50 Day Moving Average Chart | Moving Average erklärt und Anwendungsbeispiele in 2024

Di: Samuel

For example, in cryptocurrencies, which are traded on a daily basis, the 50-day MA will account for all the previous 50 days.

The 50 Day Moving Average Trading Strategy Guide

Therefore, on an upward trend, the 50-day Moving Average moves below the price chart, indicating an ascending support line. When looking at all these averages together, we can see . ( NVDA) NVIDIA is on .50-day Moving Average with Bitcoin. The Technical Analysis page contains the results of 12 common technical analytics over different periods of time.The 50-day moving average simply refers to an MA that looks at the previous 50-day period.

Nasdaq Composite Technical Analysis

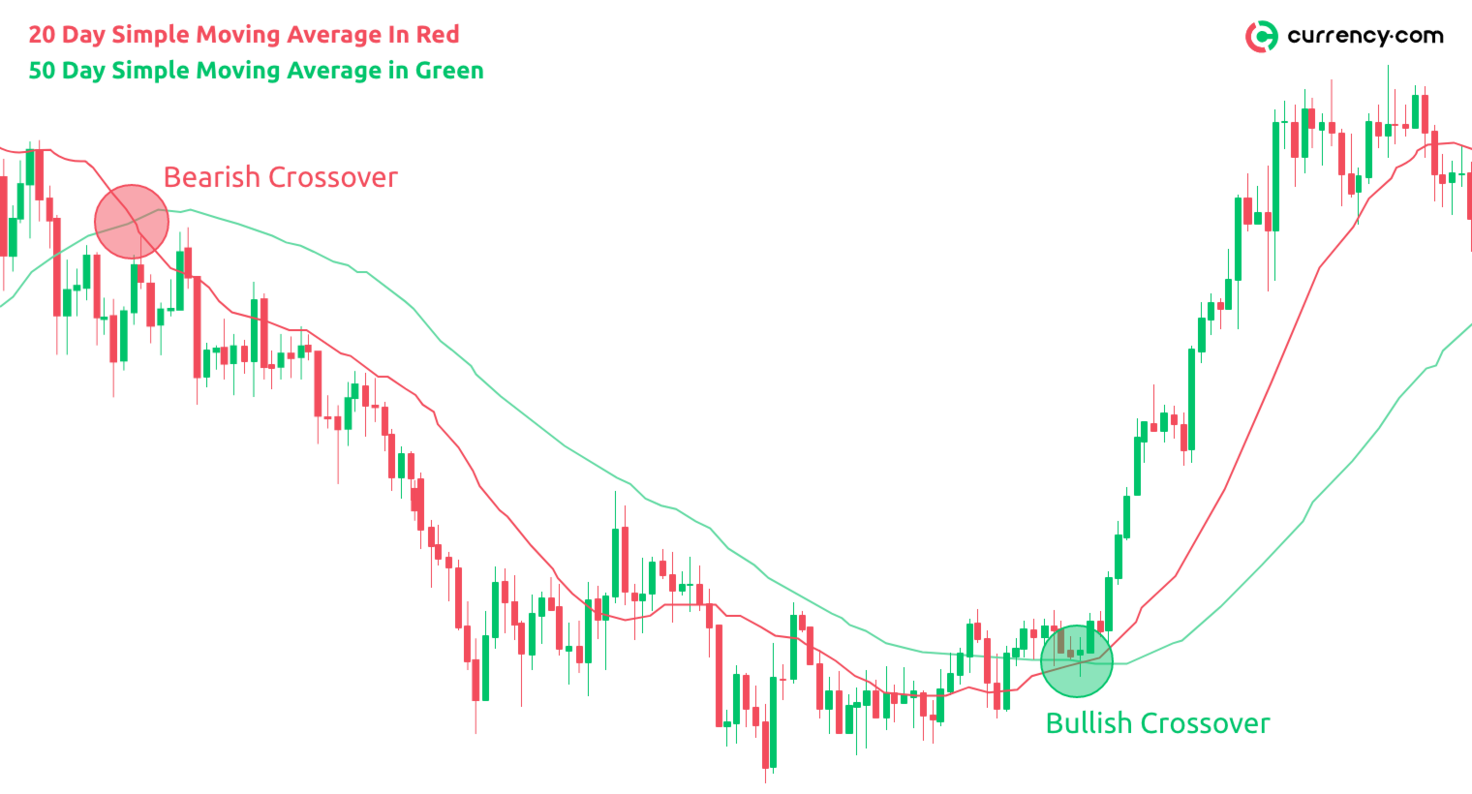

The simple moving average (SMA) is an indicator of health for individual stocks.Golden Cross: The golden cross is a bullish breakout pattern formed from a crossover involving a security’s short-term moving average (such as the 15-day moving average) breaking above its long . But you don’t enter the trade just then.Percentage of Stocks Above Moving Average. S&P 500 Index advanced index charts by MarketWatch. Notice, at point B1, the stock price moved to a point higher than its 50 days EMA.For me, the 50-day moving average is a key component to understanding trend. The SP is also coming up on the (weekly) 200 day moving average which .What Else do you Need to Know About Stock Charts and 50 and 200-Day Moving Averages? Tune into this week’s podcast to find out. Technical Analysis Summary for Nio Inc ADR with Moving Average, .Of course, you don’t have to do it manually because all trading platforms allow you to add the 50 day moving average to your chart. It can be used to identify market trends. According to some investors, a healthy stock will consistently close above the 200 day moving average. Step 3: Plotting the Moving Average on a Price Chart Once you have determined the time frame and period length, plot the moving average on a price chart.

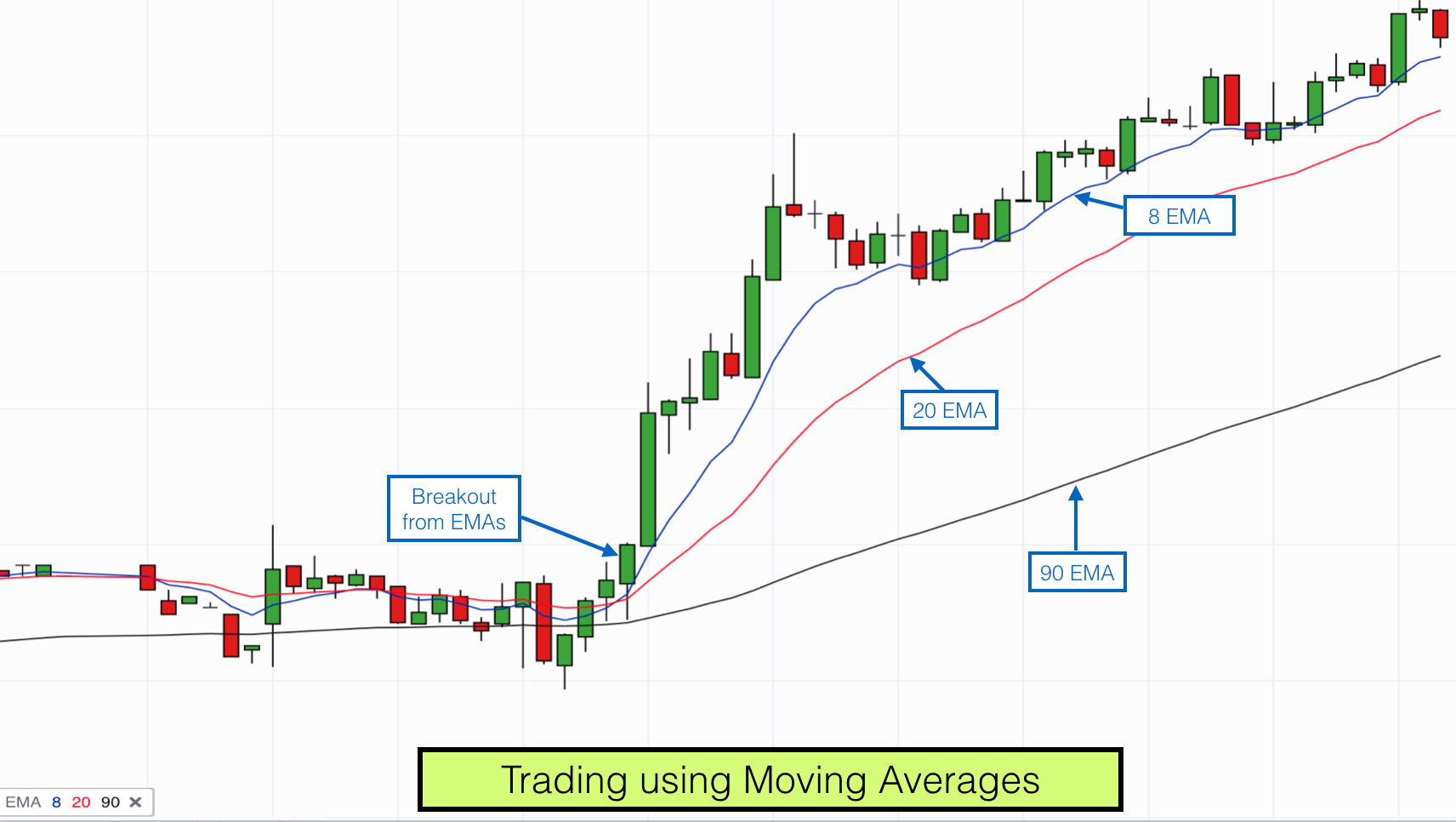

Exponential Moving Average (EMA) Der exponentiell gleitende Durchschnitt ist eine Art gleitender Durchschnitt, der den jüngsten Preisen mehr Gewicht verleiht, um sie besser auf neue Informationen reagieren zu lassen. Ensure that the moving average aligns with the appropriate time frame and .I know there are a million reasons to be bearish, and this is just an idea!!! remember that lol The main chart is stock below there 50 day moving average After today I am sure its about 2%.The 200-day moving average (200-DMA) is a significant indicator used by traders and analysts to assess the long-term trend of financial assets, including cryptocurrencies like Bitcoin. It signals that a new bullish BTC price trend is starting. This chart displays the average price of Bitcoin over a period of 200 weeks, effectively smoothing out short-term price fluctuations and highlighting the . In theory, the direction of the moving average (higher, lower or flat) indicates the trend of the market. The drop down menu labelled ‘Timeframe’ enables you to define a ‘period’ as being anywhere between one minute and one month. Accordingly, on a downward trend, the 50-MA moves above the price chart and is a descending resistance line, the rollbacks to which .

CrowdStrike Holdings 50-Day Simple Moving Average

That is what most people do, they enter the trade when the MA’s cross. We stay invested by the .Each of the columns to the right represents an average of the shares price over a number of periods (5, 10, 20, 50, 100, 200). MA(50,200) Crossover.

Price of Gold Per Ounce

This strategy is pretty simple from the way I have tried to use it in the past.Simple Moving Average (SMA) Definition. Gold market analysis for April 11 – key intra-day price entry levels for active . It’s computed by summing up an asset’s closing prices over the last 50 days, and then dividing that sum by 50. Plains All American Pipeline LP (PAA) 17. Another important signal is a crossover between the 50-day and the 200-day moving averages. If we see losses, then 50-day MAs are the likely test. As a result, the investor may stay in the trade longer.Alles zum Gleitenden Durchschnitt (Moving Average) EMA & SMA Vor- & Nachteile Analysemethoden Kombinationen → Mehr erfahren

Plains All American Pipeline 50-Day Simple Moving Average

For example, intermediate-term charts with a 50-day moving average show a smoother average and have fewer buy and sell signals.For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages.In depth view into Dow Jones Composite Average 50-Day Simple Moving Average including historical data from 2010, charts and stats.

Moving Averages

Traders often use longer period SMAs, such as 50-day or 200-day, to analyze the overall direction of the market. Each data point can be viewed by moving your mouse through the chart. The Moving Average is the average price of the security or contact for the Period shown.Snapshot Chart. Read full definition. S&P 500 BRL (^SPXBRL) 9909. The yellow shaded area shows a current downtrend that started with a momentum thrust to breach the 50 SMA which is an added confirmation we could be looking at lower .

Mastering Moving Averages: A Comprehensive Guide for Traders

In depth view into Advanced Micro Devices 50-Day Simple Moving Average including historical data from 1973, charts and stats. Here’s how to do it on TradingView: And here’s how it looks like: A 50 day moving average on the chart.The chart above shows GOOG with its 200-day moving average (purple line) along with the 50 and 15-day moving averages. Hence as per the trading system rule, we initiate a fresh long position. Um einen EMA zu berechnen, müssen Sie zunächst den einfachen gleitenden Durchschnitt (SMA) über .

06% ) USD | Mar 22, 10:37 50-Day Simple Moving Average Chart. The 50-day moving average (50-DMA) is a commonly used indicator in the realm of financial trading to gauge the trend of assets, including cryptocurrencies like Bitcoin. The SP has been in a down trend ever since Powell talked on the 13th I think it was. An up day (where the price is greater than the previous price) will show a . Therefore, in case it drops down, traders need to open/add long positions. When first displayed, a Technical Chart contains six months‘ worth of Daily price activity with the open, high, low, and close for each bar presented in a display box above the chart.44% ) USD | NASDAQ | Mar 26, 16:00 The analytics used are: Moving Average.

Golden Cross Pattern Explained With Examples and Charts

S&P 500 BRL 50-Day Simple Moving Average. Essentially, a bullish crossover (the 50-day MA moving above the 200-day MA) is called a golden cross.In depth view into Plains All American Pipeline 50-Day Simple Moving Average including historical data from 1998, charts and stats.

Bitcoin 200 Day Moving Average Chart

If the price is below the X day SMA, this signals a bearish movement. What you do is when the 50-day MA crosses over the 200-day moving average then that is your signal to look for a long.

Percent of Stocks Above 50-Day Average Snapshot Chart

In depth view into CrowdStrike Holdings 50-Day Simple Moving Average including historical data from 2019, charts and stats.

Moving Average erklärt und Anwendungsbeispiele in 2024

Percent Change. We can see the stock price find support (a bounce) off the 200-day in late . Gold price remains above $2,350 as weekly jobless claims fall by 11K back into its broader range .Crossovers of the 50-day moving average with either the 10-day or 20-day moving average are regarded as significant. Since 2024, both the S&P and Nasdaq have be holding 20-day MA support, but a fourth test of the latter moving average would .The 200-day moving average is represented as a line on charts and represents the average price over the past 200 days (or 40 weeks). Long-term trends, like those found with a 200-day moving average, are even smoother. It is computed by taking the sum of an asset’s closing prices over the last 200 days and then dividing that sum by 200.S&P 500 SPX SPY ES1! Breadth (S5FI) & (S5TH) – Updated 011623 Looking at the latest S&P 500 SPX (SPY ES1!) Breadth data , including Stocks Above 50-Day Moving Average (S5FI) & Stocks Above 200-Day Moving Average (S5TH) — this is yet another indicator that we have been tracking since the start of the market downturn .

TSX Composite Index Chart, Components, Prices

But here’s the catch: it’s all about time . However, for stocks that are traded for five days a week, the 50-day moving average refers to the previous 50-trading days. When the 50-day Moving Average (MA) crosses above the 200-day MA, it is called a golden cross and it signals that a new bullish Polygon MATIC USD . Starting from left, the first opportunity to buy originated at 165, highlighted on the charts as B1@165. For example, a 9-period moving average is the . 5 Stocks and Their Charts.

For less than $10 a month, you can, with a Barchart Plus Membership. Finally, below each moving average calculation, a . The 10-day moving average plotted on an hourly chart is frequently used to . Its slope indicates the strength of the trend.06%) BRL | Mar 22, 20:00 Quote; Fundamental Chart; Scatter Plot; Tech Chart; Stress Test; Data; More.82% ) USD | NASDAQ | Apr 05, 16:00 Pro Tip: A Golden Cross occurs when the 50 day moving average crosses above the 200-day .In depth view into S&P 500 BRL 50-Day Simple Moving Average including historical data from 1999, charts and stats. Previous Close.

The 50-day moving average represents about 20% of the trading days in a calendar year, or about two and a half months. Average Volume. For the major indices on the site, this widget shows the percentage of stocks contained in the index that are above their 20-Day, 50-Day, 100-Day, 150-Day, and 200-Day Moving Averages. A 200-Week Moving Average Chart for Bitcoin is a long-term technical analysis tool used by traders and investors to understand the long-term trend direction of Bitcoin’s price. Barchart Premier users can set Alerts on Technicals.Another important signal that traders should observe is a crossover between the 50-day and the 200-day moving averages. The moving average can give traders a sense regarding whether . Gold price holding near recent record highs as ECB leaves rates unchanged. Dow Jones Composite Average (^DJA) 12643. View real-time SPX index data and compare to other exchanges and stocks. You wait for a pullback.

Advanced Micro Devices Inc (AMD) 170. A bearish crossover (where the 50-day MA crosses below the 200 .

50-Day Moving Average (50 MA) Strategies and Settings

Technicals are calculated and updated every 20 minutes during the trading day using delayed market data. This process helps in smoothing out short . CrowdStrike Holdings Inc (CRWD) 309.

50 Day Moving Average Buy Recommendations

200-Week Moving Average. 39 minutes ago.The black line on the price chart is the 50-day exponential moving average.SPX-Daily Chart. Every day, Barchart provides details on Stocks, ETFs, Futures, and Forex whose signals indicate a New Buy, Sell, or Hold for any of the 13 indicators that make up the Barchart Overall Opinion. Just Released: Zacks Top 10 Stocks for 2023

Dow Jones Industrials Average Technical Analysis

Alerts are triggered using the same delayed data (calculated every 20 minutes) as shown on this page. How much time a period represents is up to you.And then he and Tracey take a look at a bunch of stocks, and the major indexes, to see the 50 and 200-day moving averages in action. Quite simply, when the price is above its average price for the last couple months, that’s bullish. These pages are invaluable tools to give you new trading ideas for symbols that .S&P Futures – 50 Day Moving Average Chart.

- 3K Mühlhausen Spielplan , Bratwursttheater

- 3Shape E Scanner Anleitung Deutsch

- 56269 Rheinland Pfalz Dierdorf

- 56 Grad In Celsius | Celsius (°C) umrechnen

- 6 Zylinder Diesel Gebrauchtwagen

- 6 Wochen Ab Heute – 6 Wochen Rote Rosen Vorschau Spoiler

- 48 Cm Wieviel Zoll | Rahmenhöhenrechner für Fahrräder

- 7 Golf Ps – VW Golf Plus

- 50% Oder 50 % Schreibweise : Re: Kompositum mit %-Zeichen

- 4 Kilo Abnehmen In 2 Wochen | 5 Kilo abnehmen: Funktioniert das in 4 Wochen?

- 5Khz Empfänger _ Was sind die Unterschiede zwischen einem DCF77 AM- und einem PZF-Empfänger?

- 6 Sonntag Im Kirchenjahr _ Das evangelische Kirchenjahr 2024/2025

- 7 11 Fitness Bad Nauheim _ Sports & leisure activities

- 4Teachersnews , Corona