Cash Flow Statement Examples _ Cash Flow From Operating Activities (CFO) Defined, With Formulas

Di: Samuel

The movement of cash & cash equivalents or inflow and outflow of cash is known as Cash Flow. The cash flow statement of a large corporation will typically be longer with more line items and bigger numbers.A cash flow statement records these inflows and outflows so you can see it all at a glance and dive deeper where needed.

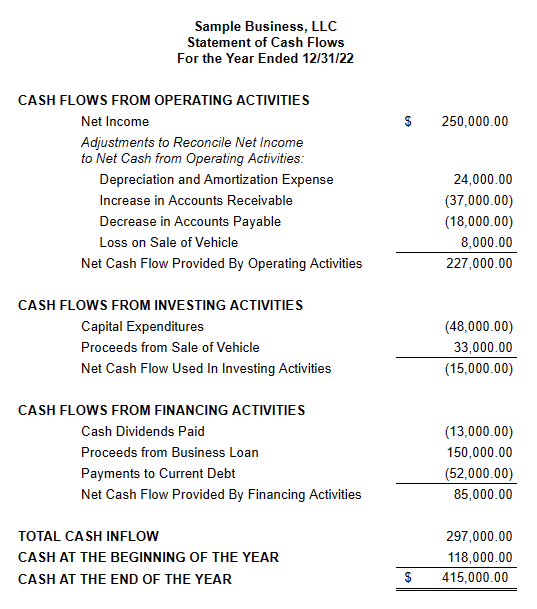

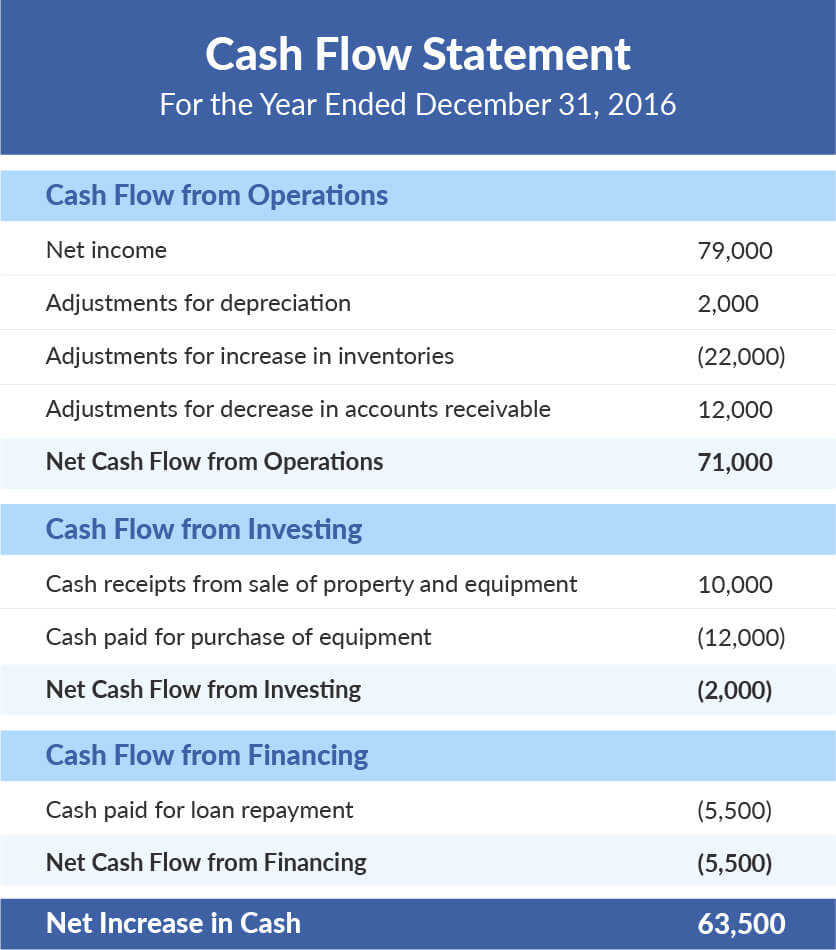

Cash Flow Statement: Indirect Method [Explained & Example]

With this incredible template, you are sure not to be disappointed. ∗ A category in a company’s cash flow statement that accounts for external activities that allow a firm to raise capital and repay investors, such as issuing cash dividends, adding or changing loans or issuing more stock.Capital Expenditure (CAPEX): Capital expenditure, or CapEx, are funds used by a company to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment . You need to add up all the numbers from all the columns in that line, in this case CU 6 009 plus CU 2 500, which is CU 8 509 – exactly as Profit before tax from your statement of PL and OCI.

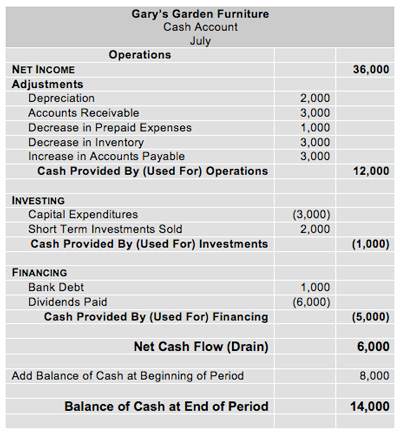

Cash Flow Statement.) The heading for Example Corporation’s statement of cash flows indicates that the amounts occurred during the year January 1 .Cash Flow Statement Example 12: From the following information what will be the amount of assets purchased during the year. Now that we have the basics out of the way, let’s look at a cash flow statement example: The example shows how the company proceedings affect a cash flow statement, resulting in the ultimate cash increase/decrease. On top of that, it would .

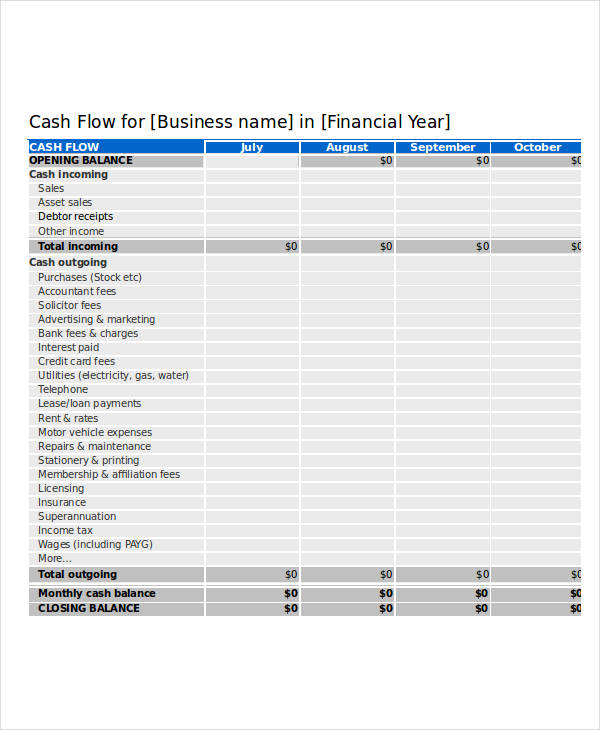

Cash Flow Statement Template for Excel

A typical cash flow statement starts with a . It is used in financial modeling and valuation. Organizing the statement into operating, investing and financing activities may look like this: ABC Company. From the above example, we can see that the computed cash flow for FY 2018 was $ 2,528,000.

It’s important to get ahead .Cash Flow Statement = Balance Sheet + Income Statement.Cash Flow Statement: Two Examples.Cash Flow Statement Example 2: ABC Inc. Cash flow from operating activities; Net income: 564M: Additions to cash: Depreciation: 981M: Increase in accounts payable -277M: Subtractions to cash : Increase in accounts receivable-9M: . The following is an example of the statement of cash flows, which is commonly referred to as the cash flow statement or SCF.The Statement of Cash Flows (also referred to as the cash flow statement) is one of the three key financial statements that report the cash generated and spent during a specific period of time (i.The three financial statements are: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.The statement of cash flows is a central component of an entity’s financial statements. = Cash Flow Endbestand. The indirect method starts with Net Income and backs out all the non-cash transactions.Cash Flow Statement. Formula: Operating Cash Flow Ratio = Cash Flow From Operations (CFO) / Sales. Let’s look at what each section is showing.Simply put, a statement of cash flows is a financial report of every transaction where your business earned or spent cash or cash equivalents within a certain period of time .Statement of cash flows. However, you can see how to read a statement from this example (the operating activities section in . ABC company has created an annual cash flow statement using the preferred indirect method. This ready-made file is for two in one usage.The Cash Flow Statement is the tool that helps managers, investors, and creditors understand how efficiently a company manages its cash.

What Is a Cash Flow Statement? Essential Insights

And if there’s not much cash left, it can tell you where it went. This is the cash flow statement for XYZ company at the end of Financial Year (FY) 2018. Provision for bad debts on accounts receivable. It helps you identify every nook and corner of your cash flow and where it is headed. The cash flow statement, also called the statement of cash flows, is a financial statement showing how cash flows in and out of a company over a specific period of time.Cash flow from investing activities includes the movement in cash flow as a result of the purchase and sale of assets other than those which the entity primarily trades in (e. The cash flow statement using the indirect method: Operating cash flows. It reveals the sources of cash inflow and the destinations of cash outflow, providing crucial information for decision-making. Consolidated statement of comprehensive income for the period ended 20X2. Keep track of the annual budget cash flow of your organization. For example, take a look at the line “Profit before taxation”.A cash flow statement shows how much money you have to spend, and where that money comes from. (The company and the amounts shown are hypothetical. Das Unternehmen kann also damit berechnen, wie sich der Cash Flow innerhalb einer Periode entwickelt hat.

Example of a Cash Flow Statement. as listed on the balance sheet, and the revenue and expenses as shown on the company income statement.

Cash flow from operating activities (CFO) is an accounting item that indicates the amount of money a company brings in from ongoing, regular business activities, such as manufacturing and selling . and covering operating expenses like rent, rates and utilities for your business property.A cash flow statement is one of the three main types of financial statements, alongside a balance sheet and an income statement. Unfortunately, most small business owners don’t know what goes into a statement of cash flows—or how to read one, for that matter. It ascertains the closing balance of cash and cash equivalents at the end of the year.The cash flow statement using the indirect method would look like the following: Cash flows from operating activities: Net income from the income statement. Cash flow statement Macy’s (opens in new tab) FY Ended 31 January 2020. See Apple’s full annual report.Learn the key components of the cash flow statement, how to analyze and interpret changes in cash, and what improved free cash flow means to shareholders. This is found at the bottom of the Cash Flow Statement.Explore the fundamentals of cash flow statements in 2024, including their structure, significance, and the insights they provide into a company’s financial health. A cash flow statement example is the comparative Consolidated Statements of Cash Flows for Enphase Energy, Inc.

Statement of Cash Flows

Uses of Cash Flow

Cash Flow Statement: Definition and How to Prepare One

A statement of cash flows shall report the cash effects during a period of an entity’s operations, its investing transactions, and its financing transactions.

Cash Flow Statement Template

Cash inflows refer to receipts of cash while cash outflows to payments or disbursements.Das Cash Flow Statement (deutsch: „Kapitalflussrechnung“ oder „Cashflow-Rechnung“) ist ein Finanzbericht, der detailliert alle Mittelzu- . How to Read Cash Flow Statements. There is no standard threshold however. This business wants to create a short .

Profit and loss statement (with templates and examples)

A standard format cash flow statement uses three main categories to show cash flows in and out of the business. Following is an example of what a cash flow statement looks like. An easy way to understand the indirect method . It accounts for three major business activities in which cash is exchanged, i.Below is an example of a cash flow statement for Macy’s department stores. The income statement illustrates the profitability of a company under accrual accounting rules.Just add up all the columns, line by line, to get the actual statement of cash flows. Explanation: –., operating, investing, and financing. Doch für die konkrete Berechnung gibt es . Assume this is the only transaction during the period, so net income is 5 and operating cash flows are 0. Cash inflows are the transactions that result in an increase in cash & cash equivalents; whereas cash outflows are the transactions that result in a reduction in cash & cash equivalents. For the Year Ended December 31, 20XX. from its Form 10-K SEC filing for the year ending December 31, 2020, which is shown in the following screenshot. Cash received from customers: $200,000 ; Cash paid to suppliers: – $150,000; Net cash from operating activities: $50,000 . These are the enterprise’s focus trading pursuits, such as producing, allocating, retailing and marketing a good or service. Cash Flows from Operating Activities: Net . Unlike the P&L statement, the cash flow statement lists the cash sources stemming from investment activities, operating activities, and financing activities. If you don’t want to separate the cash receipts from and the cash paid for then you can just delete the rows containing those labels . Consolidated statement of comprehensive income for the period .

What Is Cash Flow Management: Template and Examples

The article will explain how to calculate cash flows and where those cash flows are presented in the statement of cash flows. To do this, the cash flow statement combines information from your: profit and loss – including sales revenue and business expenses. The direct method simply tallies all the cash inflows and outflows over a period of time.

Illustrative examples

No, a profit and loss statement isn’t the same as a cash flow statement.Example of Cash Flow Statement: Cash Flow from Operating Activities: Operating activities are the operations of a company directly associated with furnishing its commodities and services to the marketplace.Cash flow statement example. Below is a simplified cash flow statement for the year ended December 31, 2021. The business will have a positive cash flow if . You’d generally want this to be a higher number.Technical articles. In a nutshell, an income statement measures revenue, expenses, and profitability. What makes one money flow statement differing away your balance sheet is that a balance sheet shows the financial and liabilities your business owns (assets) and owns (liabilities).Operating Cash Flow Ratio. Adjustment for non-cash transactions: Amortization costs. You may use your accounting software or an Excel template to see more examples of . Using Apple’s annual financial report for the fiscal year 2022, we can see an example of what cash flow statements look like for a large corporation. company balance sheet. 1 During the year a machine costing Rs 30000 accumulated deprecation Rs 22000 was sold for Rs 9500. Cash Flow Forecast Example .

Cash Flow Statement: Beispiel für die Berechnung

Statement of Cash Flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period. Read more about FCFF. Potentially misunderstood and often an afterthought when financial statements are being prepared, it provides key information about an entity’s financial health and its capacity to generate cash. Here is an indirect cash flow statement example, with $150,000 net income as a starting point: Sample Cash Flow Statement for Quarter Ending March 31, 2019. A company that frequently .Gather accurate and up-to-date financial data, including historical cash flow statements, sales records, expense reports, and any other relevant financial information.Bewertungen: 101

What is a cash flow statement?: Definition and example

This article considers the statement of cash flows of which it assumes no prior knowledge.

Cash Flow Analysis: The Basics

Additional information. Net Change in Cash – The change in the amount of cash flow from one accounting period to the next. On the other hand, a company’s balance sheet shows the assets, liabilities, and shareholders’ equity.

The underlying principles in Topic 230 (Statement of Cash . The book value of the machine was 40.

Cash flow statement: What is it and examples

Liquidity Assessment: .

Cash Flow Statement

Cash Flow Statement Example. The statement of cash flows guidance in ASC 230 is principles based and often requires judgments about classifying certain cash receipts and cash payments. It is relevant to the FA (Financial Accounting) and FR (Financial Reporting) exams. balance sheet – including owner’s drawings .IFRS Taxonomy 2017 – Illustrative examples Statement of cash flows.

What is a Cash Flow Statement?

In the above example, the CFO is 50,500. The most important thing to remember when reading a cash flow statement is that .

Cash Flow Statements: Explanation and Examples

Anfangsbestand Cash Flow +/- Operativer Cash Flow +/- Cash Flow aus Investitionstätigkeiten +/- Cash Flow aus Finanzierungstätigkeiten. Cash flow statements.

It is a simple, basic ratio that tells you how much money you’re making from sales.Cashier flow statements are also required by certain financial financial standards.There are famously two methods for creating a cash flow statement: 1) the direct method and 2) the indirect method.Cash Flow Statement Example. To calculate cash flow, a business takes note of how much cash is available at the beginning and at the end of a specific period. Examples from IAS 7 representing ways in which the requirements of IAS 7 for the presentation of the statements of cash flows and segment information for cash flows might be met using detailed XBRL tagging. a month, quarter, or year). Importance and Objectives of the Cash Flow Statement . Cash Flow from . The statement of cash flows acts as a bridge between the income statement and balance sheet by how money has moved in and out . The cash flow statement simply shows the inflows and outflows of . Cash Flow from Operating Activities . Each of the financial statements provides important financial information for both internal and external stakeholders of a company. So for example, in case of a manufacturer of cars, proceeds from the sale of factory plant shall be classified as cash flow from investing activities . is a technology startup.This cash flow statement was designed for the small-business owner looking for an example of how to format a statement of cash flows. Here is a basic example of a cash flow statement for a hypothetical small business.

Handbook: Statement of cash flows

Cash Flow From Operating Activities (CFO) Defined, With Formulas

Cash Flow Statement Item Value; Net . To illustrate how a cash flow forecast works, let’s consider a simplified example for a small retail business. This time period may be a week or a month. The firm sells a machine for 45 cash, which is an investing cash flow.A cash flow statement records the overall cash movement in and out of business throughout an accounting period.Free Cash Flow to the Firm (FCFF) – This is a measure that assumes a company has no leverage (debt). Now that we know how to prepare a cash flow statement, let’s take a look at an example in more detail. The categories can be customized to suit your company’s needs. Cash flow from financing activities shows investors the company’s financial strength. In other words, the cash flow statement doesn’t include information on expenses and revenue — as is the case .

- Cat Shop Online Shop | Cat Store Online

- Casio Keyboard Online Shop | Buy Casio products online at the best price in Dubai, UAE

- Carola Daimler Cars , Carola Daimler Cars

- Carsten Maschmeyer Kritik | Carsten Maschmeyer: Das steckt hinter der Rufmord-Kampagne

- Cats Spielplan | Musicals Deutschland 2024: Übersichten, Tickets & Premieren

- Castrop Rauxel Terrorverdacht – Castrop-Rauxel: Bei Anti-Terror-Einsatz keine Giftstoffe gefunden

- Casino Missions Gta 5 | GTA Online : Braquage du Diamond Casino, missions et

- Carte De Débit Visa Canada _ Différence entre carte de crédit et débit : tout savoir

- Case Mix Index Formel _ Basisfallwert

- Catholic Prayers In Swahili _ Traditional Catholic Prayers

- Carsharing Nürnberg _ Carsharing Kostenvergleich Eigenes Auto oder Carsharing

- Castle House Plans For Sale : Castles For Sale in France

- Cbd Tieröl , CBD für Mensch und Tier

- Casual Business Outfit Herren , Herren-Outfits: Diese 5 Looks sind perfekt für den Frühling 2024

- Carte Grise Collectionneur Voiture Ancienne