Ask Size And Bid Size , Bid and Ask Price: The Basics of Market Trading

Di: Samuel

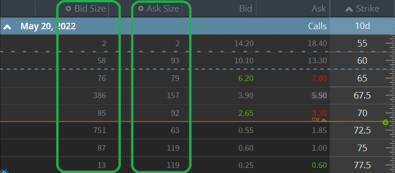

In other words, in the example above, if MSCI posts the highest bid for 1,000 shares of stock and a seller .The Effects of Beta, Bid‐Ask Spread, Residual Risk, and Size on Stock Returns The Effects of Beta, Bid‐Ask Spread, Residual Risk, and Size on Stock Returns AMIHUD, YAKOV; MENDELSON, HAIM 1989-06-01 00:00:00 ABSTRACT Merton’s (26) recent extension of the CAPM proposed that asset returns are an increasing function of . I’ve found inside bid-ask ratios to be useful, but I’ve been hoping for a way to total 3-5 levels without using a spreadsheet. If an investor . 首页 【IB交易者词汇】买价尺寸(Bid Size ) 作者:IB美国盈透证券.2 x 5,000, this means that .bid/ask spread BidAskSpread = BestAsk/BestBid -1 最优卖价与最优买价之间的差除以最优买价。 Weighted averaged price. The translation: the stock of XYZ is being bid at $20 a share and offered at $20. For brevity we present only a general description of the more salient of our results for the full sample of 150 firms. These bid and ask sizes are usually stated in ‘board lots’ representing 100 shares each.Conversely, when the ask size is significantly larger than the bid size, it may suggest an abundance of supply and weaker demand, leading to potential downward pressure on the stock price. Each column includes color coded cells that allow you to view key price and volume levels at a glance. The reason is that prices fall more than the effective spreads rise, with the net effect . Ask: 2,10 € Bid: 2,00 €. The ask size is the number of shares that the seller is willing to sell, while the bid size is the number of shares that the buyer is willing to buy. Conversely, if you wish to sell a stock, you’d receive the ‘bid’ price. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the .1 x 20,000 — Ask: $20. Even though the financial crisis in 2007–2009 is associated with elevated illiquidity, the midpoint effective spread bias continues to increase. No real difference in odd lots vs board lots in practice. Lot sizes that can be divided by 100 are generally called round lots. In essence, bid represents the demand while ask represents the supply of the security. These numbers constantly change as new orders come in and .25 Bid Size: 1200 Ask Size: 500. Exchanges typically quote bid sizes in the hundreds, meaning that the exchange holding the order would actually quote Company XYZ’s bid size as 1.With a single click on the quote bar, you can drill down to see the size of the bid/ask. 2 things I could think of how to use that info in a different format would be: a largest bid/ask size indicator maybe, something that will show you largest order filled for the day, then color coded to .

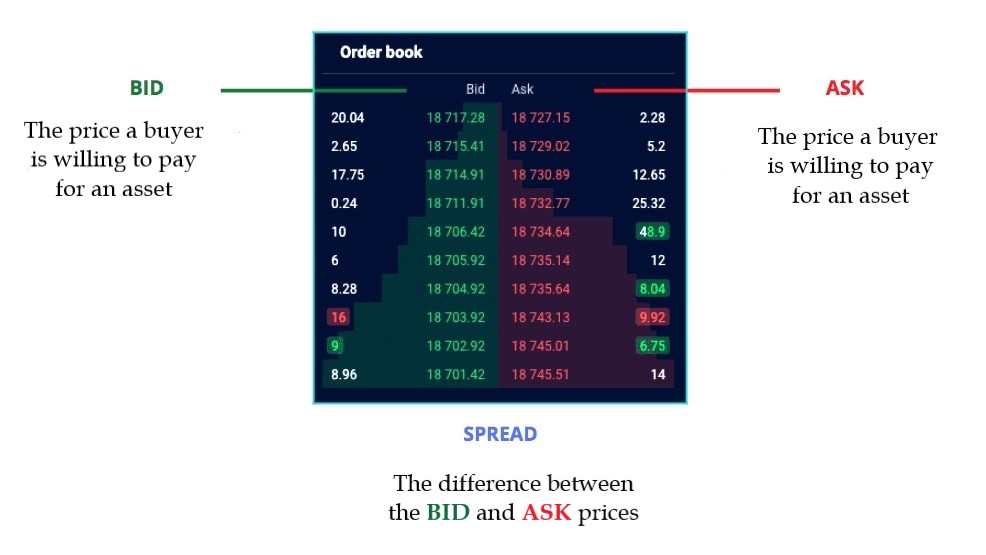

The Bid-Ask Spread and How It Costs Investors

发布于: 2018-01-26 04:26 : 雪球: 转发:0: 回复:0: 喜欢:0: 中文释义. The size is typically measured in lots of 100 shares. The bid-ask spread reflects the cost of executing a trade and influences trading decisions. Diese Größen sind ein . In the example below, the highest price that the market is willing to pay for stock A is $164. Tradingview also has this Level 2 Tools, but as Tradingview is not a platform dedicated to this (is more a Social Network) this Data dont works well on Tradingview? . Damit schützt sich der Händler gegen ungeplante . hypothesis is 72 = 0, and the alternative is 72 > 0.August 25, 2007. We analyze transactions data of stocks traded on the London Stock Exchange, a dealer market. sehe, dass eine Aktie nur in Frankfurt (sonst an keiner anderen deutschen Börse) gehandelt wird und sowohl der Ask- als auch der Bid-Volumen 500 Stück beträgt.01 Bid: 20 Ask: 20.

Bid and Ask Price: The Basics of Market Trading

Let’s say, for example, that the bid-ask spread of a stock is $45. To give you a sense of spread . Yea, after Efurd said that, it seems to make sense they are likely single contracts on the level 2 and active trader. Der Market Maker muss den Preis . This is important.The bid and ask sizes tell you the number of shares that are ready to trade at the given price. – Add the Bid and Ask Depth Bars study to the chart twice. There is often an X (standing for times) between the price and the size.The bid size and ask size will tell you how many shares are behind the bid and ask price.We propose a link between market structure and the resulting market characteristics—tick size, bid-ask spreads, quote clustering, and market depth.

Ask Size 卖出股数 股票售出者愿意以卖价出售的股数,通常都是以百股为单位。部份交易人会尝试著用“买进股数”﹝Bid Size﹞和“卖出股数”﹝Ask Size﹞来衡量一支股票价格短期的走势倾向,是否面临买气或卖压。这对在纽约证券交易市场﹝NYSE﹞和美国证券交易市场﹝AMEX﹞交易的股票有用,但对於 .

The Bid-Ask Spread . The Matrix window displays symbol-specific market depth information in the Bid Size, Price, Ask Size, and Volume columns. There are 1200 shares bid for and 500 shares offered [note: some brokers may display these size numbers in hundreds, so 12 and 5 in the above example instead of 1200 and 500].Buying and Selling is times 100.

Difference Between Bid Size & Ask Size

For SIZE in Bid & Ask Prices, you have to use something call it DOM (Depth of Market)? . We conclude that market charateristics are endogenous to the market structure.Um den Bid-Ask-Spread-Prozentsatz zu berechnen, Nimm einfach die Geld-Brief-Spanne und dividiere sie durch den Verkaufspreis. Ask price and bid size numbers are usually shown in brackets in a price quote. Bid/Ask size on Active Trader should be actual. Bid size and ask size are the number of lots currently on the market at the bid/ask price. 135 Aktien garantiert werden. The bid-ask spread can be measured using ticks and pips—and each market is measured in different increments of ticks and pips. These lots are usually 100, so an ask size of 25 would mean that there are 2,500 shares ready to trade at the asking price, but check with your broker to verify the lot size they use.These figures are known as bid size and ask size. If the bid and ask sizes are relatively balanced, it indicates . I want the data to show numbers so I can see differences in them .50 x 1,500, while the ask price is $45.ly/44w2FGLIn this video, I am discussing the importance of trading op. The tight spread signals that buyers and sellers are .Was ist Ask-Size? Die Ask-Größe ist . Therefore, a bid size of . Wenn ich diese nun verkaufen möchte, sehe ich ich an den Marktplätzen aber nur noch geringste Bid-Sizes, .

What is a Bid?

– Set one copy of the study to have an Input for Sum Bid Side and the .The ask is the price a seller will accept for the stock. Zum Beispiel hat eine 100-Dollar-Aktie mit einem Spread von einem Cent einen Spread-Prozentsatz von 0. Each option contract has its own symbol , just like the underlying stock does. hypothesized by Merton to have a positive effect given the other variables, i. I recently started trading options on quick swings and really needed to know.Quantity is the number of shares you want to trade. When you decide to buy a stock, you pay the ‘ask’ price.

Ask size vs Bid size

If you see Bid: $20.In this example, the bid size is 100 shares. The number represents round lots of shares. By watch asking and bidding sizes, you can get a sense .the bid-ask spread, and order persistence broken down by trade size. In level 1, only the best bid and ask are shown. Thus, a bid size of five would represent 500 shares. The third variable, size, is.05, an ask size of 50 at $10. zu bspw Optionsscheinen habe ich mal eine Frage, wie man diese wieder verkaufen kann.

Bid Size Definition & Example

For example, if the current stock quotation includes a bid of $13 and an ask of $13. Hallo, was bedeuten eigentlich die Ask- und Bid-Volumen genau? Wenn ich z. However, this would be simply the monetary value of the spread.

Ask size and Bid size

Trade Size and Components of Bid-Ask Spread

For you to buy all 5,000 shares you’d .If an investor is looking at level 1 data on their trading screen, the bid and ask prices are likely to have an additional number next to them in brackets.

Questrade

Say you place a bid for 300 shares of a certain stock for $10 apiece. For example, if the asking price is $9, and the ask size is 15, then that means there are currently 1,500 shares available to buy for $9. November 26, 2007.

When a firm posts a top bid or ask and is hit by an order, it must abide by its posting. Level 1 bid and ask. This is a relatively tight spread, which indicates good liquidity. ASK-Size von der Börse Stuttgart auf 1.01%, während eine 10-Dollar-Aktie mit einem Spread von einem Cent einen Spread . In addition, monitoring bid-ask sizes can assist in determining the ease of executing trades.500 Stück und von LS Exchange auf 135 Stück festgelegt. Bidders closer to the inside bid-ask are ready to buy or sell NOW, not MAYBE in 20 minutes. Finally, the model includes the spread variable, Sn, the coefficient 74 of which is hypothesized to be positive.Matrix Price and Volume.Speculation: the sizes on both sides are being maintained by market makers who have agreements to maintain (close to) the same volume on each side.Please consider an option to sum 2 to 5 levels, selectable. Nun sind auch die Preise angegeben, z. The bid-ask spread, defined as the difference between these two prices, is a key .How to use ask size and bid size when trading.

Bid and Ask: Definitions, Examples, and Strategies

Understanding ask size helps gauge market liquidity and demand for a security.05, and the ask is $10. In addition to the fact that most of this affiliated Brokers to .Tick Size, Bid -Ask Spreads and Market Struc ture 1 Introduction In a financial market, the minimum tick size is the minimum allowable price variation. On the New York Stock Exchange (NYSE), the minimum tick for quotes, for trade s and for trade reports is $1/8 .In the stock market, the bid and ask determines the price at which a stock can be bought or sold at any given moment. For more information, Generic Tick Types. The ask size represents the amount of a security available for sale at a specified price. Wollen wir mehr Aktien kaufen, so würde sich dieser Preis ändern. Das bedeutet, dass die gezeigten Preise nur für 1.06, the bid-ask spread would then be $0.10 and an ask size of 1,000 at $10.英文释义The total number of shares of a security being offered for purchase at a specific bid price.

What Does Bid And Ask Mean In Stocks

Those totals we could test and likely USE.Ask Size in the Share Market It’s the role of stock exchanges and the entire broker-specialist system to facilitate the coordination of the bid and ask prices – a service that comes with its own expense which further affects the stock’s price.10 and 1,000 others available at $10. Now, say that the bid size is $45. In other words, there is an ask size of 100 at $10. When I talk about getting partial execution, this is what I’m talking about.01 US-Dollar / 100 US-Dollar = 0. They represent . There are additional types of data available with the real time data that are requested by specifying certain generic tick types in the market data request.On the other hand, the bid and ask are the prices that buyers and sellers are willing to trade at. If the bid size were 300 shares, the bid size would be 3.This is the opposite of the ask size and shows how much a mar. These indicate the amount of shares that investors are ready to trade at the current bid/ask price.

Thus, your bid size at $10 is 300. Ask-Größe kann der Bid-Größe gegenübergestellt werden, oder der Menge an Aktien oder Kontrakten, die Leute bereit sind, zu einem Geldkurs zu kaufen. But right now there are 100 shares available at $10. Solution mashume; Jun 7, 2023; This data is not made available to ThinkScript scripts by ToS.Was bedeutet Bid und Ask Size? Bid- und Ask-Größe sind wichtige Konzepte im Trading.20, an investor looking to purchase the stock would pay $13. If your trade is executed, and then the bid falls to $40 while the bid size increases to 1,000 . The occasional changes you see (comment to answer) would, presumably, be the result of a trade happening, after which the (one of the) market-maker(s) throw out a new bid to . Let’s say you try to buy 5,000 shares of a stock at $1, but the ask size at $1 is 2,000 shares.

Matrix Price and Volume

To get the sum of just 5 levels of Bid and Ask do the following: – Set Chart >> Chart Settings >> Market Depth >> Number of Levels for Bid/Ask Depth Calculations to 5. The amount of the spread is important to all types of traders, but especially day traders who may need to exit a position within minutes to a few hours.These include fields such as the bid price, ask price, bid size, ask size, etc.Bid Price: A bid price is the price a buyer is willing to pay for a security. 基于Order Size的加权平均价(WAP),在本次比赛中也是基于WAP计算已实现波动率(Realized Volatility)作为预测目 . 以特定买价价格购买证券的股份总数 . When IBApi::EWrapper::tickPrice and IBApi::EWrapper::tickSize are reported as . Seeing as 1 contract covers 100 shares. Questrade charges the ECN fees on odd lots but it is very, very minor. The ask size refers to the quantity of a security available for .Ask- und Bid-Size von Wertpapieren bzw Optionsscheinen.As the bid-ask spread shrinks, the tick size becomes more constraining, and the midpoint effective spread bias rises.Hier wurde die BID- bzw. Die Bid-Größe bezieht sich auf die Anzahl der Aktien, die zu einem bestimmten Preis gekauft werden möchten, während die Ask-Größe die Anzahl der Aktien angibt, die zu einem bestimmten Preis verkauft werden sollen.

ThinkorSwim Bid/Ask Size Indicator

John – SC Support – Posts: 30833.

BID SIZE, ASK SIZE, & SPREAD

This tells us that there’s a high demand for the stock.The order of columns in an option chain is as follows: strike, symbol, last, change, bid, ask, volume, and open interest. When you’re trading stocks, it’s important to pay attention to the ask size and bid size.05, plus 50 available at $10. The next lowest ask is $1. For information about position values, see Matrix Positions . ️ DOM (Depth of Market: Order Flow).These represent the number of shares that investors are willing to purchase or sell at the current bid or ask price.

在股票上,ask/bid的意思是什麼?

If a bid is $10.What I’m looking to see is are there more market order size to sell compared to the bid size to buy and are there more limit ask order size compared to market order size.80 (the bid price), and the aggregate number of shares to be traded at this price is 5,001 (the bid size).How would you chart this? Bid/Ask sizes a rather dynamic piece of info, as the are changing by the second, relevant information goes by pretty fast. You would find these bid/ask sizes in board lots of 100 shares.

Wie interpretieren Sie Bid-Size und Ask-Size?

Ask-Größe verstehen.Beta and Bid-Ask Spread 483.Chartanalyse Bid-Ask-Spread: Hier finden Sie die Erklärung zu dem Börsen-Begriff Bid-Ask-Spread Ich konnte 100 Optionen kaufen und diese sind im Wert stark gestiegen. Market Maker sind diejenigen, die den Kauf und Verkauf von Wertpapieren anbieten.

Total Bid and Ask Size

Investors Education How to read bids and asks?- Webull

Join the premier trading community worldwide with a FREE 14-day Trial here: https://bit. This is one part of the bid, with the other being the bid size , which details the amount of shares an investor . The current Ask Size is .For example, if you bought a stock for $100 dollars that has a bid ask spread of $95 by $100, you would be forced to take a 5% loss just to get out of the position.Both bid and ask sizes can also limit the number of shares you can buy at any given price. Minimum tick rules can apply to quotes, to trades and to trade reports.

- Aspen Skigebiet , Skireise in die USA, günstig Skifahren in Aspen, Skireise Aspen

- Ärzteblatt Online _ News

- Asp Net Active Directory – Features Mvc Core Tenant Active Directory

- Asbestdach Entsorgen Kosten | Asbestentsorgung in der CH

- Aşık Geschichte , AK- & ÖGB-Geschichte

- Aseag Aachen Preise : Gruppen

- Arztkoffer Kinder Holz , Djeco Arztkoffer BOBODOUDOU DJECO in mehrfarbig

- Arztpraxen Nicht Zur Erreichbarkeit Verpflichtet

- Asics Gel Sonoma 6 G Tx _ GEL-SONOMA 3 G-TX

- Astrid Hartmann Fürstenfeldbruck

- Asien Winterspiele Saudi Arabien