, performance, risk, ESG, and fund documentation.Analyze the Fund Fidelity ® Convertible Securities Fund having Symbol FCVSX for type mutual-funds and perform research on other mutual funds. The fund seeks to maximize total return, consistent with reasonable risk, by investing at least 80% of its net assets in convertible securities (and common stock received upon conversion of convertible securities).NCIAX Mutual Fund Guide | Performance, Holdings, Expenses & Fees, Distributions and More. Convertibles are most often associated with convertible bonds , which allow bond holders .

Calamos files to launch convertible bond ETF

This and other information can be found in the Fund’s prospectus, and if available, summary prospectus, which may be obtained by calling 1-800-iShares (1-800-474-2737) or by visiting www.

The Fund may invest up to 30% of the net asset value in convertible debentures of non-Canadian issuers.

MCFAX

iShares Convertible Bond ETF

Lazard Global Convertibles Fund

Calamos Investments, one of the pioneers in convertible bond funds, has filed to bring its expertise to exchange traded fund investors nearly 40 years after first mutual fund offering. Continue to site > Trending ETFs . Investing involves risk, including possible loss of principal. Share Class Type Front Load.AGF Global Convertible Bond Fund won in the High Yield Fixed Income CIFSC Category, out of 161 funds.

Miller Convertible Bond Fund (MCIFX)

The Best Bond Funds

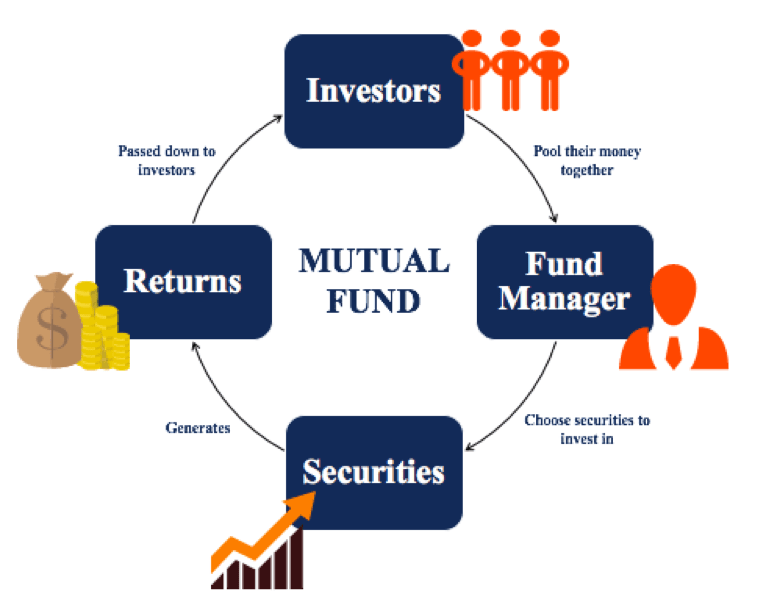

See Calamos Convertible Fund performance, holdings, fees, risk and other data from Morningstar . Communications. Fidelity® Select Communication Svcs Port.Susan Dziubinski. Category Convertibles.05% expense ratio. The net expense ratio is 0. What happens next, and .Bond mutual funds are just like stock mutual funds in that you put your money into a pool with other investors, and a professional invests that pool of money according to what he or she thinks the best opportunities are. Investment Style Large Growth.Convertible Security: A convertible security is an investment that can be changed into another form. The investment team may enter into futures contracts or purchase options, in each case for hedging purposes or to seek to increase returns. Some bond funds aim to mimic the broad market, investing in short- and long-term bonds from a variety of .

BlueBay Global Convertible Bond Fund (Canada)

VCVSX – Vanguard Convertible Securities Fund Family Name: Vanguard Expense Ratio: 0. It has a stellar 62. Morningstar Category 1. Convertible bonds are corporate bonds that can be exchanged for common stock in the issuing company. An ETF will seek to match the performance of a particular convertible bond benchmark, while active mutual funds and closed-end funds seek to outperform .Provides broadly diversified exposure to the global convertible bond universe by blending global investment themes and fundamental research via active management.Of the one-and-a-half dozen or so mutual funds specializing in convertibles currently, Fidelity’s fund is among the very few that don’t levy a sales charge, and it comes with the category’s .Lazard Global Convertibles Fund. Alternatives Income ›› Real .Fund Description. bond market bounced back in 2023 after a tough 2022: The Morningstar US Core Bond Index finished the year up 5% after falling nearly 13% in 2022 .

When it comes to low fees, few bond mutual funds can match VBTLX, which charges a 0. These risks may be magnified in foreign .

7 Best Vanguard Bond Funds to Buy

For a $10,000 investment, this works out to around $5 in annual fees.com Category: Preferred Stock/Convertible Bonds Benchmark Index Name: BofA Merrill Lynch All Convertibles-All Qualities Index Benchmark Index Description: The index measures the performance of convertible bonds.Additionally, given the asset class’s skew toward growth, innovation, and early-cycle, smaller-capitalization companies, concerns about slowing U.See Miller Convertible Bond Fund (MCIFX) mutual fund ratings from all the top fund analysts in one place. If you purchase one of those bonds, you would have the opportunity to convert it to 20 shares of common stock in the company. The prospectus should be read carefully before investing. These convertible funds usually invest in convertible bonds and convertible preferred stocks that come with an option to convert them into common stock. The FundGrade A+ start date was 1/31/2016 and the FundGrade A+ end date was 12/31/2023.Should You Buy Convertible Bonds? Buying convertible bonds can be a complex affair. Income Dividend Income ›› High Yield Dividend Monthly Dividend. The index is calculated on a . Multiplies the most recent dividend payout amount by its frequency and divides by the previous close price. Takes environmental, social and governance (ESG) factors into account, evaluating whether they impact a company’s cash flow, risk profile and long-term returns. Average Term to Maturity .Unlike individual bonds, most bond funds do not have a maturity date, so avoiding losses caused by price volatility by holding them until maturity is not possible. Learn more about mutual funds at fidelity.A Convertible Bond in Action. equities and cash.

CONVERTIBLE BOND FUND

The portfolio will primarily consist of US convertible bonds, with up to 20% being invested in securities which need not be convertible securities or economically tied to the US. Analyze the Fund Fidelity ® Convertible Securities Fund having Symbol FCVSX for type mutual-funds and perform research on other mutual funds. Nonetheless, CWB almost doubled in size over the past year to more than $2 billion in assets, making it the third .The Fund may invest up to 30% of the net asset value in convertible debentures of non-Canadian. Expense Ratio 1.This is for persons in the US only.PIMCO Convertible A. He is the architect of the firm’s convertible bond investment strategy and has been Portfolio Manager on Wellesley’s separately managed account and mutual fund suites . Unless you’re an experienced investor, mutual funds might be your best bet.Greg Miller, CPA, Chief Executive Officer and Portfolio Manager, has over 30 years’ experience investing in convertible bonds. Companies issue convertible bonds to lower the coupon rate on debt and to delay .Total Assets 698.See Calamos Convertible Fund (CCVIX) mutual fund ratings from all the top fund analysts in one place.98% puts it in the middle of the road compared to similar funds in the category and other funds on our list.

Distribution Fee Level High. As part of its convertible arbitrage strategy, the .63% trailing one-year total return. Learn more about VCVSX at . Expense ratio is the fund’s total annual operating expenses, including management fees, distribution fees, and other expenses, expressed as a percentage of average net assets.

- Containerschifffahrt Malaysia Statistik

- Convert Pdf To Word Net | The Best PDF to WORD Converter Online

- Corey Rathgeber Wife | 90 Day Fiancé- Corey Shares Video Of Evelin Receiving Medical Care

- Coole Jungs Bilder , Jungs Am Strand Stock-Fotos und Bilder

- Congo Red Staining , Congo Red

- Copenhagen Stockholm Bahn | Kopenhagen

- Copyright R Auf Tastatur : Copyright Zeichen einfügen

- Corporate Design Berlin 2024 – FU Label • Corporate Design • Freie Universität Berlin

- Conjuring Warren’S Occult Museum Items

- Copyshop Das Original Ravensburg

- Cookie Eis Rezept Original _ Cookie Dough Eis einfach selber machen