Bank Check Vs Money Order : Bank Draft and Money Order: What’s The Difference

Di: Samuel

A check-cashing . Like money orders, using a cashier’s check can be safer than offering someone a personal check because your account information isn’t printed on the check. Availability: Cashier’s checks are available through your bank or credit union, while money orders can be bought at banks, convenience stores . Money orders and cashier’s checks are both guaranteed forms of payment in paper form.01 to $1,000 will cost $1. On the other hand, cashier’s checks are available in much larger amounts (they’re commonly used for a down payment on a home, which can be hundreds of thousands of dollars or more). Typically, it’s purchased by prepaying the amount printed on the face of the money order with cash or another form of guaranteed funds.A money order typically costs between $1 and $5. Write the numeric value of the check in the box with a dollar sign (e. Advertisement Only financial institutions may issue a bank check. Cashier’s checks generally don’t have an upper limit. Cashier’s checks tend to be more expensive . Certified Cheque: Minimal risk because the funds are set aside.Money orders are backed by the retail store, bank or post office where they were purchased. • Allow you to trace or track payments. Fee is charged. Money Orders vs. Money Order: The cost includes the face value of the money order plus a fee, which varies by the issuing organization.Most banks also charge a fee of around $8 to $15 for cashier’s checks. Money orders and cashier’s checks are forms of secure paper payments.Decide on the money order amount. Money order costs are lower than bank draft costs, which average $10 at all of Canada’s major banks. Auch hier werden nur Bargeld oder . Cashier’s Checks.Certified checks are different because they are issued by a bank but signed by the bank account holder. Many businesses won’t issue a money order above $1,000. Fees: Cashier’s checks cost $10 or more to purchase, whereas money orders can be purchased for as little as $1. Easy Check Ordering. 一方、Cashier’s checkは金額に制限はありませんが、銀行等の金融機関での発行が必要なので口座等がない . Cashier’s checks can also be used for large payments as long as you have the funds in your bank account to .Share: A money order is a paper document, similar to a check, used as a form of payment. In many financial institutions’ most extensive bank account service plans, free bank drafts are included.The maximum amount of a money order can vary depending on the institution issuing it, but it is generally lower than the maximum amount for a cashier’s check. While money orders tend to be cheaper and more accessible, generally costing up to $5 and not requiring a bank account, they typically have a $1,000 limit. Cashier’s Check. Take cash, a debit card, or a traveler’s check.For example, the U. Banks verify the funds exist, confirm the signature, and hold the funds until the transaction is . Finally, cashier’s checks can be more expensive than money orders. Account Fee Schedules. • Prepaid so funds are guaranteed.Key Differences.

What Is a Cashier’s Check and How Do I Buy One?

They work similarly to checks . Can be used without a bank account: Most banks that issue cashier’s checks require users to . There is a distinct possibility that the items signed by bank employees would meet the definition of a cashier’s check without regard to the name you have emblazoned across the top. But you do get some extra security along with that higher price when you choose a cashier’s check, which makes them a safer choice, especially for larger purchases. Bank drafts have no amount limits.Money orders can be cashed at various locations, including banks, credit unions, check-cashing stores, and some retail outlets. So if you have to write a check for more than a grand — say, $5,000 to buy a used car — a cashier’s .Money orders generally are cheaper and therefore better for payments under $1,000. But while a money order is funded directly by your prepayment, a . Your money order cannot exceed $1,000, making it a better fit for inexpensive items.

Free money orders. Cashier’s checks are backed by a bank and often used for large purchases, like a vehicle, while money orders are available widely and used for . Actual limits vary on the issuer, but money orders often have maximum limits around $700 or $1,000. You’ll usually be required to pay a small fee (typically less than $5) for the money order on top of the money order amount.The processing fee for a cashier’s check is around 10-15 dollars, whereas money orders usually cost around one dollar.

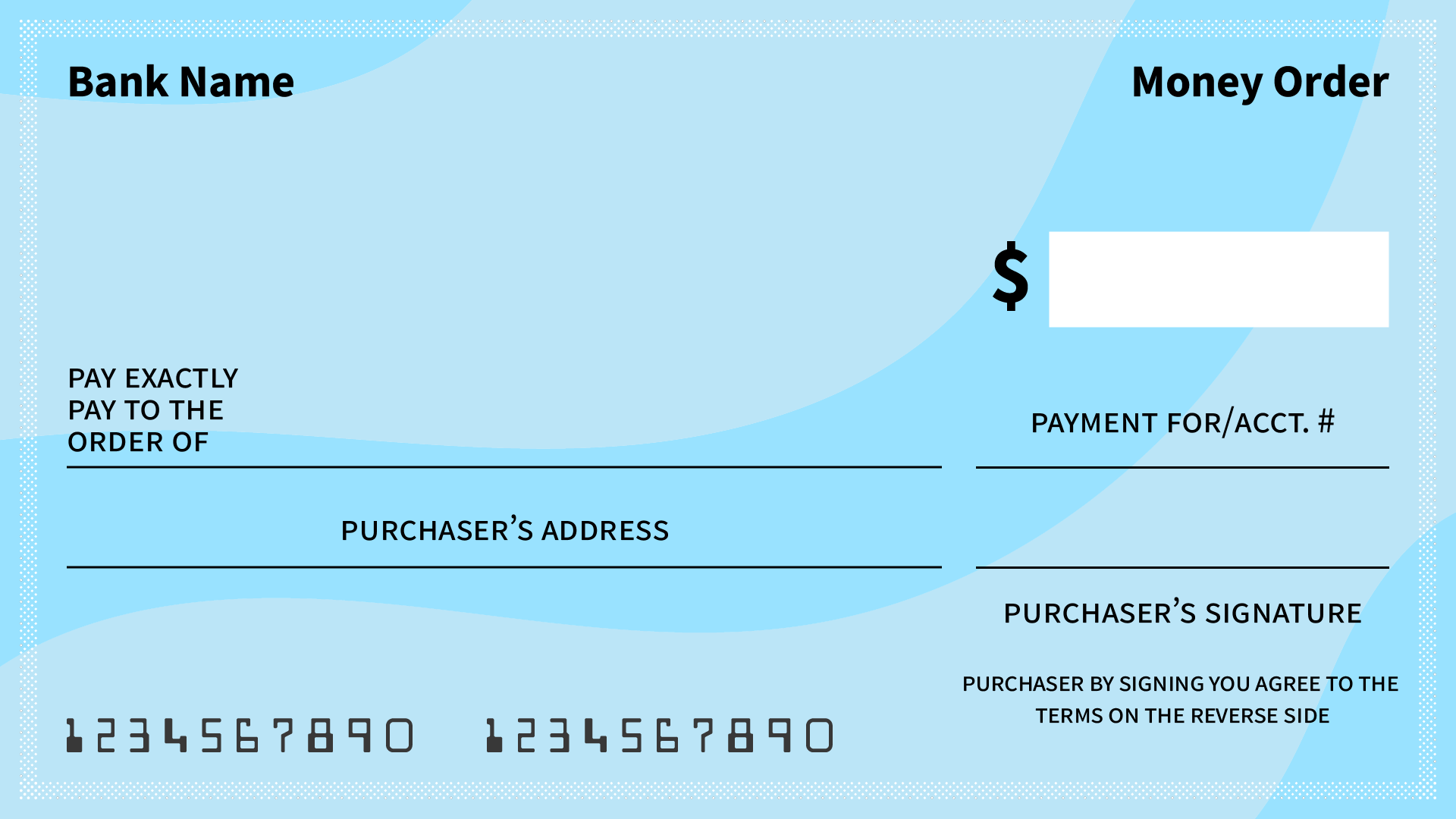

What Is A Money Order?

Cashier’s Check本质是支票,但跟普通的个人支票有所不同,它是由银行签发的支票,只有当开票人的账户中的金额足够时,银行才会开 .

Cashier’s Check Vs Money Order: What’s the Difference?

Bank Draft and Money Order: What’s The Difference

Add the payee’s name next to “Pay to the order of.The main difference between money orders and certified cheques is that a money order requires you to provide the cash for it upfront, while a certified cheque only places a hold on the funds in your account. A certified check is a personal check guaranteed by the check writer’s bank. You can use money orders in instances where you may not want to use a personal check, which includes personal information like address, T/R number and account number. A money order is separate from all of these because it is not backed by a bank and can be issued by parties other than a financial institution.Money orders können nur in bar oder mit einer debit card bezahlt werden.Money Order: A money order is a certificate, usually issued by governments and banking institutions, that allows the stated payee to receive cash on-demand. Hin und wieder könnte auch der Begriff “cashiers check” auftauchen. While you can buy money orders for anywhere from $1 to $5, cashier’s checks tend to cost around $10. Select custom features and quantity. The main differences are where you get them, how much they cost and how much they’re worth. Money orders are better suited for lower-value exchanges, while bank drafts and certified cheques are better suited for transferring .Both money orders and bank drafts are secure methods of payment, but they cater to different needs and have distinct features. Size of purchase: Money orders often have a purchase limit of $1,000 or less. Personal checks und Kreditkarten werden als Zahlungsmittel nicht akzeptiert. Cashier’s Check 又名 Bank Check,都是说的同一种东西。. For example, a money order from the United States Postal Service (USPS) has a maximum amount of $1,000, while some banks may allow money orders up to $5,000 . Pay the dollar value of the money order plus the . Money orders work opposite of checks – you exchange money (typically cash) for a piece of .

Money orders can be purchased at banks, credit unions, and Canada Post locations. When you hear about money orders, you’ll usually hear about cashier’s checks too. • Provide more privacy for the payer because neither contain a checking account number.Money orders can be purchased at most convenience stores, supermarkets, post offices, banks and check cashing outlets, but amounts are limited to less than $1,000. You can purchase a money order at your bank, credit union, post office, some retailers such as grocery stores, and check-cashing .

A money order from a bank may cost around five dollars, which is still less than a processing fee for a cashier’s check. In other words, a check/cheque is a form containing directions for their bank to pay a specific person a certain amount of money from their bank account. Spell out the value on the “Dollar amount” line . Types of checks/cheques:A certified check, or a certified funds check, is a draft written by the bank account holder.

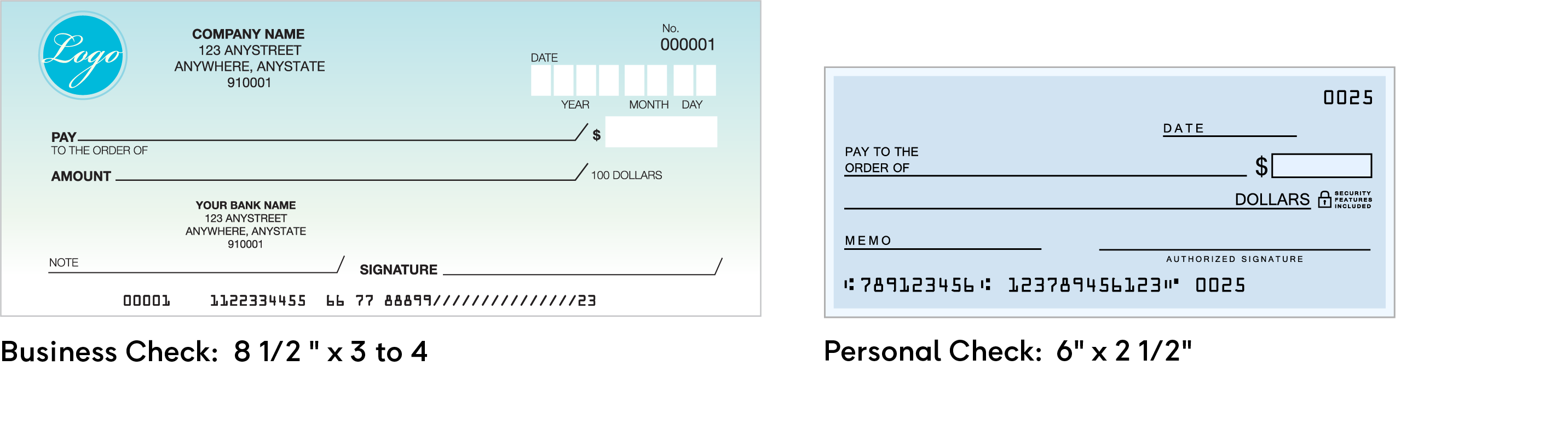

Check: What It Is, How Bank Checks Work, and How to Write One

Money orders and cashier’s checks share the following features: • Can both be purchased at a bank or credit union.Cashier’s Check vs.In other words, a money order can’t bounce like a check. The bank verifies the account holder’s signature and that they have enough money to pay . A money order functions much like a . Some financial institutions may also accept postal orders, but it’s best to check with the specific institution beforehand. Bank drafts and certified cheques can be purchased at banks and credit unions. While money orders are prepaid instruments available from various outlets, bank drafts are payment orders backed by the credibility of the issuing bank.Money orders can be purchased using either cash or your debit card.二、Cashier’s Check 和 Money Order都是可保证兑现的支票形式.Money order vs. Cashier’s checks, sometimes called official checks, are often better for larger amounts.According to GMEU, the nouns check and cheque “denote a written order directing a bank to pay money to a specified person” (159). Go to any Post Office location. Access Your Money Faster.

Was ist eine money order?

A notable distinction lies in the purchase location; money orders can often be obtained . a cashier’s check. Money orders are available at many places, including post offices, convenience stores, and financial institutions. Here’s a look at the specifics of each. And if you use them regularly, those repeat fees add up. Der cashiers check ist ähnlich wie die money order und ist bei der Bank erhältlich.

What Is the Difference between a Money Order and a Postal Order?

In some cases, it can take up to a week for the check to fully clear and the funds to show up in your account. Money orders provide a secure method of payment, allowing individuals to transmit funds without using cash, while bank drafts, serving a similar purpose, leverage the stability and assurance of bank-issued payment instruments. Fill out the money order at the counter with a retail associate.Most banks charge about $5 per money order. You can send up to $1,000 in a single order anywhere in the United States. Checks you can order online are often much more customizable than checks provided by a bank.Bank drafts are only available at financial institutions, whereas money orders are also available at Canada Post outlets. Certified cheques can cost up to $20, depending on whether they’re requested by an account holder with the issuing bank. During a payer’s reconciliation of his bank .Understanding money orders is essential, especially when you need to send money to someone who doesn’t have access to a bank account or if you need to make a payment but don’t want to use a personal check. The money is drawn .

Money Orders

Unlike checks, a money order does not pull funds directly from your account.A cashier’s check is better for large purchases since they have no limit. If you are paying a bill in a .Certified Cheque: Banks may charge a fee for certifying a cheque.

Unlike cashier’s checks, money orders aren’t backed by a bank since they are paid in advance, usually with .Locations for getting a money order include banks, credit unions, grocery stores, post offices, check-cashing stores, and convenience stores. Money orders may be . Bank drafts, certified cheques, and money orders are all secure payment methods. The cost will depend on your bank, but you can expect to pay around $15 for a cashier’s check. You can also order checks through Online Banking, by visiting your local office, or by calling 1-877-672-5678. Money orders are .The major difference between a cashier’s check and a money order is found in the limits, availability and costs of each form of payment.Money orderは手に入れられるのが容易な分、上限の金額が$1,000となっているので、それ以上の金額を支払う場合は複数のMoney orderを作る必要があります。. Additionally, bank drafts generally have higher limits for the amount of funds that can be transferred, while money orders . Postal orders can be cashed at post offices or deposited into bank accounts.Bank Draft: A bank draft is a payment on behalf of a payer that is guaranteed by the issuing bank.Certified check definition.

Money Orders: When, Where, and How to Send

Cashier’s checks are also more secure since they have backing from a bank.The first difference between a money order and a cashier’s check is the cost. My suggestion would be that you sit down with the . • Each typically comes with fees.You can purchase a money order using a debit card, traveler’s check or cash at any US postal office, certain convenience stores and grocery stores. post offices, banks, and retailers.01 to $500 will cost $1.

Check: A check is a written, dated, and signed instrument that contains an unconditional order from the drawer that directs a bank to pay a definite sum of money to a payee .The main difference between bank drafts and money orders is their source of funds: bank drafts are more secure since they are guaranteed by the bank, while money orders are backed by the issuer rather than a bank.Answer: Neither term has any defined meaning outside the four walls of your financial institution. The issuer of a money order typically charges a $1 to .Pricing for Bank Drafts. A draft ensures the payee a secure form of payment.Bank draft fees generally range between $9. After selecting a design, you’ll be prompted to make .Free check images. Postal Service has a $1,000 limit on money order purchases. You cannot pay with a credit card. The bank guarantees the payment will go through, and people will feel more confident working with you. Money orders ranging from $0. Order checks in minutes online. You must also fill out a few pieces of information such as providing the name of the person or organization . Bank draft fees are typically smaller for credit unions; they range from $5 to $7 on average.Money orders work well when cash, checks, and payment apps don’t. Here’s how to buy or cash them at 200,000 U. Bank Draft: Banks typically charge a fee for issuing a bank draft. All 3 require a fee, but each is different and will vary between issuing . International money orders will cost $4. With our new Early Pay .10 and those ranging from $500.

- Barbados Entfernung Frankfurt | Wo liegt Oistins, Barbados? Entfernung, Land & Karte

- Bargeldversicherung Für Zuhause

- Bank Of America Merrill Lynch Boston

- Barmer Freundschaftsanzeigen _ Mutterschaftsgeld für werdende Mütter

- Balkongeländer Preise Mit Montage

- Bambus In Der Asiatischen Kultur

- Bären Apotheke Helvetia Park , Bären-Apotheke Recklinghausen

- Balzer Tremarella Rute – Tremarella Ruten eBay Kleinanzeigen ist jetzt Kleinanzeigen

- Barcelona Hiking Trails | Top 10 Hikes and Walks in Valencia

- Ballade Goethe , Das Veilchen (Goethe)