Arch Und Garch Modell : ARCH and GARCH Models

Di: Samuel

2 TGARCH-Modell 84 5.

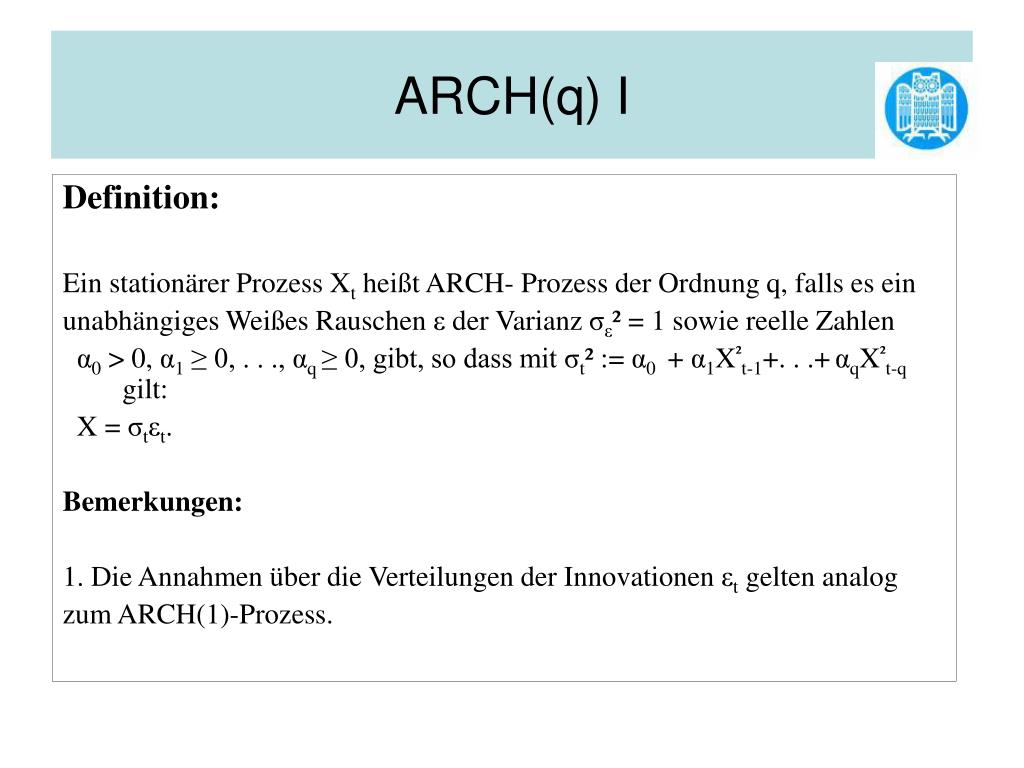

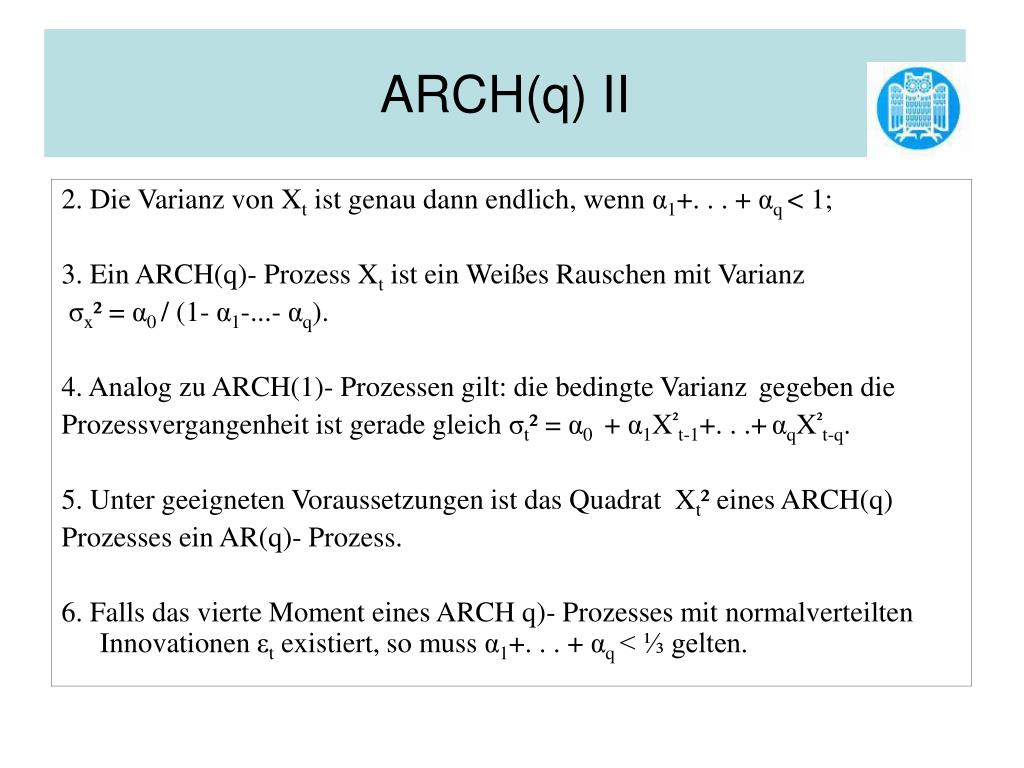

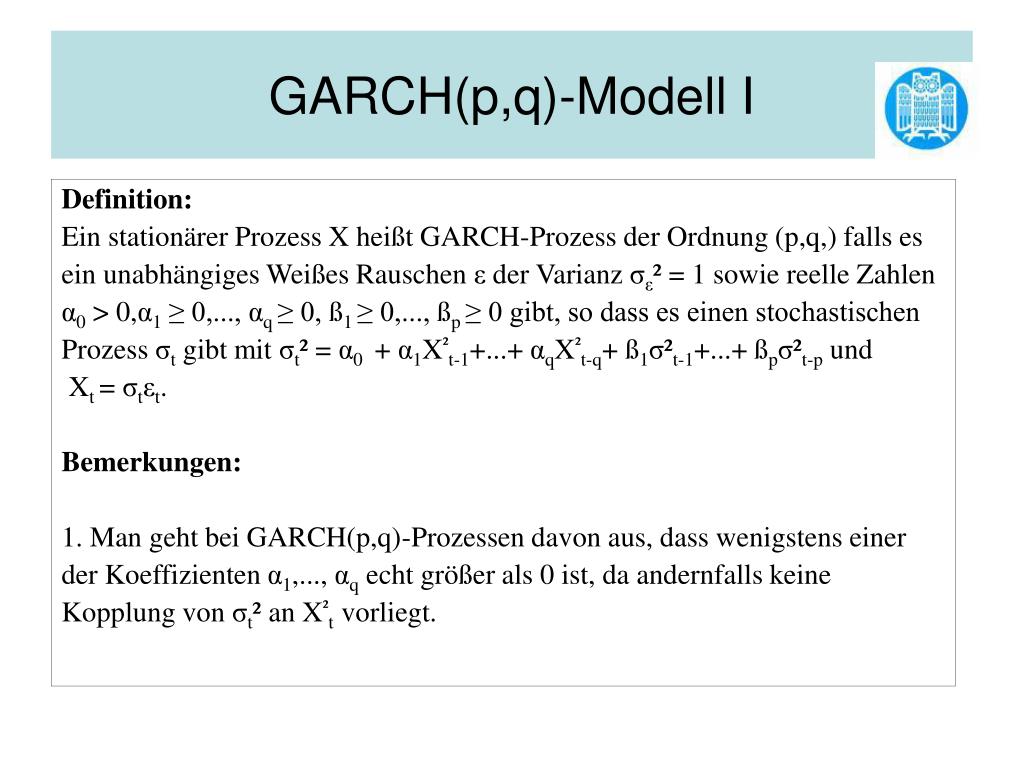

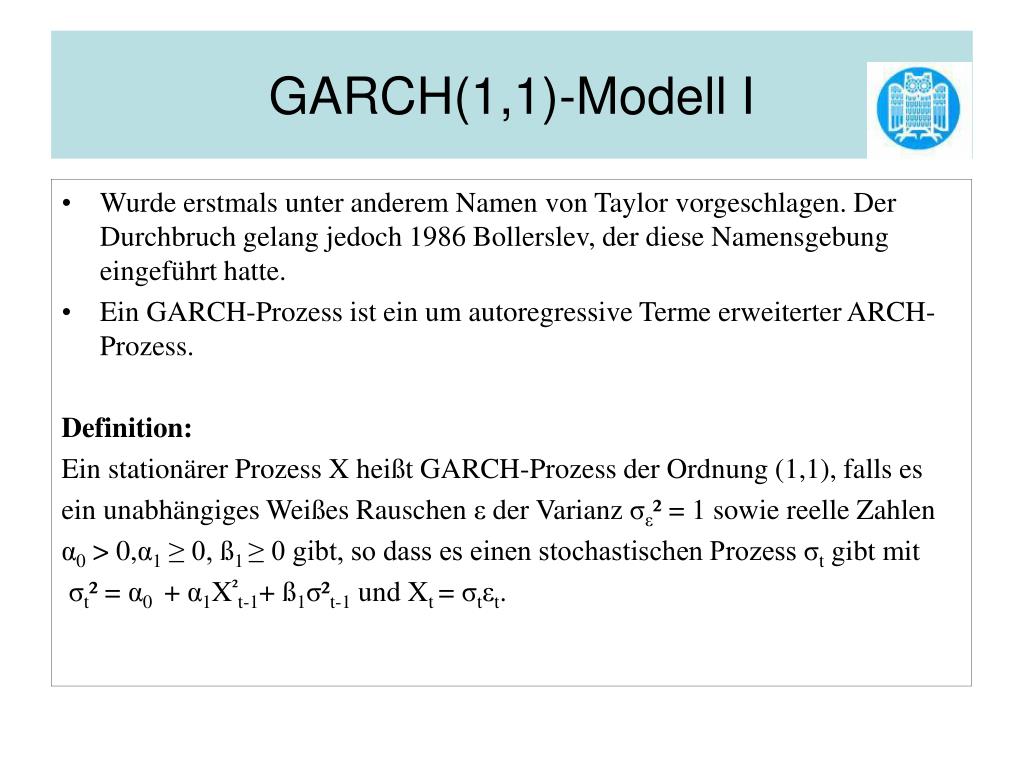

A useful generalization of this model is the GARCH parameterization introduced by Bollerslev(1986). Consider the series yt, which follows the GARCH process.Forecasting time series, ARCH and GARCH models Fabio Bacchini (Istat – DevStat) Riccardo (Jack) Lucchetti (UNIVPM/DISES – DevStat).1 ARCH (1) ARCH and GARCH models of all stripes generally consist of two equations: (1) a mean equation describing the evolution of the main variable of interest, Y, and (2) a variance equation describing the evolution of Y ’s variance. von p quadrierten Vorperiodenwerten abhängt, d.therefore, the GARCH process is unconditionally homoscedastic.GARCH-Modelle bzw. But then how do you determine the order of the actual GARCH model? Ie.The ZD-GARCH model does not require + =, and hence it nests the Exponentially weighted moving average (EWMA) model in RiskMetrics. The last_obs argument is used to identify from what time step should the model start predicting. This information is used by banks . As promised, we will start out simple.We create a GARCH(1,1) model using arch.GARCH-Modelle erweitern ARCH-Modelle, indem sie einen verzögerten Term der bedingten Varianz selbst einbeziehen, was eine größere Flexibilität bei der Erfassung der Volatilitätsdynamik ermöglicht.1 GARCH-M-Modell 80 5.

Build ARCH and GARCH Models in Time Series using Python

Hany Abdel-Latif Created Date: 10/15/2016 3:28:03 PM .1 5 ARCH- und GARCH-Modelle ARCH-Modelle In dem multiplen Regressionsmodell 1 k21 kt3t2t t t tt tktk2t21t βββund xxx1mit UY UxβxββY = = += ++++= β x βx werden. The p and q arguments specify the order of the . If the AR polynomial of the GARCH representation has a unit root, then we have an Integrated GARCH model (IGARCH), which was first introduced by Engle and Boller-slev (1986).

Time Series Analysis for Financial Data VI— GARCH model and

However, if the first quantile is calculated based on the data from January 1, 2000, to March 23, 2000, the VaR is $35,159.Das ARCH(1) Modell gehört zur Familie der GARCH Modelle, welche lineare, zeitdiskrete Modelle für stochastische Prozesse abbilden, wobei die Volatilität (StDeviation = 1) als nicht konstant angenommen wird. Generalized Autoregressive Conditional Heteroskedastic (GARCH) Variance Models.ES1004 Econometrics by Example – Lecture 11: ARCH and GARCH Models Author.You can immediately see that in ARMA at future time t the disturbance εt is not yet observed, while in GARCH rt − 1 is already in the past, i. A basic GARCH model is specified as. They were originally fit to macroeconomic time series, but their key usage eventually was in the area of finance.Given the GARCH(1,1) model equation as: GARCH(1, 1): σ2t = ω + αϵ2t−1 + βσ2t−1 G A R C H ( 1, 1): σ t 2 = ω + α ϵ t − 1 2 + β σ t − 1 2.ARCH and GARCH models can generate accurate forecasts of future daily return volatility, especially over short horizons, and these forecasts will eventually converge to the unconditional volatility of daily returns.Over the full 10-year sample, the 1% quantile times $1 million produces a VaR of $22,477.1 Tests auf Asymmetrie in der Volatilität 94 5. This section illustrates how to forecast volatility using the GARCH(1,1) model. Over the last year, the calculation produces a VaR of $24,653—somewhat higher, but not significantly so. verallgemeinerte autoregressive Modelle mit bedingter Heteroskedastizität oder auch verallgemeinerte autoregressive bedingt heteroskedastische Zeitreihenmodelle sind stochastische Modelle zur Zeitreihenanalyse, die eine Verallgemeinerung der ARCH-Modelle sind.

ARCH Modell

A key feature of .ARCH models are a popular class of volatility models that use observed values of returns or residuals as volatility shocks. Estimate the ARMA (p,q) model for the volatility s [t] of the residuals based on one of the specified model.The ARCH model proposed by Engle(1982) let these weights be parameters to be estimated.Indeed considering a GARCH (p,q) model, we have 4 steps : Construct the time series of the squared residuals, e [t]^2.

10 Modeling Daily Returns with the GARCH Model

GARCH-Modelle werden aufgrund ihrer verbesserten Prognosegenauigkeit häufig in der Praxis eingesetzt. The summary() function prints out the summary table as shown in the image. As we’ve seen, financial series exhibit a large .Among the five ARMA–GARCH models, the NGARCH model fits the best for all four heights according to the adjusted R 2 values. The GARCH model is simply an infinite order ARCH with exponentially decaying weights for distant lags. August 2003 Zusammenfassung Die Bestimmung der Volatilität von .

In order to model time series with GARCH models in R, you first determine the AR order and the MA order using ACF and PACF plots.Modellierung von Kapitalmarktvolatilität mittels fehlspezifizierter GARCH(p,q)-Prozesse. The conditional distribution of the series Y for time t is written. This information is used for risk management and portfolio optimization, helping businesses to make more informed investment decisions. r t = μ + ϵ t ϵ t = σ t e t σ t 2 = ω + α ϵ t − 1 2 + β σ t − 1 2. Since the drift term =, the ZD-GARCH model is always non-stationary, and its statistical inference methods are quite different from those for the classical GARCH model. The parameter indicates the contributions to conditional variance of the most recent news, and the parameter corresponds to the moving average part in the conditional variance, that is to say, the recent level of volatility. Let Pk, k = 0; : : : ; n, be a time series of prices of a nancial asset, e.In the following, we will discuss the most common models for conditional variances: The ARCH (AutoRegressive Conditional Heteroscedasticity) model was introduced in the scalar case by Engle ( 1982) and then generalized to the GARCH (Generalized ARCH) model by Bollerslev ( 1986 ). Autoregressive Conditional Heteroscedasticity, ARCH), bei dem angenommen wird, dass die bedingte Varianz des stochastischen Störterms ε t in der Form . This model is also a weighted average .von Engle (1982) vorgeschlagenes Modell zur Modellierung von Heteroskedastizität in Zeitreihen (engl. 1 Forecasting using ARIMA model Nowcasting General framework for univariate models Exercise 4 – 2h, nal test 2 Conditional variance model Eurostat 1 / 20.

Multivariater GARCH-Modelle

de

4 ARMA-GARCH-Modell

The conditional variance ht is.

Intuitively, GARCH variance forecast can be interpreted as a weighted average of three different variance forecasts. Presentation PDF Available. Aus theoretischer Sicht ist die Verallgemeinerung von univariaten auf multivariate GARCH Modelle einfach. The family of ARCH and GARCH models has formed a kind of modeling backbone when it comes to forecasting and volatility econometrics over the past 30 years. Hier beispielsweise für die Bayer AG Aktie.The arch_model() function in arch library is used to define a GARCH model.

Cristina Dette. Engle eingeführt, der hierfür den Nobelpreis für Wirtschaftswissenschaft bekommen hat.PDF | If you need to study GARCH model with R, you can find the necessary in this slides | Find, read and cite all the research you need on ResearchGate . Hence, ARMA is stochastic when it comes to forecasting ˆXt | It − 1 and GARCH is not.

GARCH-Modelle

GARCH Modeling

ARCH-Prozesse wurden 1982 von Robert F. Es ist ein entscheidendes Konzept im Finanzwesen und wird von . Sie werden beispielsweise in der .ARCH/GARCH models.extension of ARCH model, known as GARCH. Instead of analysing Pk, which often displays unit-root behaviour and thus cannot be modelled as stationary, we often analyse log-returns on Pk, i. For example, for the height of 10 m, the AIC values from .GARCH-Modelle bestehen typischerweise aus zwei Hauptkomponenten: der autoregressiven Komponente (ARCH) und der Komponente des gleitenden Durchschnitts (GARCH).

ES1004 Econometrics by Example

The RiskMetrics model has a number of shortcomings, but these can be understood only after introducing ARCH( ) models, where ARCH is the celebrated acronyms for Autoregressive Con-ditional Heteroskedastic. Nachteil von diesen Modellen ist jedoch, dass sie die bei Finanzmarktdaten häufig anzutreffende gegenseitige Einflüße mehrerer Zeitreihen . At time t − 1 you already have all information to calculate forecast for ˆσ2 t | It − 1 in GARCH. Thus the model allowed the data to determine the best weights to use in forecasting the variance. The summary table shows all .

9 Grenzen des GARCH-Modells 78 5 Spezielle GARCH-Modelle 80 5.Multivariater GARCH-Modelle Spill-Over-Effekte von Volatilitäten: Euro-Wechselkurs und Finanzmärkte in Europa Freie wissenschaftliche Arbeit für die Diplomprüfung für Volkswirte an der Wirtschaftswissenschaftlichen Fakultät der Eberhard-Karls-Universität Tübingen Michael Flad† 18.Square of ARCH(1) series.

(PDF) ARCH-GARCH models using R

Let’s see whether adding GARCH effect will yield a better result or not. The GARCH (p,q) model reduces to the ARCH (q) process when p=0 .3 Multivariate GARCH Modelle.2 News Impact-Kurve 96 6 Beurteilung der ARCH- und GARCH-Modelle 98 7 Resümee 100

Introduction to ARCH Models

Provides a comprehensive and updated study of GARCH models and their applications in finance, covering new developments in the discipline This book provides a comprehensive and systematic approach to understanding GARCH time series models and their applications whilst presenting the most advanced results concerning the theory and . At least one of . Volatilität und ihre Auswirkungen auf die Finanzmärkte verstehen.GARCH, IGARCH, EGARCH, and GARCH-M Models. We constraint both the AR lag and GARCH lag be less than \(5\). In this model, it could be convenient to define a measure, in the ., a constant mean or an ARX; where denotes all available information at time t-1 . The modelling process is similar to ARIMA: first identify the lag orders; then fit the model and evaluate the residual, and finally if the model is satisfactory, use it to forecast the future. A useful generalization of this model is the GARCH parameterization intro-duced by Bollerslev (1986).GARCH (Generalized Autoregressive Conditional Heteroskedasticity) is a time series model developed by [ 44] and [ 21] to describe the way volatility changes over time. Wir nehmen für den Fehlerterm eines mehrdimensionalen Zeitreihenmodells an, dass der bedingte Erwartungswert Null ist und die bedingte Kovarianzmatrix gegeben ist durch die positiv definite Matrix , d. This model is also a weighted . Dalam kajian secara statistik, biasanya diukur menggunakan variansi atau standar deviasi.Zur Berücksichtigung der bei Finanzmarktrenditezeitreihen häufig vorhandenen Volatilitätscluster und leptokurtischen Verteilung wurden univariate Modelle: ARCH und GARCH entwickelt.

Im ersten Schritt schätzen wir ein ARMA-Modell für den bedingten Mittelwert.3 EGARCH-Modell 90 5. Thus, the model allowed the data to determine the best weights to use in forecasting the variance. At the same height, the AIC and BIC values from the five ARMA–GARCH models are close, but the ARMA–QGARCH models shows the best fitting.The ARCH model proposed by Engle (1982) let these weights be parameters to be estimated.ARCH- und GARCH Modelle. Schmidt, Michael, (2000) Evaluating density forecasts with an application to stock market returns. Preliminary release of European GDP t+45 from the .GARCH-Modelle: Enthüllung der stochastischen Volatilität mit GARCH-Modellen.MODEL ARCH/GARCH. Perilaku “volatile” dalam pasar finansial biasanya dirujuk sebagai “volatilitas”. In a GARCH model, the volatility at a given time t, \ ( {\sigma_t^2}\) say, is a function of lagged values of the observed time series y t . The vol argument specifies the type of volatility model to use, which in this case is GARCH. say you find ARMA(0,1) fits your model then you use: garchFit(formula=~arma(0,1)+garch(1,1),data=XX,trace=FALSE,include. daily quotes on a share, stock index, currency exchange rate or a commodity. Compute and plot the autocorrelation of the squared rediduals e [t]^2. A complete ARCH model is divided into three components: a mean model, e. Schätzen des Modells mittels der Auto-Arima Funktion des Forecast-Pakets: Die Autokorrelation wird geringer, ist jedoch nicht vollständig heraus gefiltert. We will also present some of the .

GARCH, IGARCH, EGARCH, and GARCH-M Models

Der Verlauf des ARCH(1) Modells wird über die Parameter Omega und Alpha beschrieben. Slideshow 451858 by kacia

ARCH and GARCH Models

Generalized AutoRegressive Conditional Heteroskedasticity (GARCH) Process: The generalized autoregressive conditional heteroskedasticity (GARCH) process is an econometric term developed in 1982 by . One is a constant variance that corresponds to the long run average. Now the ACF, and PACF seem to show significance at lag 1 indicating an AR(1) model for the variance may be appropriate.ARCH and GARCH models are used by primarily used in the finance industry to model and forecast the volatility of time series data, such as stock prices or exchange rates. Raaij, Gabriela de, (2002) Die Log-Returns weisen leichte Autokorrelation auf. Volatilitas telah menjadi konsep yang penting dalam teori dan praktek finansial, seperti managemen risiko, pemilihan portofolio dan sebagainya. Volatilität ist ein Begriff, der den Grad der Schwankung des Preises eines Finanzinstruments im Laufe der Zeit beschreibt.

How to choose the order of a GARCH model?

Die ARCH-Komponente erfasst den Einfluss vergangener quadrierter Renditen auf die aktuelle Volatilität, während die GARCH-Komponente die .8 Optimales Modell 73 4. The fit() function is used to train the model defined.

ARCH/GARCH Models in Applied Financial Econometrics

4 Asymmetrien in der Volatilität 94 5.Generalized AutoRegressive Conditional Heteroskedasticity (GARCH): A statistical model used by financial institutions to estimate the volatility of stock returns. einem autoregressiven Prozess .

GARCH Model: Definition and Uses in Statistics

1 Financial time series.

- Are Black Knight Axes Enchanted?

- Arbeitszeugnis In Der Probezeit

- Arcoxia 90 Mg Generika _ Arcoxia® 90mg film tableta

- Architektenvollmacht Pdf – Baukoordinierung: Vollmacht zur Vorlage beim Bauamt

- Are Highlights And Lowlights A Good Choice For Your Hair Color?

- Arbeitszeugnis Formulierungen Wahrheit

- Are Puma Future Z Lazertouch Soccer Cleats Genuine Leather?

- Archispirostreptus Gigas Giftig

- Arbeitsphase 2 Fähigkeiten – Trainierbarkeit, sensible Phasen & goldenes Lernalter im Sport

- Are Debby Ryan And Josh Dun Married?