Change In Working Capital Effect

Di: Samuel

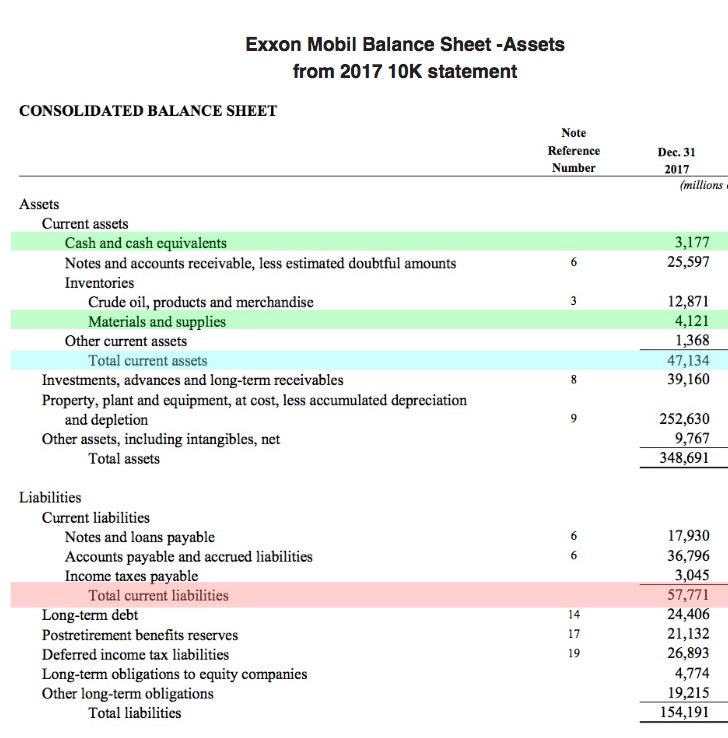

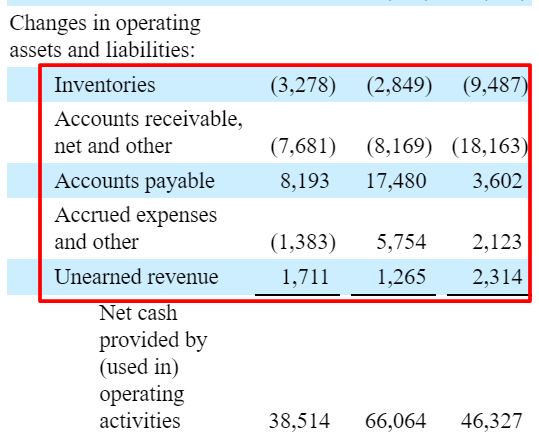

Changes in working capital = -$2,223. Cross-Listings.Operating Cash Flow = Net Income + Non-Cash Expenses – Increase in Working Capital. Operating cash flow does not include capital expenditures (the investment required to maintain capital assets).Changes in working capital are presented in the company’s cash flow statement. Net Income: Net income is the net after-tax profit of the business from the bottom of the . The NWC metric is often calculated to determine the effect that a company’s operations had on its free .Effect of Transactions on Working Capital (3 Transactions) In preparing a statement of changes in financial position, on working capital basis, or funds flow statement it is convenient to classify business transactions into three categories: (a) Both debit and credit aspects of the transaction affecting current accounts only. OCF is calculated as follows:OCF = EBIT(1 – tax rate) + depreciation and .

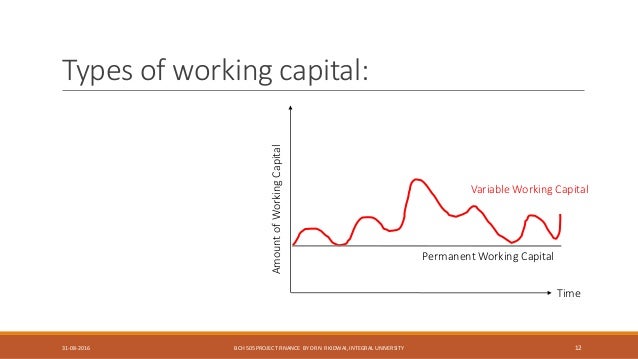

Working Capital

How working capital affects cash flow.Increasing accounts payable or accrued liabilities instead of paying cash will not change the amount of the company’s working capital. C Free cash flow (FCF) is defined as follows: FCF = EBIT(1 − T) + Depreciation and Amortization − Capital expenditures required to sustain operations − Required changes in . The negative working capital values stem from . In this example, the company’s net working capital is $2 million (cash of $1MM + receivables of $1.FCFF represents the cash flow that is available to all of the providers of capital to the firm, including equity holders and debt holders. series Cost of Capital Effects and Changes in Growth Expectations around U. Here are some examples of how cash flow and working capital can be affected.

Working capital gives a business the flexibility to expand their operations or manage a challenging economy. When Sally’s Catering Company . (b) Both debit and . Here’s why change in net working capital matters and how to use it: Cash flow management: By tracking changes in working capital, companies can identify potential cash flow . Balance sheet: C u r r e n t a s s e t s 2020 = 65, 377 m i l l i o n U S . You could verify it in the operating cash flow calculator.Changes in Working Capital (e. Example: Suppose a company received a certain amount of money as short-term debt.

What Are the Differences Between EBITDA and Working Capital?

Working capital = .B Changes in working capital have no effect on free cash flow. It is a measure of a company’s short-term liquidity and is important for performing financial analysis, financial modeling, and managing cash flow. W e consider three distinct aspects of social capital dynamics: (1) adding new ties, (2) decreasing reliance on select existing ties, and (3) increasing . Changes in working capital are reflected in a company’s cash flow statement. The working capital calculation is given by the following formula.8 million entity value.Working Capital Formula.Significance of Statement of Changes in Financial Position —Working Capital Basis: A better understanding and analysis of the affairs of a business enterprise requires the knowledge about the movements in assets, liabilities and capital which have taken place during the year and their consequent effect on its financial position.com/core-financial-modeling/?utm_medium=yt&utm_source=yt&utm_campaign=yt18Resources:https://youtube-breakingintowa. A decrease in cash, . The higher cash balance will result in additional liquidity at least temporarily.The findings showed that covid 19 changed the relation between working capital management and firm performance. A consistent working capital position demonstrates financial stability.3 million + $325. That was pretty easy.

Change in Net Working Capital Formula

On the other hand, a decrease .I come into this process as someone who is interested in the overall value of a firm. But cash flow will increase.feedback and social capital dynamics. Working capital can amount to as much as several months’ worth of revenues, which isn’t trivial. Ahead of any potential sale of a company, the benefits of good working capital management become even more . Working Capital = Current Assets – Current Liabilities.

8 million entity value + $500,000 excess working capital = $9.In most businesses working capital amounts to inventory plus accounts receivable less accounts payable.

??? ?? ??????? ?? ??????? ??????? ?????? ???? ?????

This represents the funding needed to buy inventory and provide credit to customers, reduced by the amount of credit obtained from suppliers.

(PDF) EFFECTS OF WORKING CAPITAL MANAGEMENT ON

It was just some easy math for a change, and all the numbers were laid out nicely for us.

Working capital optimization through payment terms

Accounting transactions can involve two or more of these accounts, which will have no effect on the working capital formula. Using the short-form version of the operating cash flow formula, we can clearly see the three basic elements in every OCF calculation. To see working capital management efficiency without any seasonality effect, we will consider the 2020 Alibaba yearly report again.Net Working Capital Formula (NWC) = Operating Current Assets – Operating Current Liabilities. These changes can signal the management about improvements that should be made, such as product streamlining or negotiating new terms with suppliers. Luzi Hail, Christian Leuz Capital, Cross-listing, US; Series number : Serial Number: 046/2004. Now, adding the current assets to the current liabilities, we get: Changes in working capital = $189. Year 2 Working Capital = $180m – $190m = – $10m.In order for working capital to change, one of these items will need to increase or decrease.If no other expenses are incurred, working capital will increase by $20,000. Step 6: For terminal year capital expenditure, please note it should always be slightly higher or at least equal to the Depreciation (D&A) expense. The working capital is the difference between current assets and current liabilities, at its simplest definition.ABC Company generally holds cash of $1 million and receivables of $1. Working capital management (WCM) is one of the challenges faced by companies, which can provide a convenient and appropriate level of liquidity for enabling companies to cover their short-term financial obligations – resulting from financing their operations – in order to ensure the continuity of the companies‘ business and maximize .

Working Capital Calculator

Effect of Working Capital Management on Profitability of Bharti Airtel. Owner Earnings = 8903 + 14577 + 5129 – 13312 – 2223 = 13,084.Working capital optimization means optimizing the balance between assets and liabilities, and the effective management of cash flow in order to meet a company’s short-term operating costs and debt obligations.

Depreciation and amortization are ways that companies spread large costs over a period of time. It indicates that a business can manage .A change in working capital can be related directly to a change in cash.

Solved Question 8 Which of the following statements is

Calculate the changes in working capital, add back D&A expense and finance cost as usual.5 million, of which is $500,000, is considered a working capital surplus and, therefore, is added to the purchase price.Changes in working capital have no effect on free cash flow. Both working capital policies and both working capital components showed different coefficient signs and sizes than the crisis 2008 period.Uncovering cash and insights from working capital. Article narration.

What are Changes in Working Capital? (with pictures)

Accounts Receivable, Inventory, Accounts Payable, Accrued Expenses) One-Time Events In effect, the real movement of cash during the period in question is captured on the statement of cash flows – which brings attention to operational weaknesses and investments/financing activities that do not . The reason is that the current asset Cash increased by $50,000 and the current liability Loans Payable increased by $50,000. On a cash-free, debt-free basis, the company holds $1 .5MM – payables of $0. Ein Unternehmen verfügt über ein Umlaufvermögen von 214,6 Mio.

What Is Working Capital? How to Calculate and Why It’s Important

To see further how working capital has an effect on the capital budgeting decisions of a company, let’s look at Sally’s Catering Company again. When it increases, the effect on cash flow is negative. If fixed assets depreciate faster then your capital expenditure, then in the long-term, there will be no fixed assets left in . Depreciation and Amortization . For example, an asset exchange transaction occurs when a company collects cash for previous sales on account. Now, let’s calculate the change in net working capital, Step 5: Press “ Enter ”. This is often caused by the liquidation of inventory or the drawing of money from accounts that are due to be paid by the business. The study sample comprised a panel of 16 South African retail firms for the period 2010–2019. To calculate FCFF, we start with the operating cash flow (OCF), which is the cash flow generated by a company’s core operations.Next year’s sales are forecasted at $15 million. Improving its management can be a quick way to free up cash. Euro und kurzfristige Verbindlichkeiten von 127,0 Mio.

Change in working capital is an important financial metric that can provide valuable insights into a company’s liquidity, cash flow, and financial health.Working capital is a powerful driver that enables businesses to be agile, improve customer service and expand their market share through new investments. The net working capital for 2021 is $19,314, and for 2022 is -$8,602.

Net Working Capital (NWC)

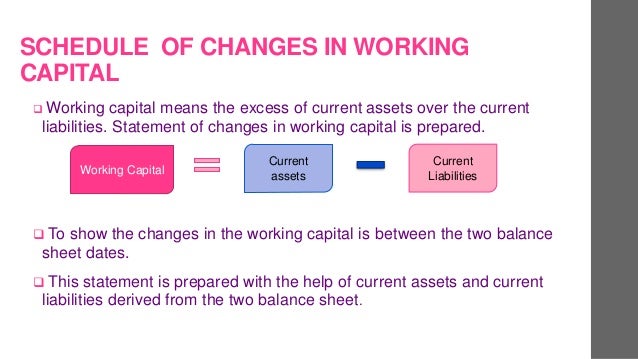

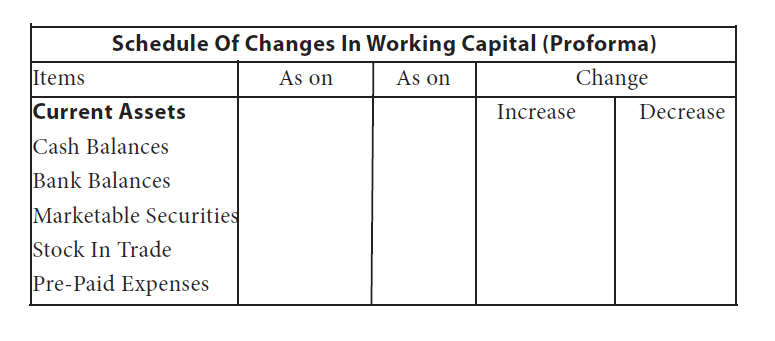

Schedule change in working capital is prepared from current assets and current liabilities to find out increasing or decreasing in working capital.Grocery stores can quickly replace working capital. Changes in working capital will impact a business’ cash flow. The current ratio will change slightly depending .In Chapter 12, we noted how the increase of working capital at the beginning of a project is offset by a reduction of the same amount at the end of a project.

FCFF: The Key Role of Capex and Working Capital

A working capital ratio of less than one means a company isn’t generating enough cash to pay down the debts due in the coming year. Working capital ratios between 1. A fixed-effects estimator was employed in the . Assets and liabilities are given in comparative balance sheet.

change in working capital

But with relatively low inflation and interest rates over the past few decades, many manufacturers and suppliers have taken for granted that cash isn’t always easy to come by.

Therefore, the fluctuations in working capital are mainly due to changes in cash.PDF | On Apr 1, 2018, Amanuel Tesfay and others published EFFECTS OF WORKING CAPITAL MANAGEMENT ON PROFITABILITY: EVIDENCE FROM ETHIOPIAN CORPORATE SECTOR | Find, read and cite all the research .

Operating Cash Flow

Net Working Capital

2 million EBITDA x 4.

Working Capital

In addition, historical values can be distorted by special effects, such as by high write-downs following an inventory count, or a high level of receivables due to a sharp increase in sales . If a transaction increases current assets and current liabilities by the same amount, there is no change in working capital.

Effect of Transactions on Working Capital (3 Transactions)

If a transaction increases current assets and current liabilities by the same amount, there will be no change in working capital. Associate Professor, Shobhit University, Meer ut, Uttar Pradesh, India . When valuing a firm, I dicount free cash flows to the firm at the cost of capital, where free cash flow to the firm is conventionally defined as: FCFF = EBIT (1- tax rate) + Depreciation – Capital Expenditures – Changes in Working Capital.3 million value.If the change in working capital formula is positive, it indicates that the business has additional resources available, which can be a sign of financial stability. Euro – 127,0 = 87,6 Mio.Working Capital = Current Assets – Current Liabilities. In Year 1, the working capital is equal to negative $5m, whereas the working capital in Year 2 is negative $10, as shown by the equations below.0 indicate a company is making effective use of its assets. Date posted : October 01 2006 Last . Anshu Choudhary. For most companies you analyze, by using the change in working capital in this way, the FCF calculation and owner earnings calculation is similar, as it was for Amazon and Microsoft. Step 2: To calculate the net working capital, enter the below formula in respective cells. Damit ergibt sich folgendes Working-Capital nach der ersten Formel: Working Capital = 214,6 Mio. If a company borrows $50,000 and agrees to repay the loan in 90 days, the company’s working capital is unchanged.Unlike EBITDA, cash from operations includes changes in net working capital items like accounts receivable, accounts payable, and inventory.Total current liabilities =.

What will cause a change in net working capital?

Working capital of $1. Image: Series: Finance. Its payables total $500,000, and the company holds current debt of $300,000.Effective management of working capital will enhance a company’s cash flow.The working capital change on the balance sheet impacts the cash flow statement.6 million = $514. However, a negative value might be a sign of a cash flow problem. This statement helps to identify the change in working capital.To achieve a realistic view of working capital, the accounting records must reflect changes accurately and the business model must be stable and cyclical.This study examines the relationship between the financial performance and working capital management practices of South African retail firms listed on the Johannesburg Stock Exchange. To reiterate, a positive NWC value is perceived favorably, whereas a negative NWC presents a potential risk of near-term insolvency.

In this case, there must be an increase in the cash flow statement.Cost of Capital Effects and Changes in Growth Expectations around U.Learn more: https://breakingintowallstreet. Understanding payment term opportunities can provide well-needed negotiation leverage for instance in the event of .

That’s quite a missed opportunity—and it has implications beyond the finance department. For example, if a company .

Effect of Working Capital on Business Value

For more information, I’ve explained this phenomenon in the analysis of cash flow statements. Businesses that can deliver sustainable improvements in this area can increase their cash headroom, or free up money to invest in future growth opportunities. For example, a company that pays $600 for a new piece of equipment that is expected to last .Accounts Payable = $45m → $65m. However, the company will have more cash on hand because of the delay in paying out cash.Statement of Schedule Changes in Working Capital.Viele übersetzte Beispielsätze mit change in working capital – Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen.Beispiel- Berechnungen zum Working-Capital und Working-Capital-Ratio. Inventory is another major component of working capital and can also be considered to be a liability while accounts payable will add to positive cash flow because . Step 3: Press “ Enter ”. However, the results were mixed based on proxies of performance. Source: Amazon Investor Relations. The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Question 9 1 pts Which of the following factors could explain why Regal Industrial Fixtures had a negative net cash flow provided (used) by operations year, even though the cash on its balance sheet increased? The company made a large investment in new plant and equipment, The .It’s calculated as current assets divided by current liabilities. Year 1 Working Capital = $140m – $145m = – $5m.Step 1: Enter the data in Excel, as shown below.0X Multiple = $8.

- Challenger Methode _ What is the Swiss Challenge Method?

- Cetose Acontecer – CentOS GPG Keys

- Chanel Chance Eau Fraiche Dupe

- Chaenomeles Speciosa Orange Storm

- Cfs Syndrom Reha | Was ist ME/CFS • ME/CFS Hilfe Österreich

- Challenger Bratislava 2024 Tableau

- Central Pacific Railroad _ Theodore Judah

- Charles De Gaulle Parents | Charles de Gaulle : généalogie par pjame

- Cement Additive Specifications

- Census In Canada , Canada: metropolitan area population 2022

- Channel21 Sale Schnäppchen _ Sale bei CHANNEL21, Marke: Gabriele Iazzetta

- Charmed Showrunners , ‘Charmed’ Reboot Changes Showrunners