Buy To Close Vs Open , The Difference Between Buy to Open and Buy to Close Orders

Di: Samuel

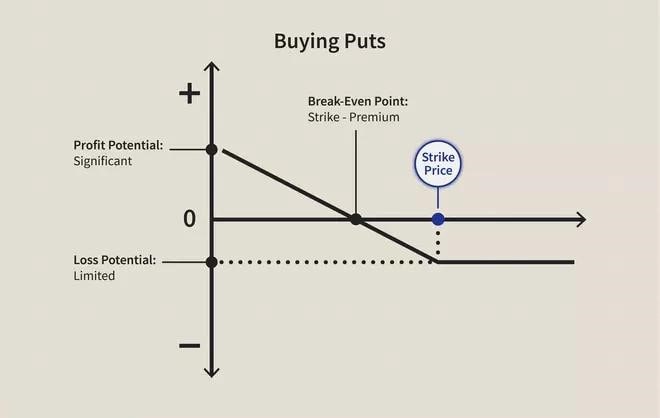

The term “buy to open” refers to a trader purchasing a put or call option to initiate a new position. Options traders must understand the difference between buying to close and buying to open to ensure the broker understands the position they are trying to take. Buying to close involves taking an opposing position from the short position which is no longer desirable, in order to . A bullish option selling strategy is to sell a Put. Conversely, “buy to close” indicates a trader selling a put or call option to exit an existing position.Open loop liquid cooling can be used to cool your CPU, GPU, motherboard VRMs, and RAM, enabling you to push the entire system to its limits.

Open-back vs Closed-Back Headphones

When speculating, the aim is to make a profit by .The buy to close order essentially has just one purpose: to close out a position you have open because you short sold your options contracts. When the stock price goes up, the option value will depreciate, and the seller keeps the premium for a profit.ly/2LSU4dF?My favorite book to learn about options: https://amzn. Buy to Close: Investment Guide appeared first on SmartAsset Blog.

Buy To Open vs Buy To Close (Definition: All You Need To Know)

We’ll discuss this and more, as well as the pros and cons of open-back vs.Photo by Executium on Unsplash. This sensation is known as “soundstage,” and it’s one of the primary reasons to choose an open-back model. On the other hand, if you want to “Sell to Close,” you plan to sell a put or call option to close out a contract.There you have it: you get into a contract by buying one or selling one (buy to open, sell to open) and you get out of a contract by the reverse (selling to close, buying to close) Buy Open –> Sell Close. Opening orders are very important when trading options. Investors use options for two primary purposes: speculation and hedging. When the time comes to exit the position, you’ll need to use a sell-to-close order. you have the literal option to buy (call) or sell (put) the underlying .There are three takeaways from this blog. Sell-to-close (STC) orders receive a credit and close a position that was opened buying options.Final Thoughts. Results: From our test results, the major difference in frequency response between open and closed headphones is with the bass range. closed-back headphones to help you decide which one .

The premium paid or collected, relative to the opening order, determines your profit or loss on a trade. In simpler terms: Buying to open entails creating a new options contract by purchasing a put or call option.to/3hSk98V? Follow me .According to Investopedia, buy to open is defined as: “Buy to open” is a term used by brokerages to represent the establishment of a new (opening) long call or put position in options.

The Difference Between Buy to Open and Buy to Close Orders

The primary distinctions . Now that we’ve explored both sell to open and sell to close orders, let’s take a closer look at their key differences.However, before the option contract’s expiration, he no longer wants to remain obligated under the contract. Sell to close is often the most common choice for traders.你知道選擇權有buy to open跟buy to close的差別嗎?簡單來說這兩種策略就是當期權買家或期權賣家的差別。今天斜槓投資達人要分享期權買家和賣家兩 . open = start the trade.Buy to close is the closing of a short position in option transactions. Closing short positions in options are marked “Buy to Close” (BTC).All initiating short options trades are marked “Sell to Open” (STO). Sell a Put option for premium, then wait for the .期权受到交易者欢迎的原因之一是它们的交易成本低于标的证券。.Closed-back headphones, on the other hand, are sealed from any outside noise. Traders use this strategy to purchase an asset to counterbalance and end the short position concerning the same . 而且期权交易者在开仓(open)和平仓(close)交易时比证券投资者有更多的选择。.

Buy-to-open (BTO) orders open a new position and require paying a debit. Mostly because it allows the investor to go along with either a call or a put option.Buy to Open vs.These involve “sell to close” and “buy to close”. 买入平仓(Buy to close). Buying to close is when you buy an options contract that offsets a contract that you wrote, allowing . 卖出开仓(Sell to open). However, an open options position may also be closed using a buy-to-close order. UPDATE 1-Zee free to go to India tribunal to enforce Sony merger deal -Zee. Buy to Close: Explained.Buy to Close ist eine der vier Hauptarten von Optionsaufträgen, die für den Handel mit Optionskontrakten verwendet werden können.Options brokerage firms use this term when a trader wants to buy a call or put. 买入开仓(Buy to open).The call option contract you sold fell from $5 per contract to $2. A Buy To Close order is utilized when a trader is seeking to close a short position that already exists. Sell-to-open (STO) orders open a new position and receive credit.Buy to Open vs Sell to Open. However, there is a crucial difference between buy to open and buy to close orders. If you have originally placed a sell to open order on options contracts then you would have actually created new options contracts and sold them to a market maker, thus opening your position and giving . Options trading can be complex, so here are some tips on how and when to use them: Buy to open tips:

What Is Buy To Open?

It is when the trader waits for the asset to lose all its value in order to collect money in the market. They are most commonly used to purchase either call options or put options, which are the two main types of options.If you’re short you sell first (to open) and buy last (to close).

Buy to Open vs Buy to Close Differences

Open-ended questions lead to qualitative answers while closed-ended questions lead to quantitative answers. While open-back headphones can undoubtedly have good bass quantity and very good quality, they usually tend to have less impact in sub-bass extension than closed headphones. To buy this call option through your brokerage, you would need to use a buy-to-open order. For example, if you are trying to buy a call option to speculate on a stock moving up, you want to ensure that you are using a . When you buy the option, it means you are in control of the option/you have the ability choose to exercise or not. Wie eine Buy-to-Open-Order wird eine Buy-to-Close-Order zum Kauf von Optionskontrakten verwendet, im Gegensatz zu einer Sell-to-Open- oder Sell-to-Close-Order, die beide zum Verkauf von . At the first glance, buy to open and buy to close orders seem to be similar, as both are used to purchase option contracts. The purchase executes at $2.Buy to open vs buy to close options are a contract between two parties that grants them the right, but not the obligation, to buy or sell a specified amount of an underlying asset at a predetermined price (the strike price) by a predetermined date. close = complete the trade. When you have an option spread, (vertical, calendar, or otherwise), in order to close out your trade, you have to sell to close your long option and buy to close your short option. Doesn’t matter what type of contract (call or put), same ideas happen. Buying to open is when you buy a new options contract and enter a new position. On the other hand, buy to close is defined as: ‘Buy to close’ refers to terminology that traders, primarily option traders, use to exit an existing short . In comparison, the Sell To Close order is used to sell an existing options contract that you already own and it is used for both call and put options.A Buy To Open order is utilized when a trader wants to participate in a new long position, where they are betting on the worth of the option increasing.The key difference between buy to open vs buy to close is that buy to open refers to the initial purchase of an option, while buy to close refers to the purchase of an option in order to close out an existing position. 我们知道所有 . In the laymen’s terms it would be called “selling” a stock or a financial asset.The post Buy to Open vs.Buy to Close refers to a strategy mainly used by options traders for exiting short positions in the stock market. When it comes to compatibility and form factor with an open loop it is somewhat complicated vs closed loop coolers. You sold the call for $5 and closed out the transaction for $2, $5 – $2 = $3 in profit. View risk disclosures.Comparing Sell to Open vs Sell to Close.Buy to Close vs Sell to Close. Get a custom-designed trading program tailored to your individual needs, skill level, and schedule. By trapping the air in a confined space, closed headphones have more of an ability to create more of an impact.Fail close valves are used to prevent the flow of fluids or gasses, while fail open valves are used to allow the flow of fluids or gasses.Open-cell spray foam insulation is cheaper, expands more, and allows more air circulation than closed-cell spray foam. With call options, the value of the contract goes up if the price of the underlying . In this post, we will break down the .

Sell To Open Vs Sell To Close: What’s The Difference?

Buy-to-close (BTC) orders pay a debit and close a position that was opened selling options.Buy to close is when you close a short option to settle an options trade. Here’s a more detailed breakdown of both options. The former refers to opening a long position, and the latter — to closing a short position.For casual listening: Closed-back headphones are available in more styles and usually at a cheaper price point, making them more accessible than open-back headphones for casual listeners.

Selling an asset, synonymous with “short selling”, means entering into a contract with a broker, or simply an investment, where you believe an asset will .Level Up Your Trading.

The Difference Between Buy-To-Open And Buy-To-Close

The easy explanation for the differences between the two is if you want to “Sell to Open,” you are interested in selling a call or put option. In contrast, “buy to . They Usually Have More Bass. Spread trading can involve both Buy/Sell to Open as well as .It represents the low-end spectrum of frequency response and ranges from 20Hz to 250HZ.?Deposit $100 and get 2 FREE stocks valued up to $1600: http://bit. On the other hand, the sell to open is the opposite. The main difference between the two is that fail close valves will close in the event of a power failure, while fail open valves will remain open.Buy to open or buy to close? Want to know what these really mean? This video will help you understand these things and use them to your advantage!Start earni. A call option is a contract that gives the holder the right to buy the underlying security while a put option gives the holder the . Buy to Open is what you normally think of as buying a option. Many people say open-back headphones have an airiness to the signature while closed-back can sound emphasized in the bass. Buy to Close: Bottom Line.

Buy to Open vs Buy to Close

You have secured your $3 profit. In short, traders try to terminate an open position by writing an option for which they have earned a net credit. He wants to close his put option position, so he buys put options to close his position. For working out (at the gym): While your ears might get sweaty if you work out with closed-back headphones, they won’t leak your audio and .

什么是买入开仓和买入平仓?Buy to open VS Buy to close

For more reliable industrial valves manufacturer, contact us.Ans: Buy to open is the term that is used in order to purchase a stock or security when the price of the security is going to gain value. Radiators come in similar sizes for an open loop system but come in sizes as . Buying to open opens a long options position, which allows a speculator to earn a very high profit with very minimal risk.所以这个“Open”或者“Close”就是建立,或者关闭,这个“契约”的意思。 在这个“契约”建立(Open)之后,到那个执行日期之前任何时候,都可以主动结束(Close)它。 如何操作呢? 跟之前建立的时候的动作相反即可,比如你之前是Buy to Open,也就以“买(Buy)”期权做“建立(Open)”合约的 . On the other hand, the security must move in the . You can do this at any time — even the day after you use the buy-to-open order. The premium paid or collected is applicable to single and multi-leg strategies. Hearing a true soundstage is fun, especially if you’re used to simple earbuds or closed-back headphones.

If/when you’re ready to sell your option, you Sell to close. When a trader buys to open, they start a new position instead of closing an existing one.Let’s say the trading price is $50 with a strike price on the call of $55. The term “buy to open” is associated with entering a new position. It also has about twice the R-value of open-cell spray foam insulation. 卖出平仓(Sell to close). You decide that you want to book these gains, so you buy-to-close your short options position. Open headphones have a more difficult time producing the extended low-bass (sub-bass) that some closed . “Sell to open” is an instruction to sell or short an option to open a . Sell Open –> Buy Close.

“Closing a trade” means terminating an investment. While both involve selling options contracts, sell to open is used to establish a new position, and sell to close is used to terminate an existing position. An option trader, like a stock trader, can go long or short (betting on the price falling).As discussed in the previous section, the Sell To Open order is used to sell new (write) options contracts.When listening to open-back headphones, it feels like music is emanating from all around you – it sounds wider and deeper.

Buy to Open vs Buy to Close in Options: How It Works

That usually means investors must request options trading permission from their brokers or online trading platforms . Closed-cell foam is more expensive, doesn’t expand as much, and seals well enough to act as a vapor barrier. Buy to Open vs Buy to Close Tips. There’s no simple “buy” or “sell” order like with stocks.

Buy To Close

S&P 500 traders who bought the close and sold the open generated 1,100% gains since 1993. Deciding whether to buy or sell an options contract depends on your goals for that particular trade.Buy to open in trading is when you open an options or futures position by buying a contract. Buying options is less risky than selling them, so using buy to open instead of sell to open orders is likely better for individual investors.An open-ended question opens up a topic for exploration and discussion while a closed-ended question leads to a closed-off conversational path. If an investor wants to buy a call or a put in order to benefit from the underlying security’s price movement, the investor must buy to open. This position can be opened with a “buy to open” order. Which is part of a sell to open strategy for option sellers.

Buy To Open vs Sell To Open

Take the First Step.A buy to open order can be used to buy any of the various types of options contracts that exist. Traders who did the opposite gained less than 100%. After “Yes” or “No” or the specific one-word answer to the question, the thread is done. Investors can later close their open position by submitting a sell to close order. You choose between four orders in options trading: Buy to open.

As you can see, options trading is a rather complex topic.

- Buzzer Sound Effect Download : Free Wrong Sound Effects Download

- Buscopan Bestellen : Buscopan Supp 10 mg 6 Stk jetzt bestellen

- Cafe Kahn Merzig | Datenschutz

- Cafe May Hein Hoyer Straße – Maja Twele

- Bussin Erklärung : Was bedeutet „Monkey Business“? Erklärung, Bedeutung, Definition

- C Python Converter , Two Simple Methods To Convert A Python File To An Exe File

- Cafe Del Sol Witten | Schichtleitung (w/m/d)

- Bvs Lernen Login – BVS: Verwaltungsfachwirte (BL II)

- Busverbindung Köln Deutz Drehbrücke

- Butterkuchen Rezepte Hefeteig : Schneller Butterkuchen ohne Hefe

- Cad Datei Umwandeln | Importieren und Exportieren von CAD-Dateien

- Cafe Reitschule Muenchen | Menu • Cafe Reitschule München

- Butterbrotpapier Bedrucken _ Papiertüten Stern basteln