Cameco Uranium Price _ Numerco: Nuclear Fuel Snapshot

Di: Samuel

In addition, we have a $1 billion undrawn credit facility.63 in the quarter versus $54. The company’s shares are traded on both the Toronto Stock Exchange (TSX:CCO) and the New York Stock Exchange (NYSE:CCJ). We hold some of the world’s most promising uranium projects and invest in ongoing exploration .

Uranium Projects

Cameco Corporation

Cameco’s tier-one mining and milling operations have the licensed capacity to produce more than 30 million pounds (our share) of uranium concentrates annually, backed by more than 485 million pounds (our share) of proven and probable mineral reserves.CAMECO AKTIE und aktueller Aktienkurs. Our contracting decisions consider the uranium market structure, the nature of our competitors, and the current market environment. Home › Invest › Stock Information › Dividend History. Cameco (TSX: CCO; NYSE: CCJ) announced that it has signed a uranium supply agreement with the China Nuclear International Corporation, a subsidiary of the China National Nuclear Corporation (CNNC), one of the country’s largest nuclear power operators.Goldman Sachs starts with Buy on Cameco stock amid high uranium demand. The latest closing stock price for Cameco as of April 11, 2024 is 50.DEAL WORTH $4 BILLION. RBC Capital Markets Investor Webcast .Canadian giant Cameco lays out its argument for why the uranium market is positioned for a boom; Australia’s next producer Boss says higher prices are on the cards, with inflation sending incentive pricing to US$80/lb ; Ramelius sees inflation now, dumping gold mine expansion over potential cost blowouts; One of the world’s biggest .50 per pound for triuranium octoxide, a form of uranium that is extensively . If EPS Growth Is Important To You, Cameco (TSE:CCO) Presents An Opportunity. This is one of the most direct ways investors can gain exposure to spot uranium prices in Canada. (Simply Wall St. Pricing differences between these locations are generally contained within the active bid/offer spread of the spot uranium price, however have occasional moved beyond these.Cameco will benefit from increased uranium prices.Given the run-up in Uranium prices, investors should watch for a possible retest of the initial breakout level around $46.

Cameco has never missed a dividend payment . Meanwhile CCJ had realized prices of $52. Cameco’s Near-Term Prospects Discussed As you know, Cameco’s production schedule hit a snag a few months back that led .2022 Q1 – Q and A (00:50:08) 00:00.33, which is 1. Uranium prices reached the .Canadian uranium producer Cameco’s net earnings and cash from operations in 2023 more than doubled compared with 2022, and adjusted earnings before interest, taxes, depreciation and amortization was up 93%, off the back of higher uranium prices.Graphic: Ryan Trefes. The Uranium segment is involved in the exploration for, .Shares of Cameco (CCJ 2.5 billion (US) of cash and drew the full amount of both $300 million (US) tranches of the term loan put in place concurrently with the execution of the acquisition agreement, and which mature two years and three years from the date of close.To finance Cameco’s 49% share of the purchase price, equaling $2. On Monday, Goldman Sachs initiated coverage on Cameco Corporation (NYSE:CCJ) stock, a major nuclear fuel supplier, with a . At the Cigar Lake mine, we now expect to produce up to 16. Cameco’s uranium projects are properties that may be developed into uranium-producing operations at some point in the future.Spot and long-term uranium prices (2000-2023) Source: Cameco, UxC, TradeTech. ET by Tomi Kilgore. The high ore grades at the McArthur River mine means it can produce more than 18 million pounds per year by mining about 300 to 400 tonnes of ore per day. The company’s revenue for 2023 reached $2.Zudem hat Cameco mit der Westinghouse-Übernahme deutlich stärker ins Service-Geschäft expandiert. Cameco (TSX: CCO; NYSE: CCJ) has signed a uranium supply agreement with China Nuclear International Corporation, a subsidiary of China National Nuclear Corporation (CNNC), one of the country’s largest nuclear power operators. In our uranium .Despite the recent increase in market prices, the deepening geopolitical uncertainty and years of underinvestment in new uranium and fuel cycle service capacities has shifted risk from producers to utilities.The purpose of our contracting framework is to deliver value. Read why CCJ stock remains a top way to place an attractive uranium and nuclear market. engages in the provision of uranium.7% above the current share price.Cameco is one of the world’s largest publicly traded uranium companies. We are the operator of both the mine and mill. Our competitive position is based on our controlling ownership of the world’s largest high-grade reserves and low-cost operations, as well as significant investments across the nuclear fuel cycle, including ownership interests in Westinghouse . The most significant are the Millennium deposit in the Athabasca Basin of Saskatchewan and the Yeelirrie and Kintyre deposits in Australia.

Numerco: Nuclear Fuel Snapshot

Strong performance in the uranium and fuel services segments and improving 2023 consolidated revenue outlook: Results for the first nine months of the year reflect the impact of higher sales volumes and average realized prices in both the uranium and fuel services segments under our long-term contract portfolio. Long-term pricing contracts have transacted at higher prices than average spot pricing.Historical daily share price chart and data for Cameco since 1996 adjusted for splits and dividends.

Invest

Russia Is the Reason. That is helping to push prices of the nuclear fuel to nearly 16-year highs. Cameco has consistently made dividend payments since 1991.

Cameco Stock: Uranium Prices Are White Hot (NYSE:CCJ)

Cameco Corporation Stock (CCO)

Received dividends totaling $40.In its article, the Journal noted that uranium prices have experienced a remarkable surge in recent times, hitting $92.57 in Q3 versus $49.

Event details Replay webcast “The world has put a priority on achieving net-zero .

Businesses

In addition to the decisions many producers, including the lowest-cost producers, have made to preserve long-term value by leaving uranium in the . Nachrichten zur Aktie Cameco Corp. McArthur River is considered a material . Annual Revenue ($ millions) 2023 2022; Annual Revenue: 2588: 1868: Gross Profit ($ millions) 2023 2022; . Press releases.Cameco Corporation is engaged in providing uranium fuel to generate clean, reliable baseload electricity around the globe. Energy Uranium Miner Cameco Catches an Upgrade.0 billion in long-term debt. Annual Highlights; Quarterly Reports; Annual Reports; Annual Highlights.

Cameco stock price target raised to $46 from $37 at BofA Securities.The rising uranium price improved the company’s profitability, as seen in the 3Q23 report. Stock Quote & Chart; Dividend History; Stock Splits; Credit Ratings and Transfer Agent; Analyst Information; Dividend History.75 for Cameco shares before a potential move higher. As of December 31, 2020, we had $943 million in cash and short-term investments and $1. The all-time high Cameco stock closing price was 50. skip to content.

Uranium Is Finally Running Hot, and Miners Can’t Keep Up

Our global exploration activity is adjusted annually in line with .

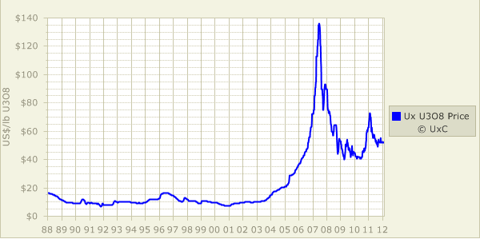

In service since 1999 and 1983 respectively, Cameco operates the ISO 14001 certified locations, which have collectively produced 535 million lbs using a variety of mining methods.Why Cameco Stock Soared 31% in July.Uranium Price: Get all information on the Price of Uranium including News, Charts and Realtime Quotes.Uranium spot prices spiked 35% from February to April 2020 as COVID-19 caused supply disruptions with Cameco and Kazakhstan’s Kazatomprom. Renewed focus on nuclear energy as a vital source in the renewables transition . 12, 2022 at 10:43 a.McArthur River is the world’s largest, high-grade uranium mine, and Key Lake is the world’s largest uranium mill.Uranium prices surged in 2023 due to supply shortages, but the rally may be unsupported by fundamental data as uranium prices reverse.TO) will supply Ukraine with uranium hexafluoride (UF6) from 2024-2035 . As such location differences are represented in .And as you can see above, uranium prices are moving higher correspondingly. Over the long term, however, pricing has been trending downward since prices spiked in 2007.6 million (US). “With the recent uranium price increase, we are beginning to enjoy the benefits of the strategic and .Saskatoon, Saskatchewan, Canada, September 3, 2023.UN, investors . On May 5, 2022, Cameco reported its consolidated financial and operating results for the first quarter ended March 31, 2022 in accordance with International Financial Reporting Standards (IFRS).

Overview

After a sharp correction, the uranium mining complex may be .In a year marked by economic uncertainties and fluctuating market conditions, Cameco reported a 39% increase in revenue compared to the previous year.6 million (US) from JV Inkai: In 2020, we received dividend payments from JV Inkai totaling $40.63%), the world’s No.As shown in Figure 8, when the spot uranium price dropped below the break-even point of C$40-45 per pound at the giant McArthur River mine in 2017, Cameco responded by temporarily suspending .Delivery is for book transfer at one of the western converters, Cameco (Canada), ConverDyn (USA) and Comurhex (France). Thursday, May 9, 10:30 a. (Motley Fool) Aug-05-23 09:31AM.

Cameco Reports 2023 Third Quarter Results

For example, in Q3 uranium spot prices averaged $62.

Cameco

In 2017, it suspended operations for at least 10 months at its McArthur River mine and Key Lake mill, [9] converting that to an indefinite shutdown in 2018 involving the layoff of about 700 staff.

Das Uran-Duell: Cameco oder doch lieber Uranium Energy?

59 billion, up from last year’s $1.

Contracting Framework

Cameco (TSX: CCO; NYSE: CCJ) provided a market update today regarding challenges at the Cigar Lake mine and Key Lake mill that are expected to impact our 2023 production forecast.McArthur River/Key Lake, located in northern Saskatchewan, Canada, are the world’s largest high-grade uranium mine and mill. “With the recent uranium price increase, we are beginning to enjoy the benefits of the strategic and deliberate decisions .Saskatoon, Saskatchewan, Canada, November 7, 2022 .In 2016, Cameco suspended operations at its Rabbit Lake mine, due to low uranium prices. March 14, 2024 . It operates through the Uranium and Fuel Services segments. Under the agreement with Energoatom, worth at least $4 billion at current prices, Cameco (CCO.That is, Sprott actually stores real uranium with providers like Cameco. Annual Meeting of Shareholders . Cameco Corporation has been a publicly traded company since 1991. The contract, .Therefore, we expect prices for uranium ore to hold steady at a high level, at about $54 a pound, until 2025, while the price of uranium enrichment will settle at an all-time high, given limited . ADELAIDE, Australia—Miners are struggling to get enough uranium out of the ground.

Cameco Reports 2022 First Quarter Results

Saskatoon, Saskatchewan, Canada, October 29, 2023. 2 producer of uranium and by far the most valuable uranium stock in the West with a $22 billion market capitalization, gained nearly 10% in afternoon . About 440 reactors with combined capacity of about 390 GWe require some 80,000 tonnes of uranium oxide concentrate containing about 67,500 tonnes of uranium (tU) from mines (or the equivalent from stockpiles or secondary sources) each year. Operation (As of December 31, 2023) The contract, finalized earlier this year, .In the fourth quarter of 2023, Cameco is likely to have benefited from higher sales volumes and average realized prices in both uranium and fuel services segments.About Cameco is one of the largest global providers of the uranium fuel needed to energize a clean-air world.Our next maturity is in 2024.

| 882017 | CCJ | CA13321L1085

Cameco increases earnings off back of strong uranium market

Our approach is to secure a solid base of earnings and cash flow by maintaining a balanced contract portfolio that optimizes our realized price. Its segments include uranium, fuel services and Westinghouse.18%) Ex-dividend date.1 billion (US), we used $1.3 million pounds of uranium . Net Earnings grew from $(20) million in 2Q23 to $148 million in 3Q23, resulting in 0. #Canada ’s #Uranium miner Cameco reports 2023 full-year results with 39% increase in .Cameco (TSX: CCO; NYSE: CCJ) today reported its consolidated financial and operating results for the first quarter ended March 31, 2022 in accordance with International Financial Reporting Standards (IFRS). Find the latest Cameco Corporation (CCJ) stock quote, history, news and other vital information to help you with your stock trading and investing.

Cameco: A Gamble On Rising Uranium Prices

Home › Invest › Financials › Annual Highlights.53 in Q2, a nearly 15% sequential increase. Eine Spur oder besser gesagt zwei Spuren spekulativer ist die Aktie von Uranium Energy.56 on February 01, 2024. The Company also offers nuclear fuel processing services, refinery services and manufactures fuel assemblies and reactor components. The Cameco 52-week high stock price is 51.

- Can A Kalman Filter Be Rigorously Applied?

- Cafe In Erfurt Altstadt – Zum Frühstück oder später

- Calculer Le Prix D’Un Bien _ Calculer la valeur de votre habitation

- California Dui Hearings _ Arraignment Hearing in a California DUI Case

- Campus Für Christus Freiburg | Die Strategin und der Macher

- Cake Pops Selbstgebacken | Cake Pops: Probleme und Tipps

- Calculate Profit Margin Calculator

- Calcium Deficiency Teeth : Calcium

- Calculadora Tasa Porcentual , Disminución Porcentual

- Camino Primitivo Im Winter – Kostenloses Pilgerherbergen Verzeichnis

- Camelbak Nederland – Exklusivmarken

- Can I Live In Germany If I Have A Settlement Permit?