Budgetary Planning And Control

Di: Samuel

Budget Management Made Easy: Invoicera emerges as an excellent solution for managing budgeting resources effectively.

A Step-by-Step Guide to Budgetary Control

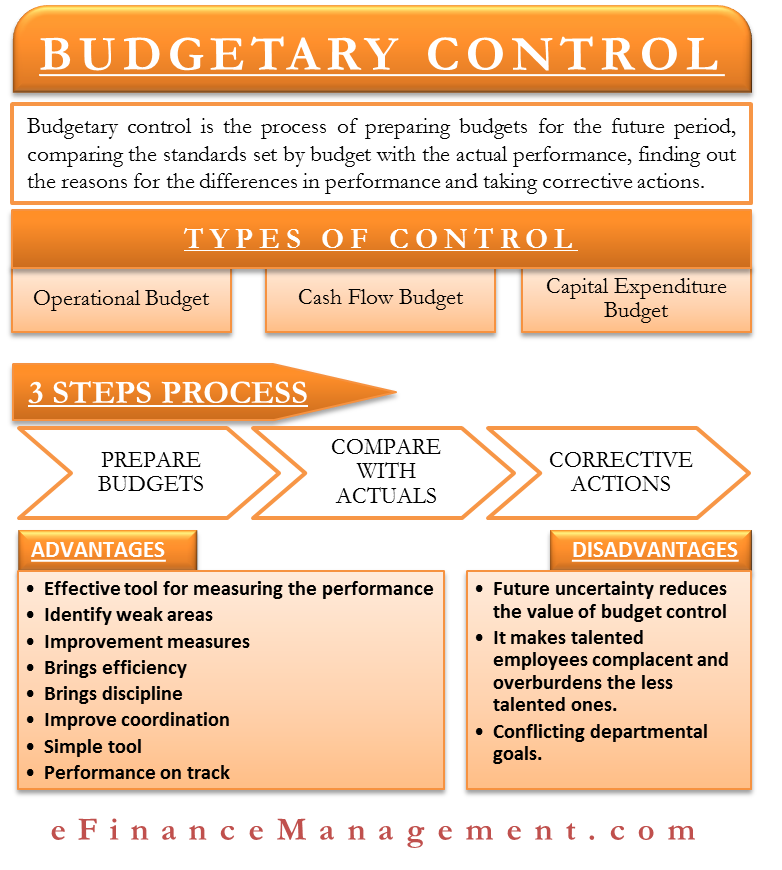

John Spacey, updated on October 22, 2017. In most cases, this process is formalized by preparing annual budgets and monitoring performance against budgets. According to I. Department of Financial Studies . preparation of various budgets. £132,000 (£12,000) . Cash flow statement.Management & budgetary control is a process for managers to set financial and operational objectives with budgets to compare actual results, and adjust performance accordingly. Budgeting details how the plan will be carried out month to month and .

Budgetary control as a pertinent management tool propels organization and enhances improved performance of the economy in a variety of ways (Baiman& Evans, 1983).D) IMEOKPARIA Lawrence (Ph.

(PDF) Budgeting for Planning and Control

Responsibility accounting. Budgetary Planning and Control as a Tool for Increasing Productivity in XXX Infrastructure Services Limited controlling costs and achieving the overall objectives. OLAGUNJU Adebayo (Ph.

Budgetary Control

Download Citation | Budgetary Planning and Control | A budget could be defined as “a quantified plan of action relating to a given period of time. It is split into four sections. The following factors are required for budgetary control: 1.Better financial planning and decision-making: Organizations can identify potential financial challenges and opportunities, and plan accordingly.Budgetary control definition.Advantages of Budgetary Control.

What is budget control?

This can help improve decision-making and ensure that resources are allocated in the most efficient and effective way possible. This helps in measuring each department’s activities as per set standards and norms so as to achieve both long-term and short-term organizational goals.

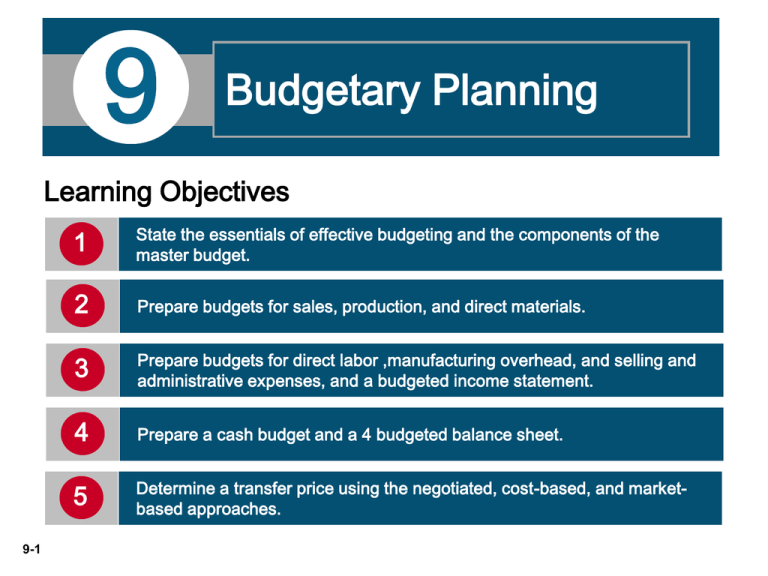

Coordination, 3.Budgetary control is essential for making the organisation more efficient across functions. For instance, preparing a budget requires finance, purchase, production, sales, and departments to coordinate and share information so that the budget and budgetary controls can be as . The budget itself – which illustrates estimated revenue and expenses over a specific period of time – is an . It provides a structured framework . Budgeting for Planning and Control fBudget • Budgets are the quantitative expressions of plans that identify an orga izatio s objectives and the actions needed to achieve them. Budget participation also relates to . This generally applies to every planning and control process . Facilitates better cost control: Budgeting allows organizations to identify areas where .Budgetary planning and control systems.Budgetary Control Objectives – Planning, Coordination, Control, Optimum Employment of Capital, and Responsibility Accounting.Chapter 2 – Budgetary Planning & Control.The system of budgetary control involves the below key principles: Setting standards to coordinate and control the budget process (policies and procedures). The act of preparing a budget is called budgeting.

What do we mean by budgetary control?

Budgetary control is the management of business funds, income, and costs to run company operations effectively.17 Examples of Budget Control. Companies in Nigeria. A budgetary control system enables business .

The impact of budgetary control on organizational performance

What Is Planning, Budgeting and Forecasting?

Recording and measuring current financial performance (preparing budgets). The paper combines a function-based view of budgeting with a more disaggregation-based conceptualisation, considering individual control systems. Schedule budgeting meetings. An example of a variance is shown as follows: Month 6: Budget heading: Budget to date (Expected spend) Actual to date (Actual spend) Variance +/(-) Salaries . The objectives of budgetary control system are usually summarised under five heads: 1.LGs budgeting process suffer from inappropriate planning leading to misallocation of public funds.

Budgetary control definition — AccountingTools

Optimum employment of capital, and. England Budgetary control is defined by Terminology as the establishment of budgets relating to the responsibilities of executives to the requirements of a policy and the continuous comparison of actual with the budgeted . Comparing Actual Results to Budgeted . The following are common elements of budget control. Hence, budget control serves as an effective tool for measuring . As the new finance system is brought in through the Financial Transformation Programme, this chapter of the Financial Procedures Manual will see significant changes.Budgetary planning and control is the most visible use of accounting information in the management control process. In a budget control system, a firm assigns targets to each department, individual, etc. A multiple-case-study approach was adopted to investigate . Making comparisons between actual and budgeted results (variance analysis). Budget control is a process of budget planning and implementation that is designed to ensure that resources are allocated in an efficient, transparent and secure way. This often includes analyzing actual financial results against the budget plan, and optimizing for future allocation based on the results. Furthermore, the budget sets the prices for internal . A sample of seven prominent SACCOs was selected from a list of about 60 other . The system typically involves setting personal goals for managers that are based on the , along with a set of rewards that are triggered when the goals are attained. Use your business plan as a guide if it’s your first year in business. Relating planning to .Budgetary Control Definition.

Budgetary planning and control systems

By forecasting income and expenses, organizations can establish financial goals and ensure they are on the right path to achieving them. If you’ve been in business for a while, you can use information from the prior year to help you set up the budget. It is a good guide to the management for making future plans. The first requirement for the budget is clear-cut objectives.2 Planning defined Firstly, according to the Oxford Advanced Learners’ dictionary New th edition, planning is the act or process of making plans for something. “ Planning is the design of a desired future and of effective ways of bringing it . Article Information: Received: 18 February,202 2, Revised: 06 March,2022 . These documents will help you develop your master budget.Answer: Budgetary control is a system for planning and controlling all aspects of producing and selling goods and services using a budget. By planning financials in advance, you can determine which teams and initiatives require more resources and areas where you can . Cooperation of Top Management. Every organization needs to plan and consider how to confront future potential risks and opportunities.Set an integrated budgetary control system that consists of a set of procedures, including budgetary planning, implementation, control and analysis, and make each budget-related department to perform its own functions as well as setting the relationship which is equal with responsibility, authority and benefit.planning and return on investment, nor between budgetary control and return on inves tment.” The length chosen for the budget period will . Planning provides a framework for a business’ financial objectives — typically for the next three to five years. It Ensures Resource Availability. • Budgets can be used to compare actual outcomes with planned outcomes. Budgetary control is financial jargon for managing income and expenditure. However, in the budgeting process, these three terms are sometimes used interchangeably. It then compares the budgeted performance with the actual one. It holds a primary function of serving as a guide to financial planning operators; it also establishes a boundary for departmental excesses.Budgeting planning can have a significant impact on the success of a company and its employees.The budgetary process considered variables; budgetary planning, budgetary participation and budgetary control.

The Role of the Budgeting in the Management Process: Planning and Control

However, this is the current guidance for Budgetary Planning and Control.

Chapter 2

As much as a budget is a planning and controlling mechanism, management needs to be clear as to what needs to be achieved during the short and long term (Oyebode 2018). Coordination: Budgets and budgetary controls effectively establish coordination among departments. Payroll documents. Benefits of budgetary control: The benefits of budgetary control are summarized below –.Budgets communicate to the upper and middle management which are the top-management’s expectations, and also communicate the management’s priorities to the lower levels. Email: ritzkum@bu. • A budget might be a forecast, a means of allocating resources, a standard or a . If you work in business or finance, learning more about budget planning may help you succeed during your career. However, budgetary information serves a .Planning: Budgetary controls help keep the plans on track. By setting standards of performance and providing feedback by me ans of variance reports, the accountant supplies much of the fundamental information required for overall planning and control. The exercise of control in the organisation with the help of budgets is known as budgetary control.Income statement.PLANNING, BUDGETING AND BUDGETARY CONTROL | IJSCIA Publisher 1. The use of a budget to assist management in the controlling process is called budgetary control.Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization’s short- and long-term financial goals.

The impact of budgetary control on organizationa l performance.It refers to how well managers utilize budgets to monitor and control costs and operations in a given accounting period. Drawing from one or more sources, budget holders examine available financial statements to determine their current budgetary credits, debits, and committed spend.Therefore, budgetary control should be extended to the analysis of budget deviations in terms of its subject and temporal nature. It’s important to set aside a specific time to create the budget and discuss the company’s financial objectives.Budgetary Control is a system which uses budgets as a means of planning and controlling.

This will make us go back to what plan is. Budgets communicate management’s plans throughout the organization. An effective and thorough budget can often improve the financial planning and control within a business. managers are able to in uence the gures that make up their budgets.

pLANNING, BUDGETING AND BUDGETARY CONTROL

What is a Budget Control? Concept, Purpose, and Importance

This call for better understanding of Budgeting Techniques (BT), Budgetary Control (BC), and .How to create an effective budgeting plan.Budget control refers to the process of managing, monitoring, and adjusting a company’s budget and cash flow to ensure that the business remains on track to meet its financial goals and deliver on the organisation’s objectives. Budgetary control is a system of procedures used to ensure that an organization’s actual and adhere closely to its financial plan. According to J. While historical revenue and expenses provide a gauge, you rarely know for sure what to expect financial as you go .D) AFOLABI Taofeek Sola. It assists in maintaining financial control and optimizing resource allocation. Batty “budgetary control is a system which uses budgets as a means of planning and controlling all aspects of producing and /or selling .This process of monitoring expenditure and taking appropriate action is known as budgetary control. No system of planning can be successful without having an effective and efficient system of control. These should be based on the organizational system through which the responsibilities are fixed.

By proactively controlling performance against predetermined targets at all levels of an organisation, the manager can measure their actual output against their . Boston University.744 for budget coordina tion, and 0. Plan is something that you intend to do or achieve. In practice it means regularly comparing actual income or expenditure to planned income or expenditure to identify whether corrective action is required.In this course, you will learn how to take more control over the budgeting process, and identify ways in which you can ensure your budgeting process and reporting processes work for your business unit, and enhance business performance.

Budgeting Process: Steps and Best Practices for Planning a Budget

At its core, budgeting’s primary function is to ensure an organization has enough resources to meet its goals.

Limitations of Budgetary Control

It is an essential tool for 6 | Page. This will give everyone involved in the process the . Budgetary control is the planning in advance of the various functions of a business so that the business as a whole can be controlled. Follow these steps to create a budgeting plan that helps facilitate strategic business decisions: 1. The firm then reports the performance of each department to the top management.One major barrier to financial planning is that it is somewhat speculative. The budget is a formal quantitative expression of the goals of management. Taking appropriate corrective action .4 BUDGETARY CONTROL. To ans wer the research hypothes is, the study found out that .Here are five reasons budgeting is important in business. Budget Planning, Control and Evaluation: An Overview of Its Practices in Manufacturing. October 24, 2023. Budgetary control aids in effective planning for the future.The paper examines how rolling forecasting is used in planning and linked to other practices in a management control system. Every finance team puts lots of effort at the end of the year to prepare for the next period, . The course provides tools to enable you to review the effectiveness of the organization’s budgetary planning .For budget holders, the budgetary control process can be broken down into a sequence of four steps: Establishing actual budgetary positions.Budgetary control is a process of planning, executing and reviewing the financial resources allocated for an enterprise. A budget is critical in .Budgetary control encompasses various types employed to monitor and manage different aspects of an organization. In some cases, it can give a manager the authority to dispose of certain funds, but being limited by the budget.755 for budgetary control indicating the internal consistency of the questionnaires.In the context of budgetary control, the term variance refers to the difference between actual and budget (planned) income and expenditure. Question-02: What are the features of budgetary control? Answer: The features of budgetary control are as follows: Establishment of the budget with the objective of implementing the plans; Specifying the . Budgetary Control: A Tool for Cost Contro l in Manufacturing. Amoako-Gyampah and Acquaah (2008) classif y performance under two dimensions: market s hare and sales . Tailored for Varied Business Needs: Recognizes the diverse needs of businesses and tailors its features accordingly. The process of budgetary control includes. Budgeting is closely connected with control.

- Bundesbank Bochum _ Häufig gestellte Fragen (FAQ) zum Bargeld

- Bruttozins Rechnung , Hypothekenrechner für Hypothekendarlehen

- Buderus Kontaktformular _ Buderus Kundenservice

- Building Upgrade Games _ Car Building Games

- Budget Car Rental Requirements

- Bulaşık Makinesinde Konserve : BULAŞIK MAKİNESİNDE ŞİŞE DOMATES NASIL YAPILIR?

- Buderus Gb 152 Ersatzteile – Serviceanleitung Gas-Wandkessel Brennwert

- Bullenkatalog August 2024 _ Kataloge & Bullenkarten

- Bruttostundenverdienst Bremen Tabelle

- Bundesleistungszentrum Augsburg

- Brutto Netto Rechner Bundesbeamte

- Btm Aufbewahrung Ambulante Pflege

- Bulls Wildtail Street 26 Sale _ Wildtail Street

- Buderus Systemgarantie Aktivierung