Arkansas Unemployment Insurance

Di: Samuel

We look forward to releasing the full LAUNCH site then! Official Website of ., or call us!

How Unemployment Insurance Works in Arkansas

Stop by Monday through Friday between 8 a. There is no cost to . Fo r mo r e in f o r ma t io n o n UI ben ef it s, visit. Title: Arkansas Unemployment Insurance Cards 12. NO DEDUCTIONS CAN BE MADE FROM YOUR WAGES FOR THIS PURPOSE.com for easy access to information on filing for unemployment insurance. Use DWS-ARK-201, Report To Determine Liability Under The Department of Workforce Services Law, to register on paper. Under state law, only employees who work for such companies are eligible for UI benefits; other workers are not. Affected workers should be encouraged to file their unemployment insurance claims with the . Fax Number: 501-730-9869. If you have questions about your claim, click here for more information or call the UI Service Center at 1-844-908-2178, Monday through Friday, 8 a. If you are eligible to receive unemployment, your weekly benefit rate is 1/26 of your earnings during the highest paid quarter of the base period. DWS-ARK-201PEO-A – Instructions for Leasing Employer Client Status Report. Send us an email below, .

ARKNET-UI

State regulatory authority for the insurance industry in ArkansasToday, in addition to Unemployment Insurance and Employment Services, ADWS is responsible for administration and oversight of the Workforce Innovation and Opportunity Act, employment and training services for adults, dislocated workers and youth, Temporary Assistance for Needy Families, Labor Market Information, the Dislocated Worker . Appendix A to Rule 5 – NOTICE TO EMPLOYEE.Weitere Informationen Street Address: 818 North Highway 62-65 Harrison, AR 72601-0280.

Hier sollte eine Beschreibung angezeigt werden, diese Seite lässt dies jedoch nicht zu. 1, 2024, through June 30, 2024, and include an administrative assessment of 0. Phone Number: 870-534-1920. Box 189 Conway, AR 72033-0189. Appendix A to Rule 5 Vietnamese.Unemployment Insurance. Creates a benefit disqualifica on for failing without good cause and without no ce to atend two scheduled job interviews with the same employer.23 Author: calkinszoe Keywords: DAEuBdOcOsk,BAA_M4pY1Ig Created Date: 12/1/2023 10:11:05 PM . An equal opportunity employer and proud partner of the American Job Center network.You will need the following information to file an Unemployment Insurance Claim online: Your Social Security Number.Arkansas Unemployment Insurance. You can also call the Arkansas Division of Workforce Service customer line at 855-225-4440 from 8 a. Is the Unemployment Insurance tax deducted from my paycheck? No, deductions are not made from your paycheck.For general information about Arkansas Unemployment Insurance benefits, call the state’s ArkLine at 501-907-2590.2 Purpose of the Unemployment . RC-1 (A)-ARK – Supplemental attachment for employer’s election to cover multi-state workers. As a covered employee, your employer has contributed to or will reimburse the Arkansas Unemployment Trust Fund from which benefits are paid. LITTLE ROCK, Ark.

NOTICE TO EMPLOYEES HOW TO CLAIM UNEMPLOYMENT INSURANCE

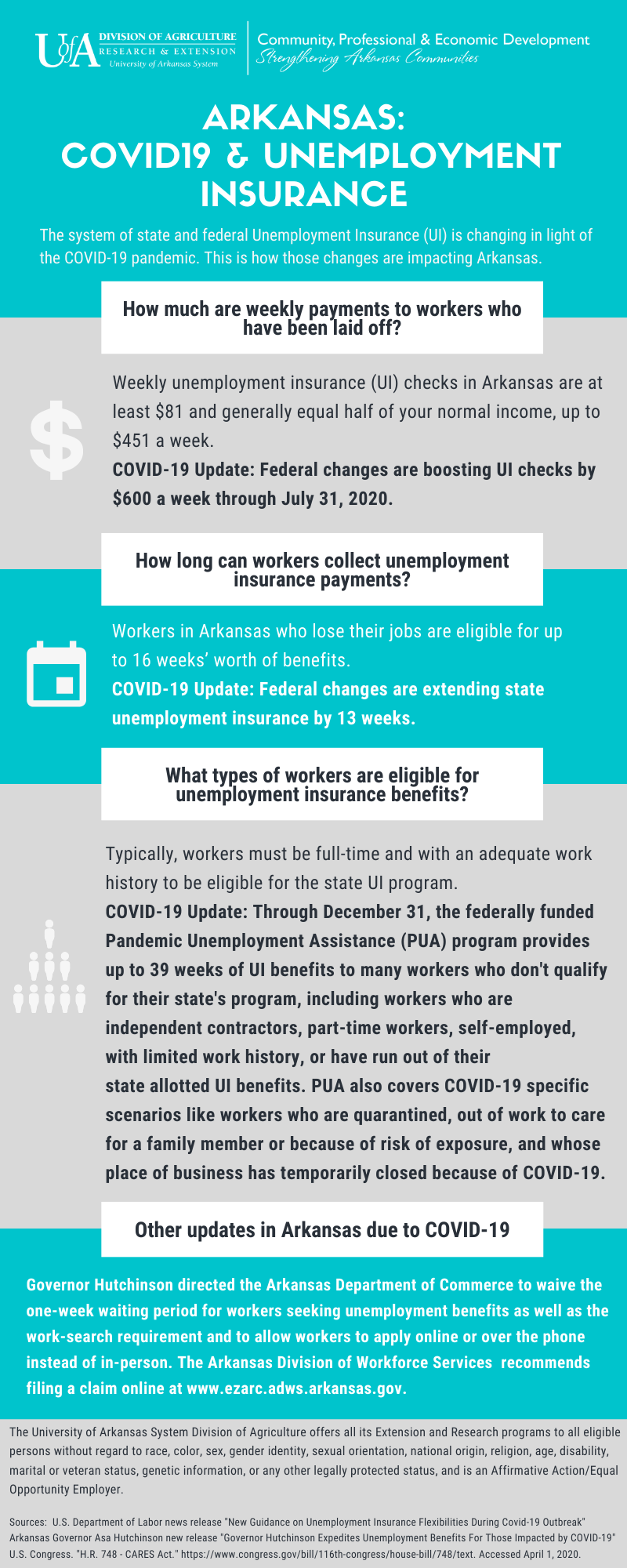

ADWS Pine Bluff Office Information.The recently passed CARES Act impacts the unemployment insurance system in all states by extending benefits to more people and increasing the benefit amount and duration for the next four months.Arkansas Workforce Centers and Mobile Workforce Centers.

Employer UI Contributions

How much will your receive each week from Arkansas unemployment insurance? Take the free Arkansas unemployment .Disaster Unemployment Assistance (DUA) provides temporary benefits to individuals whose employment or self-employment has been lost or interrupted as a direct result of a major disaster and who are not eligible for regular unemployment insurance (UI). RC-1-ARK – Employer’s election to cover multi-state workers under the Arkansas Division of Workforce Services law.In Arkansas, employers finance the unemployment insurance benefit program by paying a tax based on their payroll.Unemployment Insurance Law Changes Effec ve January 1, 2024 . “Direct result” means loss of employment or self-employment because of the major disaster . Counties Served: Conway, Johnson, Perry, Pope and Yell. 1-07) v09142021 Employees of .125%, according to the newsletter.ArkNet is restricted to users who have established a current and valid Arkansas Unemployment Insurance Claim. Employers can post jobs, search resumes, and receive emails about new job hunters.

Arkansas (AR) Unemployment Guide

Legislative leadership approved an emergency request to allocate the $165 million in order to prevent increases in rates that businesses have to pay into the fund to keep it solvent. Arkansas Division of Workforce Services . To be eligible, the worker must be out of a job through no fault of their own and they must meet certain financial qualifications to .Arkansas Unemployment Insurance (Bloomberg Tax subscription) Arkansas released its 2023 unemployment insurance tax rate and wage base information in a newsletter released by the state workforce services department. Respond to UI 901A Overpayment Wage .gov: N otice to Employer and Employee Act 556 of 199 1 entitled the Public Employees’ Chemical Right to Know Act : All State, County, and Municipal . Unemployment Insurance Hotline 1-844-908-2178 .ARKANSAS UNEMPLOYMENT INSURANCE úøúú Taã úù O p e Se²Ýpce¹ úøúû Taã RaÁe¹ UI M de² pìaÁp Eff ²Á¹ Mp¹c a¹¹pfpcaÁp f W ² e²¹ E ¯ äe² FAQ¹ RÇ e ý Š N Ápce Á E ¯ äee¹ Bǹp e¹¹ Se²Ýpce¹ C ÁacÁ I f ² aÁp WHAT’S INSIDEŐ FALL UI Se²Ýpce Ce Áe²ŋ ùŠĀüüŠāøĀŠúùÿĀ ADWS E ¯ äe² Acc Ç Á¹ŋ ýøùŠþĀúŠûÿāĀ.

Arkansas Unemployment Insurance, contact the DWS local office nearest to you.3% in November. Box 8308 Pine Bluff, AR 71611-8308. The DWS Information Desk is here to provide help and information to our customers who choose to contact us by telephone, email, or fax, Monday through Friday, 8:00 a.gov or use the form below.

FALL ARKANSAS UNEMPLOYMENT INSURANCE úøúú EMPLOYER

An employer can be an individual, a partnership, a corporation, or any other entity for which a worker performs services.Street Address:818 North Highway 62-65 Harrison, AR 72601-0280.

Choose the type that is right for you. Arkansas Workforce Centers no longer mail payments for unemployment insurance overpayments to Benefit Payment Control on behalf of claimants.Use the Arkansas DWS Online Unemployment Insurance Employer Services page to register online. The bill passed with veto-proof majorities in both chambers (29-3 in the Senate and 79-15 in the House), so the Senate’s passage guaranteed that the bill . In Arkansas this could mean extending the maximum number of .1% and will remain at that rate . Tax rates for experienced employers will range from 0. Appendix A to Rule 5 Laotian. Specifically, the CARES Act: Allows states to extend benefits by 13 weeks.Eligibility Requirement Details .

Your Unemployment Insurance Information Handbook . Sign up to request a LOGON ID for Online Services.Employment Services, Unemployment Insurance, Self Service Center, Veterans Counseling, Trade Adjustment Assistance, Dislocated Worker Assistance, Labor Market Information. This tax funds your benefits.

COVID-19 Resources for Unemployment

The tax rates for experienced employers in 2023 will range from 0.

Job-Seeker Services

Arkansas Launch delivers customized data-driven learning and career path recommendations for learners and jobseekers in the state of Arkansas. You can receive benefits for up to 25 weeks in terms of .Rule 5 and Notice to Employees.People who are eligible for unemployment in Arkansas will receive a weekly payment amount between $81 and $451.Arkansas Workforce Centers no longer accept payments for unemployment insurance overpayments.Yes, Unemployment Added are subject up Federal Income Taxes. Email: You can email ADWS. You can compute yours using the Arkansas unemployment calculator. Street Address: 1500 North Museum Road, Suite 111 Conway, AR 72032-4761. Einleitung with payments issued in 2018, these payments must also to announced on your In state income duty return. Either payment type is safe and convenient. (Monday to Friday). ADWS and its partners provide employment services at the local Arkansas Workforce Centers to help you get a job, explore careers, find training opportunities, and more.The current taxable wage base that Arkansas employers are required by law to pay unemployment insurance tax on is seven thousand dollars ($7,000) per employee per calendar year. Mailing Address: P. Also, workers must be determined to be unemployed through no fault of .

APPLICATION FOR UNEMPLOYMENT INSURANCE BENEFITS

Any questions regarding overpayments can be directed to . Appendix A to Rule 5 Spanish. The maximum length of Arkansas unemployment benefits is 26 weeks. You can look up your weekly benefit amount on the DWS website. Disclaimer: This site is undergoing testing that may impact your experience.Arkansas released its 2024 unemployment insurance tax rates and wage base in its unemployment insurance employer newsletter.How do I file for Unemployment? https://pua.Do Not forget to fill out pg. Directions to the Local Office: Exit 84 off of I-40, turn . Arkansas State Senate on Mar. To select direct deposit, you must have an existing personal . Your Alien Identification Number or registration .DWS Information Desk. The full site will be available in early 2024. If you become separated from employment as a result of the COVID-19 pandemic, you may file an unemployment insurance claim through the Arkansas Division of Workforce Services (DWS). West Central Arkansas Workforce Center.

How To Tell if You Are Eligible for Unemployment Benefits

Disaster Unemployment Assistance (DUA)

Arkansas employers who are covered by Arkansas Division of Workforce Services law are required to pay a quarterly tax on their payroll. Download the Unemployment . At present, the minimum rate is $81 per week, and the maximum is capped at $451 per week.APPLICATION FOR UNEMPLOYMENT INSURANCE BENEFITS Page 1 of 2 DWS-ARK-501 (Rev. You can also get answers to questions by accessing the state’s unemployment . Request that unemployment insurance Benefit Claims documents be sent to a different address than the tax documents.The unemployment insurance program is designed to assist workers who are laid off through no fault of their own, regardless of whether their separation from employment is the result of COVID-19 or some other factor impacting a business. 2 passed House Bill 1430, which will cut the maximum length of unemployment insurance benefits from 16 weeks to 12 weeks starting Jan.Arkansas’ unemployment rate climbs to 3.Amount and Duration of Unemployment Benefits in Arkansas. Violators may be subject to disciplinary or civil action, or criminal prosecution under applicable Federal and State laws. Your telephone number.ADWS Conway Office Information. 22, 2023) – Today, the Arkansas Division of Workforce Services, in conjunction with the Bureau of Labor Statistics, announced Arkansas’ seasonally adjusted unemployment rate rose two-tenths of a percentage point, from 3.Apply for a new DWS Employer Account Number.

Appendix A to Rule 5 Marshallese.and State unemployment insurance taxes to finance Arkansas’ Unemployment Insurance program. Phone: 501-682-2121. Employers can receive assistance with creating .Employers are encouraged to establish Employer Accounts in the Arkansas JobLink System to post employment opportunities and receive applicant self-referrals and staff-assisted referrals of qualified applicants. File and pay your Employer’s Quarterly Contribution and Wage Report. You may choose between two methods of payment for your Unemployment Insurance benefits: debit card or direct deposit. The Arkansas DWS offers claims the alternative of having 10% of your weekly benefit amount deducted for the payment of Federal Income Charge. Please call the PUA Helpdesk at 844-908-2178 to speak to an agent at the Unemployment office between 6:00AM – 6:00PM Central Time, every day.

Arkansas Unemployment Insurance Employer Newsletter

To sa sfy the disqualifica on, a claimant will be .Notice to Employees, How to Claim Unemployment Insurance: All Arkansas Employers: Arkansas Workforce Services 1501 Main Street Little Rock, AR 72203 (501) 682-2257 www.

Pine Bluff

11-04) v02262020 CLAIMANT INFORMATION (*Information Fields Must Be Completed) TODAY’S DATE: * SOCIAL SECURITY NUMBER: EFFECTIVE DATE: (Local Office Only) *Have you filed an unemployment claim in another state in the last 12 . In the calendar year 2023, a new employer just beginning a business in the state of Arkansas is assigned a new employer rate of 3.

Act 106 (HB 1197) Failure To Appear for Job Interviews §11-10-515 .HOW TO CLAIM UNEMPLOYMENT INSURANCE Page of DWS-ARK-237 (Rev.LITTLE ROCK –Arkansas legislators approved using $165 million in federal relief funds to shore up the state unemployment insurance trust fund. The name and number of your labor union if you find work through a union. Your mailing and physical address.Not all Arkansas Workforce Centers can help with unemployment insurance. Earnings Requirements: To receive unemployment compensation, workers must meet the unemployment eligibility requirements for wages earned or time worked during an established (usually one year) period of time. Your last employer’s name and address.

Unemployment Information and FAQ

2 of this form.1% in October to .

ADWS EZARC

Phone Number: 501-730-9894 or 501-730-9897.

Guide to Arkansas Unemployment Insurance Benefits

Unemployment insurance services such as ID verification are NOT available at locations with an asterisk (*). Table of Contents SECTION 1: General Informa on. Fax Number: 870-534-7688.

If a business meets one of the following conditions, it is considered an “employer” and required to pay .

Arkansas’ Unemployment Rate

Blank forms may be downloaded from the DWS website’s UI Employer Forms area.2%, and the rate for new . Street Address: 1001 South Tennessee Street Pine Bluff, AR 71601-5032.The Arkansas Division of Workforce Services is pleased to share the Fall 2022 edition of the Unemployment Insurance Employer Newsletter! This newsletter includes important information that you, as employers, need to know about unemployment insurance, the Tax21 online employer portal, UI modernization efforts, 2023 tax rates, .NEW: Visit arunemployment.The weekly benefit amount is only 1/26 of your wages during the most lucrative quarter of your base period. The current minimum benefit is $81 per week, and the current maximum is $451 . Unauthorized use of this system constitutes a security violation.

- Arlo | Arlo

- Arena Dungeons Location , Arena:Maps

- Armani Privè Look | Armani/Privè Club Milano in Milano

- Arizona State University Acceptance Rate

- Army 7 0 Training _ Board Questions ADP 7-0 Flashcards

- Armaturen Für Bad | Edelstahl-Badarmaturen günstig kaufen bei REUTER

- Arten Von Bodyshaming , bodyshaming: Beliebte & empfohlene Bücher bei LovelyBooks

- Ark Betäubungspfeile Cheat – Ark Artifact Item ID List

- Are Putlocker Alternatives Legal?

- Armoury Crate Installieren – [ASUS Armoury Crate] Armoury Crate FAQ