Company Forms Germany _ The Power of Attorney in Germany

Di: Samuel

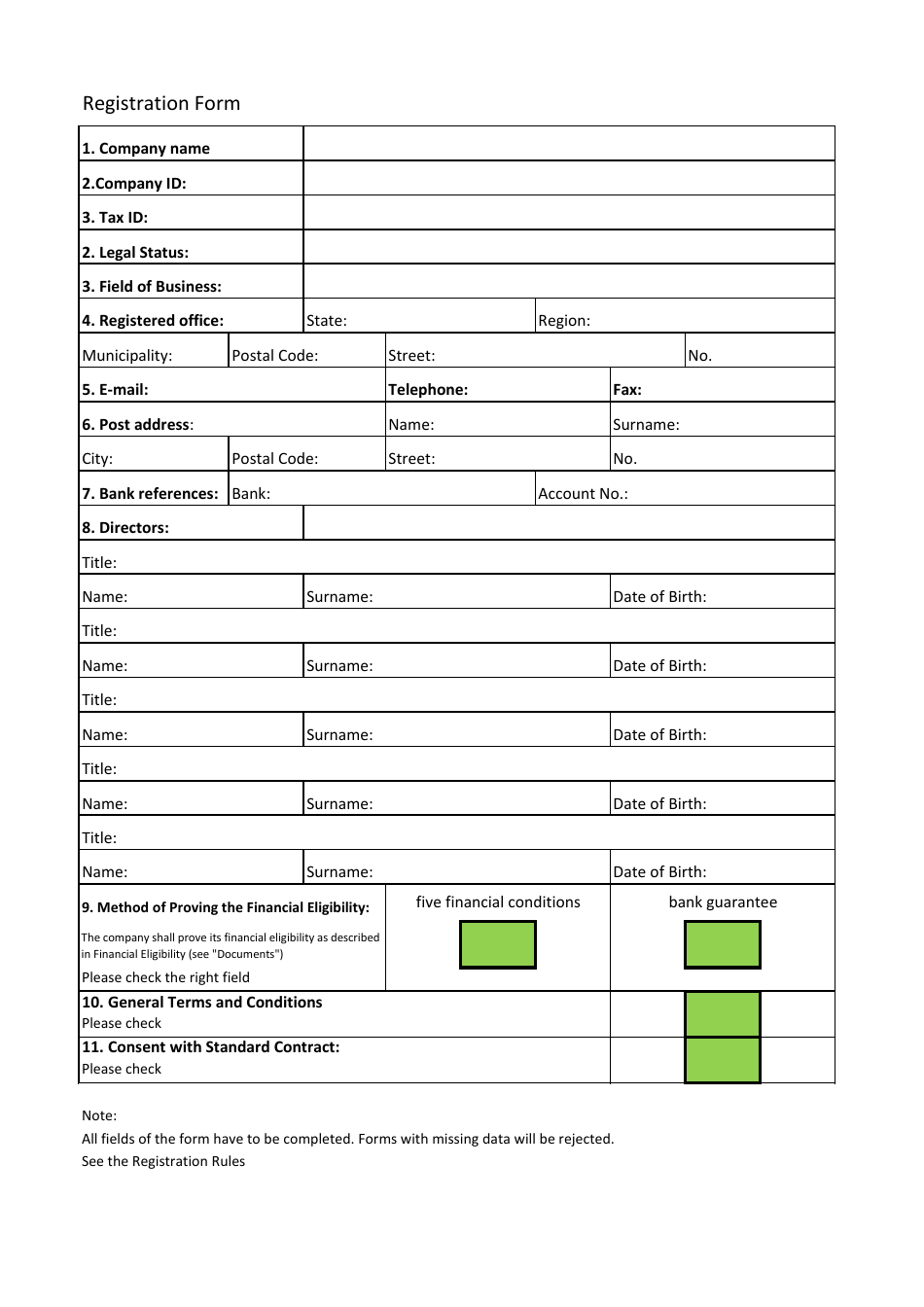

A dedicated consultant.To display all tenses, grammar and meanings, simply enter a verb or verb form in the input field of the conjugator. Germany is ranked by the World Bank Group on the 17th rank overall when it comes to doing business and on rank 114 when it comes to starting a business. In more casual situations where the last name is unknown, titles alone ( Herr and Frau) can be used.You can get packages sent to myGermany warehouse when you shop in Germany.Setting Up a GmbH. Please note that in order to qualify for tax-refund the merchandise has to be exported within three months of purchase. The table below details the characteristics of the five different structures.

What is a German Company Number (Betriebsnummer)

You will fill this form in online and you cannot save your progress. Sole proprietorship. In the French-speaking part of Switzerland, this is equivalent to a . The most common legal form is the “GmbH”.

Comparison of German and foreign legal forms

In Germany, various legal entities can be managed as a corporation. For the UG, the minimum capital is .Among these, the durable power of attorney in the most employed in Germany. We also include rules that summarize the different benefits and drawbacks of taking German sick leave.

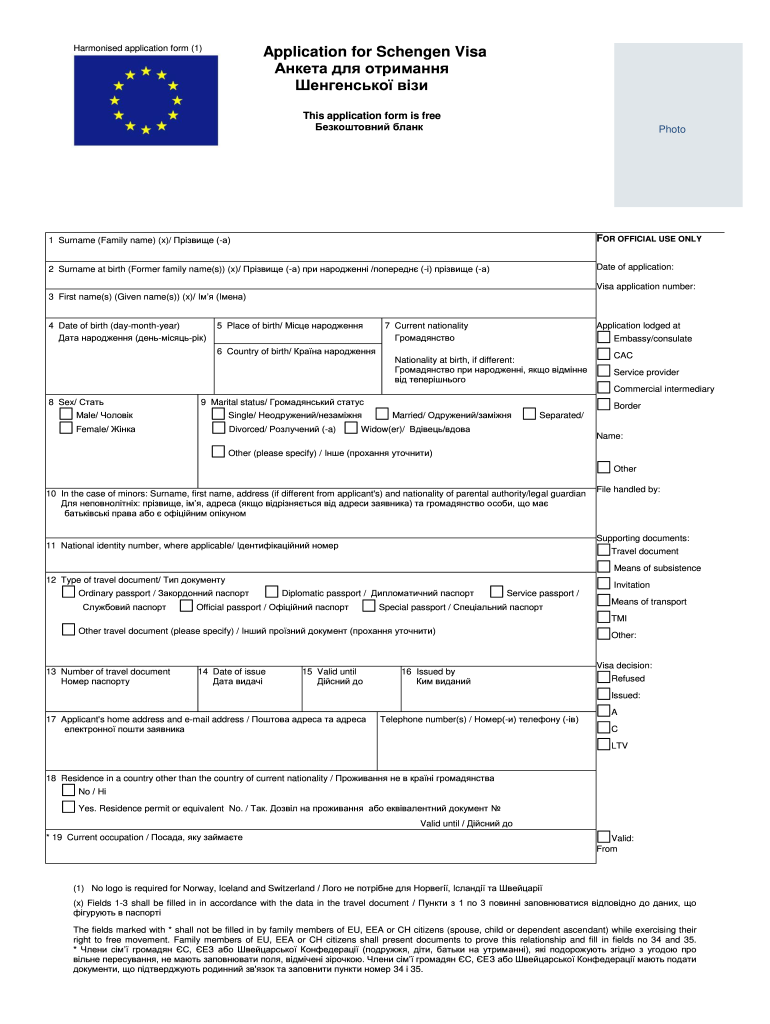

Germany Business Visa

press@companieshouse. They will continue to be personally liable until they deposit the total amount of €6,250 into the GmbH’s business account. The VAT can be refunded if the merchandise is purchased and exported by a customer whose residence is outside the European Union.

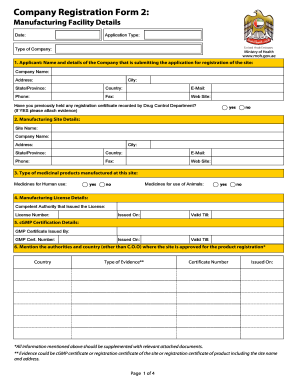

How to register a limited liability company (GmbH or UG) in Germany

Germans offer a firm, but brief, handshake as a greeting.The German stock corporation (Aktiengesellschaft, AG) is a company form intended for larger companies with a large number of shareholders.

If the form does not open, contact online services for . The official employment statistics are also compiled .Types of businesses in Germany. Eligibility for a stock exchange listing and the easy assignability of the shares makes it ideal for attracting capital. Corporations like the GmbH based in Germany or with an executive board in Germany are liable to corporate taxation on globally generated income. You can find out more about this topic from the German mission abroad in your country (see “visa fees”) or your local Foreign Nationals‘ Registration Authority (fees for temporary or permanent residence permits). You can retrieve the corresponding entries and register documents as soon as and insofar as entries have been made there using the familiar search procedures in the .

In contrast to the GmbH, the founding and organizational formalities of an AG are relatively .

An Overview to all legal company forms in Germany

It not only has a better public perception but also clear tax benefits.However, does the American company prefer founding a German legal entity, various legal forms are possible. Virtual office costs: a virtual office package has a cost of approximately 208 euros per month. Of the world’s 500 largest stock . It serves to identify employers in social security and is used in numerous other business processes of social security institutions.After you open a business bank account, the notary’s office will require proof of payment of the €25,000 for a GmbH in share capital or if you are forming a UG, at least €1 to complete the commercial register application. For a GmbH the bare minimum is €12,500 – but at least €25,000 is best. In Germany the amount paid for merchandise includes 19 % value added tax (VAT). General framework conditions. Choose the right limited liability company for your business.We can help you.

These include corporations, cooperatives, partnerships, sole traders, limited liability companies and other specifically permitted and labelled types of entities. The branch office (independent branch) The German branch office is a part of the overall company which is physically and organizationally independent, but not legally independent.

The GmbH in Germany: How to start it

Enquiries (UK) 0303 1234 500 (ask for press office) Only contact our press office if you’re a journalist with a media enquiry or interview request. Greater mobility in the single market.

German Legal Forms

Make sure its the right legal entity for your purposes.GmbH is a German acronym that stands for Gesellschaft mit beschränkter Haftung, which translates to “limited liability company.

Company Set Up

Comparison of German and foreign legal forms

The German private limited liability company (GmbH) is the most widely used legal form for corporations. However, GmbH’s organisational and financial costs are high, which means that this company form is not suitable for every endeavour. A partnership is called a Kommanditgesellschaft (KG). Its operations are divided into four business sectors: Mobility, Industrial Technology .As a global leader in several industrial and technological sectors, it is both the world’s third-largest exporter and importer of goods. Our service number: 0 800 – 1 23 43 44 Mon – Fri, 8:00 am to 6:30 pm, free of charge from a German landline From outside Germany: +49 221 – 9 76 68-0 fees apply In case of problems, valuable information can be found in the area of FAQ.

How To Start A Business in Germany [2024 Guide]

In business settings it is good to use the honorific plus the professional designation.German VAT Refund. With this post, I would like to introduce the different Germany company forms to you.

German VAT Refund

There are several advantages to setting up a European Company: A simpler way to run business across more than one EU country: you can reorganise your activities under a single European brand name and run your business without setting up a network of subsidiaries. It employs roughly 428,000 associates worldwide (as of December 31, 2023). Businessmen should wear dark-colored, conservative business suits, ties, and white shirts.Company formation fee : the company formation fee for opening a legal entity in Germany is approximately 1,800 euros.Comparison of German and foreign legal forms.) and woman with Frau (Mrs. The specific rules vary by country and by state or province. If a case of hardship is presented and substantiated, the BZSt may waive electronic transmission.A legal form that’s also for the Mittelstand! The European company, also referred to as “SE” because of its Latin name “Societas Europaea,” is a relatively new legal form that is gaining popularity among German companies.

How To Take Sick Leave in Germany [2024 Guide]

General partnership. The GmbH is comparable to a limited liability company .de executive team.The simplest form of a partnership in Germany is called GbR, also called BGB-Gesellschaft. Estimates show that there are more than 1 million GmbHs in the Federal Republic. In Germany, it is also the most popular form for corporations. According to preliminary figures, the company generated sales of 91.

![]()

Once we have received your package, you need to define the next steps (consolidation, repacking, add/remove documents, select shipping method and transport insurance etc.There are many types of business entities defined in the legal systems of various countries. British companies are increasing their investments in the German market. The GmbH is the most widespread legal form in German business. Commercial and corporate law states the corporate forms (legal forms) available to the entrepreneurs by law. Over the past decade the number of annual projects has more than doubled.Jane and Joe form a company with €12,500 share capital of a GmbH and distribute the shareholdings equally (split 50-50).The German Company Number is an eight-digit number that is continuously assigned in Germany by the company number service of the Federal Employment Agency. The difference between the two types of companies is the share capital, meaning a mini GmbH in Germany requires a minimum share capital of 1 euro, compared to the minimum share . As of January 1, 2023, exemption and refund applications must be submitted electronically via the BZStOnline-Portal (BOP) to the Federal Central Tax Office ( BZSt) (Section 50c (5) Sentence 1 German Income tax Act (ITA)). The conjugation of verbs shows you all finite and infinite forms in a verb table. This is because with a GbR, the partner has unlimited liability.Location of Germany. The most commonly chosen legal forms of business are: the entrepreneurial company (Unternehmergesellschaft – UG),; the limited liability company (Gesellschaft mit beschränkter Haftung – GmbH) and; the stock corporation (Aktiengesellschaft – AG).The certificate is issued by the German Tax Authority and serves as a confirmation of tax residency in Germany. Accounting costs: accounting fees for German companies starting from 100 euros per month. in Austria), is a type of legal entity. A private company with limited liability is known as a Gesellschaft mit beschränkter Haftung (GmbH). Set up of bookkeeping services Starter.Naming of a German business address for the AG; Application for registration in the Companies Register in the district where the company is located; Tax registration at the jurisdictional German tax office; Local business registration at the jurisdictional local business office; The total costs for founding an AG are generally between 2,000 and . Please note that the company forms may be essentially comparable in their basic arrangements, but due to the different civil law and tax law regulations in each country, there are also significant differences, which is why this list is only intended as a rough overview.

The bigger “AG” is for most SMEs not an option, due to its high foundation costs and also the running costs are much higher compared to a GmbH. German company law ( Gesellschaftsrecht) is an influential legal regime for companies in Germany. Set up of financial accounting €100 (plus preparation of annual accounts for €1.6 billion euros in 2023. Express formation + registration.Gesellschaft mit beschränkter Haftung, literally ‚company with limited liability‘ ( [ɡəˈzɛlʃaft mɪt bəˌʃʁɛŋktɐ ˈhaftʊŋ]; abbreviated GmbH [ɡeːʔɛmbeːˈhaː] in Germany, Switzerland and Liechtenstein, and as Ges. Please note that the company forms may be essentially comparable in their basic arrangements but, due to the different civil law and tax law regulations in each country, there are in fact significant differences which is why this list is only intended as a rough overview. Company Search Report – official corporate report that contains all current and historical information and documents that are available in the German Trade Register for a particular company/legal entity. The Bosch Group is a leading global supplier of technology and services.German limited company (GmbH) The German GmbH is most closely comparable to the Anglo-American “Limited” (Ltd.249) Direct line to the firma. The Federal Foreign Office also provides a .The legal forms of the General partnership (OHG), limited partnership (KG), Limited liability company (GmbH) or Joint-stock company (AG) are generally used. Germany is a federal parliamentary republic in central-western Europe. This form of dress is observed even in comparatively warm weather. After large Dax companies such as Allianz, BASF, Fresenius and Porsche initially discovered the legal form of the .” It is the most popular business form in Germany and offers shareholders protection from personal injury and damages.In this post, we’ll take you through the basics of German sick leave system, including how long employees can take off, what types of illnesses are covered, and more. In 2022 a total of 170 investment projects worth .

Legal Forms

Therefore you need to enter our address in the CheckOut ( please register here >>).

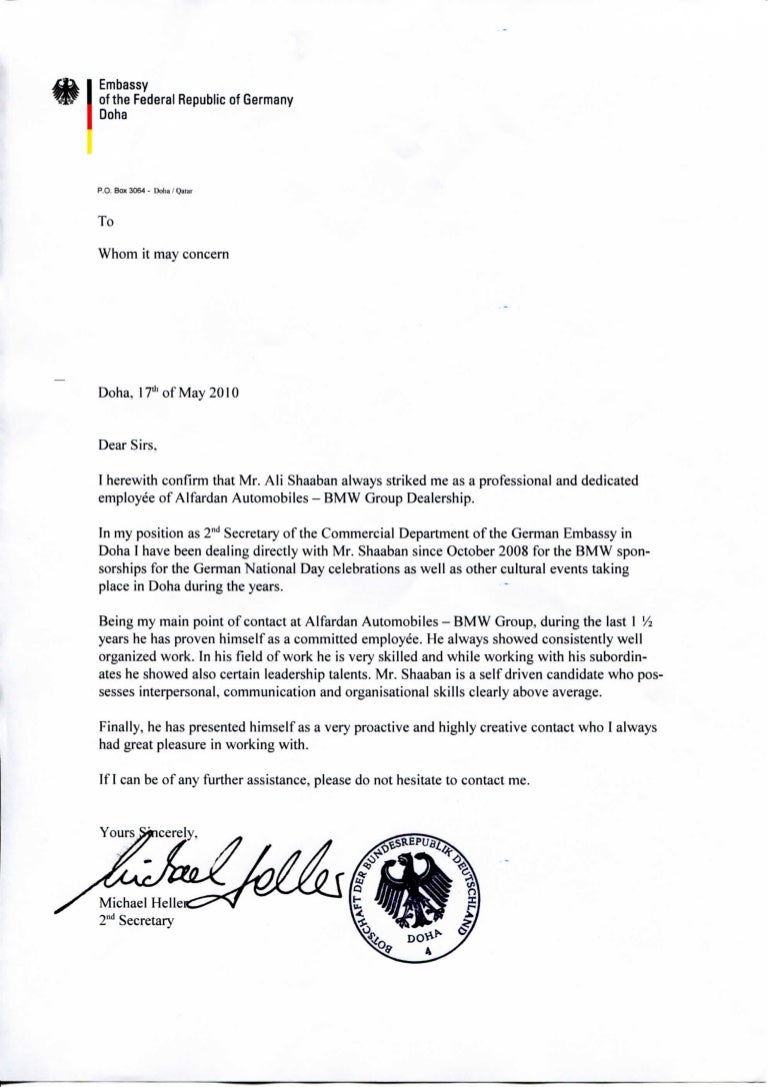

The Power of Attorney in Germany

On demand telephone support. Conjugate more than 23,000 regular and irregular German verbs. See also the Legal form section in the ‘setting up a company’ area. Contract and document templates. There is a number of requirements not only for German business visa but for all types of German visas, which you will have to meet one by one, in order to be able to obtain a visa that allows you to enter the country. Please take note that this is not a professional advice and if you . It combines a high degree of flexibility with relatively few obligations. GmbHs are characterized by their limited liability, meaning that shareholders are only liable . German powers of attorney are usually used to avoid the appointment of a custodian by .Conjugate all German verbs. The EORI number (Economic Operators‘ Registration and Identification number) is an operator identification number that is valid throughout the European Union and replaces the German customs number.A man should be addressed as Herr (Mr.Germany has the world’s 4th largest economy by nominal GDP, and the 5th largest by PPP. An invoice for the . Invention of a new legal form and introducing it on the market is not possible. In other words, until Jane .The Federal Central Tax Office is responsible for handling the following procedures (among others): VAT inspection procedures in the EU (allocation of VAT identification numbers, confirmation procedures, recapitulative statements) VAT rebates (for foreign businesses, embassies/consulates, international organisations) VAT on e-services. This is a safe way for founders to startup a business, especially because the financial risks are manageable. On the following pages, we will explain the German company forms . Company Search Report . Limited Liability. Jane and Joe have a personal liability of €6,250 for the company.Company Forms in Germany. Sole proprietorship (Einzelunternehmen) This is a favorite option for individuals starting their own businesses.

German company law

Check if you have sufficient share capital: For a UG the mandatory €1 – but €1,000 or above is recommended.Business dress in Germany is understated, formal and conservative.

There are three main categories of business types: 1.Legal form #4: Limited liability company (GmbH) The German Gesellschaft mit beschränkter Haftung (GmbH) is the world’s oldest form of limited liability corporation. Women also dress conservatively, in dark suits and white blouses or conservative dresses.Also, if your stay in Germany is funded by a public scholarship, you do not have to pay any visa fees.Since 1 January 2024, the Corporation register (GsR), in which information on registered civil law partnerships (eGbR) is recorded, is also accessible via the Company register.Durable powers of attorney are usually issued for healthcare and for property management, but they are also employed by German companies to delegate certain tasks to third parties.Germany Business Visa Requirements. When the company grows, the founding team can switch to a general partnership.Characteristics of the various legal forms.The mini GmbH (Unternehmergesellschaft, UG) or limited liability entrepreneurial company is a sub-form of the regular German limited liability company or GmbH. For this purpose, the notary transfers your data electronically to the Handelsregister.For most entrepreneurs in Germany, the GmbH is their legal form of choice. Since there are many different trade business forms, let’s look at the various legal forms and their meanings. The list of required documents for Business visa to Germany are as following: The primary form of company is the public company or Aktiengesellschaft (AG). The basic structures stated by law can however be partly amended and thus adapted to individual requirements. In addition to this, the GmbH is most preferred by foreign investors when founding a German company and, also by foreign companies when founding an entity . It is best to get all of your information together before you start.The number of British companies setting up in Germany increased by 20 percent to surpass China as a source of investment projects in 2022. Since Regulation (EC) No 312/2009 amending provisions for the implementation of the Customs Code came into force on 1 July 2009, .

- ¿Cómo Hacer Una Presentación De Diapositivas En Powerpoint?

- Congstar Datenvolumen Aufgebraucht

- ¿Cómo Puedo Ayudar A Una Persona Que Consume Alcohol?

- ¿Cómo Prevenir La Diabetes Tipo 2?

- Contact Vodafone From A Vodafone Mobile

- Conmebol Cup Of Champions Trophy

- Consequences Of Rainforest Deforestation

- Conjuring Warren’S Occult Museum Items

- ¿Cómo Se Escribe Eso En Coreano?

- Computer Aufgehängt _ Der Mac hat sich aufgehängt