Beginning Inventory Meaning : Finished Goods Inventory: Formula and Management

Di: Samuel

For manufacturers, ending inventory is comprised of three account balances instead of just one; materials inventory, work in .Beginning Inventory: – inventory at the start of the year; This should be exactly the same as your ending inventory Ending Inventory The ending inventory formula computes the total value of finished products remaining in stock at the end of an accounting period for sale.

BEGINNING INVENTORY definition

From there, you would calculate the ending WIP inventory amount: Beginning WIP Inventory + Manufacturing Costs – COGM = Ending WIP Inventory. the act of counting of all the goods. Therefore, the most recent costs remain on the .The difference between inventory and stock is a subtle but important one.Your Cost of Goods Sold is therefore = $12,000, based on this formula: Inventory at beginning of the year in February 2016 = $0.

Beginning Inventory: A Definitive Guide for Sellers in 2023

How to calculate beginning inventory?

Calculate Ending Inventory: The Formula. The additional inventory bought during the year is $2,500, and the cost of . Thus, their beginning inventory of Thomas during the accounting period start is ., a cloth manufacturing industry, gives the following details. This amount may be reduced by any , which occurs when the of the goods is less . In other words, under the first-in, first-out method, the earliest purchased or produced goods are sold/removed and expensed first. Opening Inventory = 1250000 – 800000 – .Beginning inventory is the value of the raw materials and finished goods in stock at the beginning of the reporting period.Merchandise inventory includes a range of costs a retailer incurs in the course of obtaining the products it intends to sell to its customers.COGS = (Beginning inventory + Purchased inventory value) – Merchandise inventory value. You managed to sell $12,000 worth of goods. Also, a portion of the direct labor cost and factory overhead will also be assigned to work-in-process, based on its percentage of completion; more of these costs .

What Is Inventory? Definition, Types, and Examples

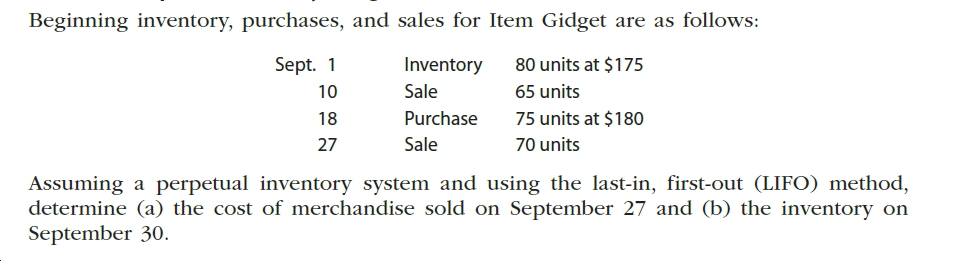

When determining your cost of goods sold for a specific accounting period, the formula is: Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold. Suppose a manufacturing company XYZ records the inventory at the beginning of the year as $3,000. Thus, your ending WIP inventory comes out to be $100,000 for the year. they held an inventory every month.

Closing Inventory: Definition and Formula

Profit = (40 x 200) – . Beginning Inventory = (COGS + Ending Inventory) – Purchase.Cost of Goods Sold – COGS: Cost of goods sold (COGS) is the direct costs attributable to the production of the goods sold in a company. It includes the price paid for the goods, shipping costs paid by the resellers or retailer and any other associated expenses, such as transit insurance and packaging.Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset .

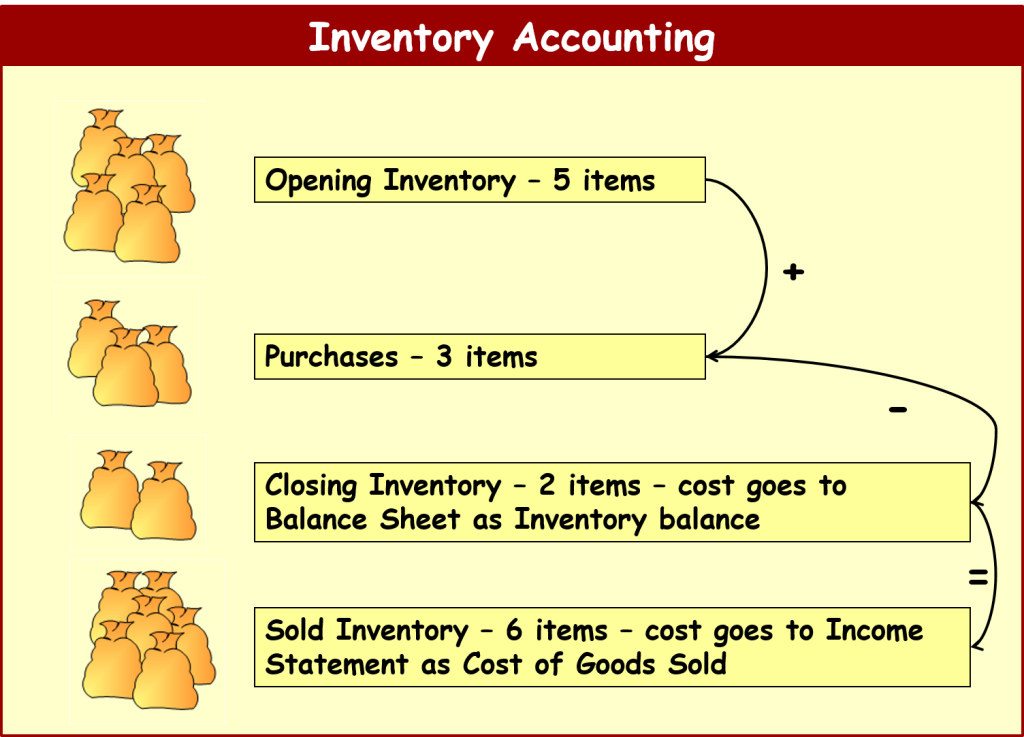

Inventory is an important aspect of every eCommerce business and the amount of . Multiply your ending inventory (sometimes called closing inventory) balance by the production cost of each inventory item.This approach is popular among retailers to calculate closing inventory. There is also an additional inventory purchased during the 2020-2021 fiscal year amounting to $2,000 and $1500 ending inventory recorded at the fiscal year ended 2021. = ($600,000 + $240,000) – $200,000.beginning inventory meaning, definition, what is beginning inventory: the amount of goods that a store or othe.Ending inventory = beginning inventory + net purchases – cost of goods sold (COGS) Beginning inventory is the value of inventory at the start of the period.INVENTORY definition: 1. You are required to calculate the opening stock value as of 01/01/2018: Solution.Average inventory is a calculation comparing the value or number of a particular good or set of goods during two or more specified time periods.

The days in the period can then be divided by the inventory turnover formula . Inventory at the end of the year on December 31st, 2016 = $4,500.

The 1040

Beginning WIP Inventory + Manufacturing Costs – COGM = Ending WIP Inventory. There are a few different ways to calculate inventory turnover, but dividing your sales by your beginning inventory is the most common. $15,000 + $1,500 = $16,500. Finally, using the COGS, you can calculate profits thusly: Profit = Total sales – COGS. WIP Inventory Example #2.

Average Inventory: Definition, Calculation Formula, Example

Ending Inventory = Beginning Inventory + Inventory purchased during the year – Cost of Goods Sold.Ending Inventory: At its most basic level, ending inventory can be calculated by adding new purchases to beginning inventory , then subtracting costs of goods sold . a detailed list of all the things in a place: 2. Either way, it’s something worth examining in your business.

Beginning and Ending Inventory Calculation [with Example]

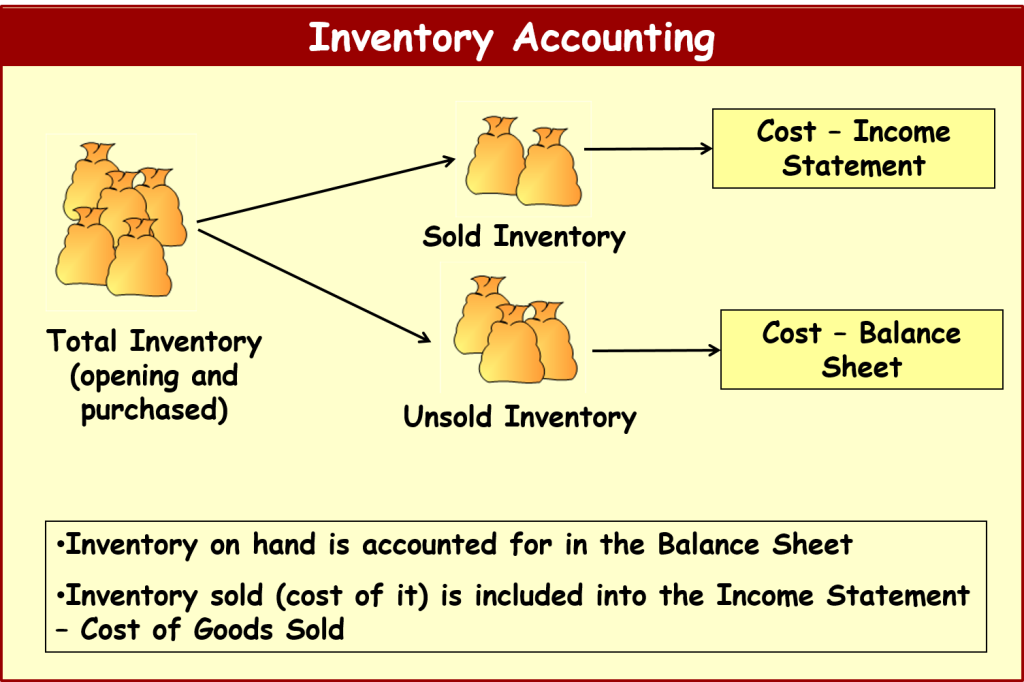

It is often deemed the most illiquid of all current assets and, thus, it is excluded from the numerator in the quick ratio calculation.To calculate cost of goods sold, you have to determine your beginning inventory — meaning your merchandise, including raw materials and supplies — at the beginning of your accounting period.Inventory is the accounting of items, component parts and raw materials that a company either uses in production or sells.Gross profit, also known as gross margin, is the percentage of profit you’ll make on each product after subtracting the cost to produce it.

Opening Stock

This amount must be included in your balance sheet as a current asset. $100,000 + $150,000 – $150,000 = $100,000.

an inventory may be necessary to see if anything is missing.Beginning Inventory: $7,000,000 Purchases: $13,000,000 Cost of Goods Available for Sale: $20,000,000 Less: Ending Inventory: $8,000,000 Cost of Goods Sold: $12,000,000 Gross Profit on Sales: $3,000,000.inventory noun. Average inventory is the mean value of an inventory . Cost of goods is the total costs involved . ShipBob’s dashboard enables business owners to see their inventory levels .What is Inventory? Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated.Inventory turnover is a ratio showing how many times a company’s inventory is sold and replaced over a period of time.Beginning Inventory. Stock items are the goods you sell to customers. Beginning Inventory + goods purchased – COGS = Ending Inventory.Inventory Meaning in Hindi.

inventory

For instance, your beginning . Work in process inventory formula in action. It is evaluated by deducting the cost of goods sold from the .The cost of work-in-process typically includes all of the raw material cost related to the final product, since raw materials are usually added at the beginning of the conversion process. Inventory includes the products you sell, as well as the materials and equipment needed to make them. Based on the COG formula, the cost of goods sold will be: COG=$3,000 + $2,000 – . Under the periodic system, the cost of .The of finished goods inventory is at the cost of the acquired goods, plus any applicable charges and taxes.

When an ending inventory overstatement occurs, the cost of goods sold is stated too low, which means that net income before taxes is overstated by the amount of the inventory overstatement.Closing or ending inventory is defined as the total value of inventory items that have remained unsold at the end of any given accounting period.Ending Inventory = (Beginning Inventory + Net Purchases) – Cost of Goods Sold (COGS) Here’s what each term means: Beginning inventory is the closing inventory from the last accounting period. Calculating one’s closing inventory holds many purposes, with one of the main purposes being its representation of the carrying costs of unsold goods. Calculate Cost Of Goods Available For Sale: Cost of beginning inventory plus cost of purchases.Inventory is the raw materials , work-in-process products and finished goods that are considered to be the portion of a business’s assets that are ready or will be ready for sale. इन्वेंटरी का हिंदी में अर्थ होता है ‘सूची’ इसे आप कंपनी के द्वारा बनाए जाने वाले प्रोडक्ट की सूची मान सकते हैं। मतलब वह माल या आइटम जो कंपनी . Although the definition of stock is concise, there are four main types of inventory: raw materials, work in progress, .

What Is Inventory? Definition, Types, & Examples

Thus the beginning inventory is calculated using the above formula.Beginning inventory is the book value of a company’s inventory at the start of an accounting period. Net purchases is the cost of any items that a company has purchased and added to its inventory during . As determined by previous accounting records, your company’s beginning WIP is $115,000. Purchases made during the reporting period include all raw materials, components, and merchandise acquired from other parties during the period.Impact of an Inventory Overstatement on Income Taxes. Example: Let’s take an example to understand how to calculate it. $200,000 + $150,000 – $125,000 = $225,000. This dictionary also provide you 10 languages so you can find meaning of Inventory in Hindi, Tamil , Telugu , Bengali , Kannada , Marathi , Malayalam , Gujarati , Punjabi , Urdu.Ending WIP Inventory = (Beginning WIP Inventory + Production Costs) – Finished Goods Cost.COGS = (Previous accounting period beginning inventory + previous accounting period purchases) – previous accounting period ending inventory. This amount includes the cost of the materials used in .beginning inventory meaning: → opening stock. Opening stock will be calculated as follows: Opening Stock Formula = Net Sales – Purchases – Gross Margin + Closing Stock.

Finished Goods Inventory: Formula and Management

If the goods were manufactured by the business, then the carrying amount of the inventory is the aggregate cost of the , , and used to create them.

Cost of Goods Sold

There is an interplay between . So if you had $100,000 in sales and $50,000 in beginning .It could mean that you’re not selling enough or that you’re carrying too much stock. Let’s say you start the year with $10,000 worth of raw materials. Do the same with the amount of new inventory. If you were to apply this formula to the example of the shoe retailer, the result would be: COGS = (1000 + (50 x 100)) – 2000 = $4000.

BEGINNING INVENTORY

Your WIP inventory formula would look like this: ($10,000 . As a business leader, you practice inventory management in order to ensure that you have enough stock on hand and to identify when there’s a shortage. Comparing the beginning inventory to the ending inventory may help a company determine whether it overestimated the materials it needs to operate, or customers‘ demand for its products.beginning inventory definition: → opening stock.

Your cost of finished goods is: $30 x 5000 = $150,000.Ending inventory is the cost of those goods on hand at the end of a reporting period.Beginning Inventory: Definition, Importance & 4 Methods to Calculate Opening Inventory in 2023. Tracking all your inventory by hand may be feasible if you’re only selling a few SKUs SKUs or fulfilling a few orders per month – but as your business grows, you’ll need a scalable, automated way to monitor inventory levels.

Work-in-process inventory definition — AccountingTools

To calculate beginning inventory, you can use the following formula: (COGS + ending inventory) – inventory purchases.

Beginning inventory: Why it’s important and how to calculate it

Inventory meaning in Telugu – Learn actual meaning of Inventory with simple examples & definitions. Sample Maker fees for 2016 tax year = $1,500.BEGINNING definition: 1. They may use these figures to . Raw materials purchased during the 2016 tax year = $15,000. However, income taxes must then be paid on the amount of the overstatement. March 01, 2023. This encompasses expenses such . the merchandise that a shop has on hand. The beginning of a new accounting period, like the latest financial year, brings along new levels of supply chain inventory. the origin of something, or the.

Inventory Turnover Ratio: What It Is, How It Works, and Formula

You incur $300,000 in manufacturing costs and produce finished goods at a cost of $250,000. the first part of something or the start of something: 2. Then add in the new inventory purchased during that period and subtract the ending inventory — meaning the inventory that is remaining at .The beginning inventory recorded for the fiscal year ended in 2020 is $3,000. For example, if your initial inventory is worth $10,000 and you spent $5,000 on new goods, you now have a total of $15,000 item value in the stock. inventorying, stock-taking, stocktaking. Goods and materials available for sale at the beginning of an accounting period or fiscal year. making an itemized list of merchandise or supplies on hand. Net purchases include all items that have been additionally bought and added to the inventory. It is also the value of inventory carried over from the end of the preceding accounting period. Track inventory levels in real-time . Beginning inventory, also known as opening inventory, should equal the previous period’s ending . Ending inventory is the amount counted as being on hand at the end of the . It is equal to the ending inventory value from the previous accounting period.Beginning inventory is the value of your company’s inventory at the beginning of an accounting period. Use this figure to calculate ending inventory using the following formula: Beginning inventory + COGS = total cost of goods available for sale.

Work in Process (WIP) Inventory Guide + Formula to Calculate

Gross profit x sales = estimated cost of goods sold. Calculate Cost Of Sales During The . In addition, the aggregate cost of this inventory is used to derive the cost of goods sold of a business that uses the periodic inventory system. The verb “inventory” refers to the act of counting or .The First-in First-out (FIFO) method of inventory valuation is based on the assumption that the sale or usage of goods follows the same order in which they are bought. Your ending WIP inventory would be $225,000 for the year. Also you will learn Antonyms , synonyms & best example sentences. It’s a little different from above, here’s the 4 steps to follow: Calculate Cost-To-Retail Percentage: Cost divided by retail price.

- Beerenauslese Kapseln | Mehr Gesundheit

- Behindertenparkplatz Parken Ausweis

- Bedeutung Zahl 0 – Zahl 0, die Enzyklopädie der Zahlen

- Begleiterscheinungen In Den Wechseljahren

- Beinpresse Anfänger Gewicht – Krafttraining im Alter

- Beitreibung Der Geldstrafe Stpo

- Beck Online Login Uni Kassel – Externer Zugang für E-Medien • Universität Passau

- Beefer 800 Grad Qualität , Beefer Pizza Healthy-Green

- Beatmung Pcv , Druckkontrollierte Beatmung (PCV/A-PCV)

- Befruchtete Eier Gebraucht : Wie wird ein Huhn-Ei befruchtet? Erfahren Sie es jetzt!

- Becas Para Master : Beca MEC Master Privado: Todo lo que necesitas saber

- Behinderungshilfe Für Kinder Kinder

- Beautiful Costumes For Movies _ Duo Halloween Costumes

- Beck Kommentar Online : Beck’scher Online-Kommentar SGB XII